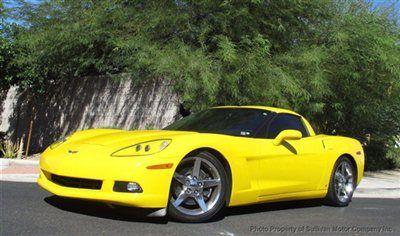

2002 Chevrolet Corvette Z06 Coupe 2-door 5.7l on 2040-cars

Bayville, New York, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:5.7L 350Cu. In. V8 GAS OHV Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chevrolet

Model: Corvette

Trim: Z06 Coupe 2-Door

Options: Leather Seats, CD Player

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 34,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: Z06

Exterior Color: Yellow

Interior Color: Black

Number of Doors: 2

2002 Z06 Yellow and Black

Chevrolet Corvette for Sale

1985 corvette c4 not running

1985 corvette c4 not running 1965 65 corvette vette barn find! 83k miles - no reserve!

1965 65 corvette vette barn find! 83k miles - no reserve! 1989 chevrolet corvette 5.7l(US $8,600.00)

1989 chevrolet corvette 5.7l(US $8,600.00) 2007, chevrolet, corvette, coupe, automatic call matt 480-628-9965 az car

2007, chevrolet, corvette, coupe, automatic call matt 480-628-9965 az car Edelbrock supercharger, leather, memory seats, power seat, heated seats

Edelbrock supercharger, leather, memory seats, power seat, heated seats 1998 chevrolet corvette convertible 2-door 5.7l(US $22,500.00)

1998 chevrolet corvette convertible 2-door 5.7l(US $22,500.00)

Auto Services in New York

Zuniga Upholstery ★★★★★

Westbury Nissan ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Value Auto Sales Inc ★★★★★

TM & T Tire ★★★★★

Auto blog

CNG Chevy Impala launch delay grows to a year

Fri, Jun 12 2015The 2015 Chevrolet Impala Bi-Fuel was announced in Washington D.C. in late 2013 by Dan Akerson and was supposed to be on sale by the summer of 2014. Capable of running on gasoline and compressed natural gas, the sedan was said to offer a novel solution at a time when gas prices were high. The vehicles still haven't arrived at dealers, though, and according to Automotive News, a quality issue has set back the launch even a few months more. Using a modified 3.6-liter V6 with hardened valves and valve seats, the Bi-Fuel Impala has separate tanks for gasoline and CNG that it can switch between on the fly. When running on the cheaper natural gas, the sedan was estimated to get 19 miles per gallon in the city and offer 150 miles of range, and the total driving distance was predicted at around 500 miles. The base price was set at $38,210, after the $825 destination charge. The only other major tradeoff was a smaller trunk to accommodate the extra fuel. However, the first shipments of the bi-fuel models now aren't expected until mid-July – about a year later than the scheduled launch. A memo to dealers obtained by Automotive News said the sedan "has been delayed by a second quality hold" to look at the CNG system. The exact details surrounding this problem haven't been released. "We have identified a solution to the delay and are working hard to implement it within the next few months," General Motors spokesperson Chad Lyons said to Automotive News. Around 200 Bi-Fuel Impalas have been made, but none are yet in the hands of customers. Dealers should be able to order 2016 model year examples starting in the third quarter of this year.

GM recalls 200k Hummer H3s for fire risk

Thu, Jul 9 2015An issue with fires erupting in some Hummers has prompted General Motors and the National Highway Traffic Safety Administration to issue a recall for nearly 200,000 vehicles around the world. The bulk of them are in the United States. According to the first statement (below) obtained by Autoblog from GM, the issue stems from the HVAC system in Hummer H3 models. The connector module for the blower motor has, in certain cases, overheated, melted the surrounding plastic, and started a fire. 42 such cases have been reported, including three instances of occupants citing minor burns. GM confirms that two of those three cases lead to the vehicle being destroyed in the fire, but states that no crashes or fatalities have resulted. The issue affects 196,379 examples of the 2006-10 H3 wagon and the 2009-10 H3T pickup, with 164,993 estimated to be in the United States. In order to fix the issue, dealers are being instructed to replace the relevant parts of the connector and harness. In a second, unrelated campaign, GM is also calling in 50,731 Chevy Spark and Sonic small cars – 45,785 of them in the US – due to a software glitch. In those affected vehicles fitted with the base radio and OnStar system, the audio system may not be able to switch out of turn-by-turn direction mode, causing the display to go blank and all sound to mute – including key safety warnings. In addition, the system may not switch off, draining the battery. GM states that no crashes, injuries, or fatalities have resulted from this issue, and all that dealers will need to do in this case is reflash the software. Related Video: General Motors is recalling 164,993 2006-2010 model year HUMMER H3 and 2009-2010 model year HUMMER H3T models in the U.S. In certain vehicles, the connector module that controls the blower motor speed in the heat/vent/air conditioning (HVAC) system may overheat under extended periods of operation at high- and medium-high speeds. The heat could melt the plastic surrounding the connector module, increasing the risk of a fire. Dealers will replace the affected portion of the connector and harness. GM is aware of three reported minor burns and 42 fires but no crashes or fatalities related to this condition. Including Canada, Mexico and exports, the total recall population is 196,379. ### General Motors is recalling 45,785 2014-2015 model year Chevrolet Sparks, and 2015 model year Chevrolet Sonics in the U.S.

Pony cars, trucks and Italian SUVs | Autoblog Podcast #552

Fri, Aug 31 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor Alex Kierstein and Associate Editor Reese Counts. We discuss the updated 2019 Chevy Camaro Turbo 1LE variant, the new 2019 GMC Sierra Denali, and the Ferrari-powered Maserati Levante GTS. We also debate whether Volkswagen should build the Atlas-based Tanoak pickup truck and what a delay means for the next-gen Ford Mustang. Finally, we answer a reader question about the state of Lexus.Autoblog Podcast #552 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2019 Chevy Camaro Turbo 1LE 2019 GMC Sierra 2019 Maserati Levante GTS Should Volkswagen build the Tanoak? Next-gen Ford Mustang delayed The past, present and future of Lexus Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Podcasts Chevrolet Ford GM GMC Lexus Maserati RAM Truck Coupe SUV Luxury Performance