1988 Corvette on 2040-cars

Sarasota, Florida, United States

Body Type:2 door

Vehicle Title:Clear

Engine:5.7 litter V8

Fuel Type:Gasoline

For Sale By:owner

Make: Chevrolet

Model: Corvette

Trim: red

Options: Leather Seats, CD Player, Convertible

Safety Features: Anti-Lock Brakes

Drive Type: automatic

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 176,000

Exterior Color: Red

Interior Color: Red

Disability Equipped: No

Number of Cylinders: 8

Warranty: no

2 door hatchback coupe. In great condition. New .30 over engine, seats, carpet, full interior wood kit.

Chevrolet Corvette for Sale

87 convertible corvette std, white, runs great, has been wrecked damaged door(US $2,995.00)

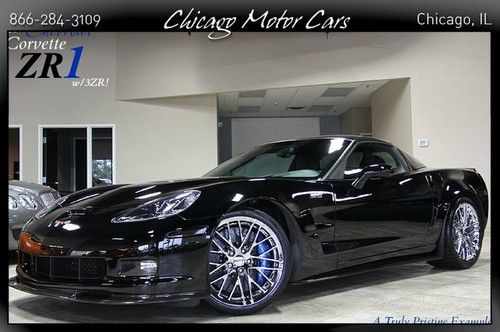

87 convertible corvette std, white, runs great, has been wrecked damaged door(US $2,995.00) 2010 chevrolet corvette zr1 3zr chrome's navigation hud carbonfiber lingenfelter(US $89,800.00)

2010 chevrolet corvette zr1 3zr chrome's navigation hud carbonfiber lingenfelter(US $89,800.00) Grand sport coupe callaway sc606 red(US $69,000.00)

Grand sport coupe callaway sc606 red(US $69,000.00) Fabulous high end build -1959 chevrolet corvette convertible replica - 3k mi

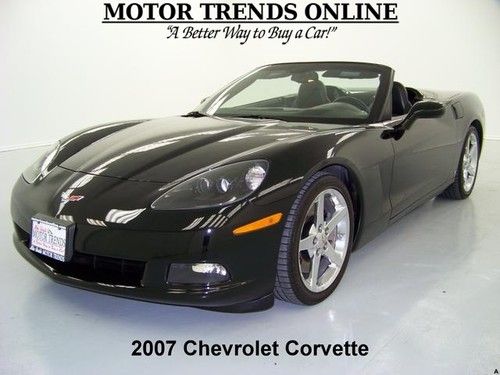

Fabulous high end build -1959 chevrolet corvette convertible replica - 3k mi Z51 navigation hud convertible chrome wheels htd seats 2007 chevy corvette 29k(US $35,700.00)

Z51 navigation hud convertible chrome wheels htd seats 2007 chevy corvette 29k(US $35,700.00) 1981 corvette red excellent condition(US $14,000.00)

1981 corvette red excellent condition(US $14,000.00)

Auto Services in Florida

Yokley`s Acdelco Car Care Ctr ★★★★★

Wing Motors Inc ★★★★★

Whitt Rentals ★★★★★

Weston Towing Co ★★★★★

VIP Car Wash ★★★★★

Vargas Tire Super Center ★★★★★

Auto blog

Chevrolet Malibu could last until 2024 before joining the dodo

Wed, Jul 31 2019Automotive News pieced together all available intel on the Chevrolet and GMC lineups, trying to ascertain how much life each model might have left. Concerning the Chevrolet Malibu, the answer is not too much, and the historic nameplate's final years don't look like the glory kind. After a major overhaul in 2016 boosted sales for the ninth-generation sedan to 227,881 units, the 2018 sales fell to 144,542, and this year's are down almost 15% through the end of June. The Malibu is one of two Chevrolet sedans still breathing - the other being the Impala for now - but only for about five more years. AN says there'll likely be a refresh in 2022, followed by a visit from the Reaper in 2024. After that, it could be "indirectly replaced" by an electric vehicle, one of the 23 EVs that GM is working on for 2023.   The Impala will meet the ax earlier despite a recent stay of execution. Production is still set to close in January 2020. In the entire GM stable, Cadillac might soon be the only marque with sedans. The Buick LaCrosse has a date with death, and Groupe PSA won't supply Opels-as-Regals forever. The Sonic hatchback should say goodbye at the end of 2020, a year before the seemingly eternal Spark is thought to die. Two years after that, according to one report, the Camaro will go back into cold storage, perhaps forever, and AN says an "expected redesign of the car in 2021 was reportedly canceled." Finally, let's give one final shout-out to the Chevrolet Cruze, a global nameplate, which in the United States alone outsells the Malibu, outsold the Camaro by a factor of three last year, and absolutely trounces the Impala, Sonic, and Spark. Even that couldn't get a stay of execution. In more uplifting news, everything's happening on the crossover and truck side in the next few years. The Chevy Bolt is due for a refresh next year, even though it has "become more important for self-driving ride-hailing fleets that GM Cruise plans to operate than for consumers." In 2021, the Bolt-based crossover should bow, first in China, then here. It's said to look like "a mix of the Bolt and Trax" in spy shots. Still waiting for a green light: a possible subcompact GMC crossover called Granite that might make it to market by 2023. The full-sized SUV triplets Tahoe, Suburban, and Yukon could show their new faces in 2020. The Silverado might get an updated interior in 2020 or 2021, while the Colorado and Canyon mid-sized pickups won't get attention until perhaps 2023.

Recharge Wrap-up: Tesla P85D upgrades coming soon, lease a Chevy Volt for $149 a month

Wed, Dec 31 2014CarCharging has raised $6 million from shareholders and has restructured to save cash. The EV charging company plans to expand further in 2015 - with an eye toward achieving profitability - in part by investing in technology and "unlocking the value of our significant equipment inventory," says CarCharging CEO Michael D. Farkas. The group expects to reduce administrative costs by 40 percent, and has hired an interim Chief Financial Officer to help carry out its plans for growth. CarCharging raised the cash through offering convertible preferred stock to its shareholders, whom Farkas thanked "for their passion and patience." Read more in the press release below. Rydell Chevrolet in Los Angeles is offering Chevrolet Volt leases for $149 per month. In a video ad, Rydell offers the Volt for $169 a month with $3,390 due at signing, but another ad shows the offer at $149 a month with $3,550 down or $248 per month with $0 down. Rydell Chevrolet will ship the car anywhere in the lower 48 states. It also appears they offer cupcakes. See Rydell's video below, or read more at Inside EVs. Tesla will upgrade the Model S P85D with higher performance and top speed. The free update, which is due "in the next few months" according to a statement from Tesla, will raise the electronically limited top speed from 130 to 155 miles per hour. "Additionally, an over-the-air firmware upgrade to the power electronics will improve P85D performance at high speed above what anyone outside Tesla has experienced to date," Tesla says. The update will be available for the lifetime of the car, which includes subsequent owners. Read more at Green Car Reports. Car Charging Group Completes $6 Million Capital Raise Concurrently Enacts Restructuring Actions to Reduce Cash Burn MIAMI BEACH, Fla., Dec. 29, 2014 /PRNewswire/ -- Car Charging Group, Inc. (OTCQB: CCGI) ("CarCharging" or the "Company"), the largest owner, operator, and provider of electric vehicle (EV) charging services, today announced that it has closed an offering (the "Offering") and raised net proceeds of up to $6 million with current institutional shareholders. The Offering consisted of convertible preferred securities with a conversion price of $0.70 and warrants exercisable at $1.00. Proceeds will be used to: - Strengthen CarCharging's balance sheet; - Build on the past year's progress; and - Provide growth capital for expanding the Company's network.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.