1971 Chevrolet Corvette on 2040-cars

Allendale, Michigan, United States

Please contact me at : dulce_scarano@zoho.com .

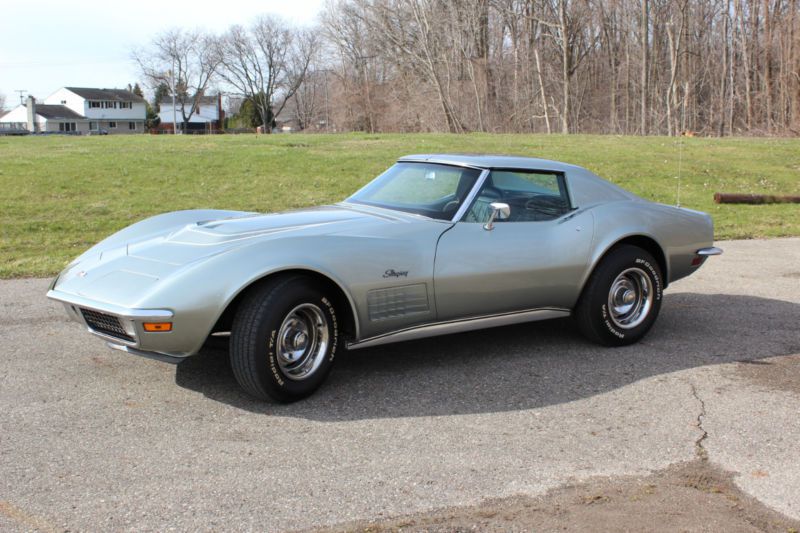

Beautiful numbers matching 1971 Chevrolet Corvette LT-1 Sport Coupe finished in its original trim code 988 Steel Cities Gray and black interior. Production date October 21, 1971.

Original numbers matching LT1 350ci, 330 hp motor and 4 speed close ratio Trans. Original factory order manifest that was located under the fuel tank has been recovered. Also have original protect-o-plate, owner’s manual, dealer brochure and other documentation and receipts from restoration all included. The tank sticker options include:

LT1 350ci 330 hp engine

M21 4-speed close ratio manual transmission

J50 power brakes

N40 Power Steering

PU9 White letter tires

T60 Heavy Duty Battery

U69 Am/Fm Radio

UA6 Alarm System

All ordered options are present and functional including the factory alarm system. Some options have been updated such as newer BFG Radial tires, new battery and am/fm radio. I do have the original radio that goes with the car. Also, the car has been upgraded with a new aluminum radiator.

Everything in the car functions as it should, all gauges, clock, radio, fiber optics, flip up lights, wipers, emergency brake and heat all function correctly. Everything is keyed properly, ignition and doors use the same square head key and rear glove storage, spare tire lock and alarm system use the same barrel head key.

Chevrolet Corvette for Sale

1973 chevrolet corvette(US $12,900.00)

1973 chevrolet corvette(US $12,900.00) 1968 chevrolet corvette(US $18,500.00)

1968 chevrolet corvette(US $18,500.00) 2015 chevrolet corvette z06(US $30,200.00)

2015 chevrolet corvette z06(US $30,200.00) 2003 chevrolet corvette z06(US $14,100.00)

2003 chevrolet corvette z06(US $14,100.00) 2014 chevrolet corvette z51 3lt(US $22,500.00)

2014 chevrolet corvette z51 3lt(US $22,500.00) 1959 chevrolet corvette(US $14,400.00)

1959 chevrolet corvette(US $14,400.00)

Auto Services in Michigan

Wilson`s Davison Tire & Auto ★★★★★

Wade`s Automotive ★★★★★

Village Ford Inc ★★★★★

Village Ford ★★★★★

U P Tire & Auto Service ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

GM laying off more than 4,000 workers Monday morning

Sat, Feb 2 2019According to reports from Automotive News, The Detroit News, and CNN, General Motors plans to begin laying off more than 4,000 salaried workers starting Monday morning. In a statement to AN, a spokesperson for the automaker said, "We are not confirming timing. Our employees are our priority. We will communicate with them first." We've been expecting layoffs at General Motors since November, 2018. At the time, the Detroit-based automaker announced it would seek to shed 8,100 salaried employees, shut down five assembly plants in North America, and kill off several slow-selling models. One month earlier, GM offered buyout packages to 18,000 workers and said it would seek to cut its global workforce by 25 percent. A spokesperson said at the time the moves were "proactive steps to get ahead of the curve by accelerating our efforts to address overall business performance." The cost-cutting moves are expected to save GM up to $2.5 billion in 2019 and as much as $6 billion by 2020. David Kudla, CEO and chief investment strategist of Mainstay Capital Management, referred to the impending culling as "Black Monday" and told The Detroit News that the layoffs would begin around 7:30 a.m. and continue in waves throughout the coming days and weeks. GM plans to deliver on its fourth-quarter and full-year 2018 earnings report on Wednesday. President Donald Trump plans to deliver the annual State of the Union address a day earlier on Tuesday. We expect to hear plenty more from both sides over the next several days.

Sunday Drive: Performance comes in many shapes and sizes

Sun, Nov 19 2017The Chevrolet Corvette has always stood out as a bastion of reasonably priced performance, and the latest 'Vette has that in spades. And while its expected starting price of around $120,000 certainly isn't cheap, it's an undeniable deal in the supercar world – remember, this thing'll do 210 miles per hour thanks to its 755-horsepower supercharged V8 engine. And did you get a load of that massive rear wing? Team Corvette's longtime foe, the Porsche 911, is similarly hellbent on ultimate performance. And as a reminder of how long the Corvette/911 rivalry has been melting tires we present the 1990 Porsche 911 as reimagined by Singer you see below. It's beautiful, it's green, and it's packing 500 air-cooled horsepower. You don't have to burn gasoline to go fast, as proven by the second-generation Tesla Roadster, which was revealed as a surprise late last week. Elon Musk says it'll be the quickest car in the world with a 0-60 time of just 1.9 seconds. And while you may not think of a semi truck when you think speed, the Tesla Semi can do 0-60 in 5 seconds flat unloaded, or in 20 seconds with a load of 80,000 pounds. Compared to today's crop of diesel semis, that's amazing. Continuing the truck theme, we present an artists rendering of what the next-generation Ram 1500 pickup may look like. Spoiler alert: Ram's mini-semi look is giving way to something much more modern. There may even be a first-of-its-kind split tailgate at the rear. And if you don't think the Ram 1500 has anything to do with performance, we should remind you that it's one of the cheapest ways to get a tire-shredding Hemi V8 engine in America. 2019 Chevy Corvette ZR1: All hail the 755-horsepower C7 king This is the first Porsche 911 to get Singer and Williams' 500-horsepower engine Tesla Roadster surprise reveal | 'Quickest car in the world' Tesla Semi Truck revealed: Here are the key details This could be the next-generation 2019 Ram 1500 2019 Ram 1500 spotted with split tailgate

GM recalls 8,500 Chevrolet Malibu models for rear suspension glitch

Mon, 04 Feb 2013According to a letter from General Motors to the National Highway Traffic Safety Administration, flaws in the build process of the 2013 Chevrolet Malibu have led to the recall of 8,519 cars. Units built between December 6, 2011 and January 15, 2013 may have been assembled with rear suspension cradles that had insufficient torque applied to certain bolts. That out-of-spec assembly could lead to issues ranging from slight noises to a loss of vehicle control.

The problem was first noticed in December of last year by a GM test fleet driver and eventually tracked back to the improperly torqued bolts on the suspension cradle assembled through July 2012 by a supplier located not too far from the Malibu's Detroit/Hamtramck Assembly Plant. Since an official NHTSA recall notice has not been issued yet, it isn't clear whether or not Detroit-built Malibus were the only ones affected (the 2013 Malibu is also built at GM's Fairfax Assembly Plant in Kansas City, Kansas). Dealers will fix the problem by inspecting vehicles for proper torque specs, retightening if not within specs and, in some cases, perform a rear-wheel alignment.