1967 Chevrolet Corvette Stingray Convertible - Frame Off Rest - Matching Numbers on 2040-cars

Naples, Florida, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Manual

Make: Chevrolet

Warranty: Unspecified

Model: Corvette

Mileage: 30,200

Options: Leather

Sub Model: Stingray

Exterior Color: Marlboro Maroon

Interior Color: Saddle

Doors: 2 doors

Number of Cylinders: 8

Engine Description: 427 V8

Chevrolet Corvette for Sale

1988 chevrolet corvette base hatchback 2-door 5.7l(US $8,500.00)

1988 chevrolet corvette base hatchback 2-door 5.7l(US $8,500.00) 2008 chevrolet corvette z06 coupe 2-door 7.0l loaded car navigation(US $51,500.00)

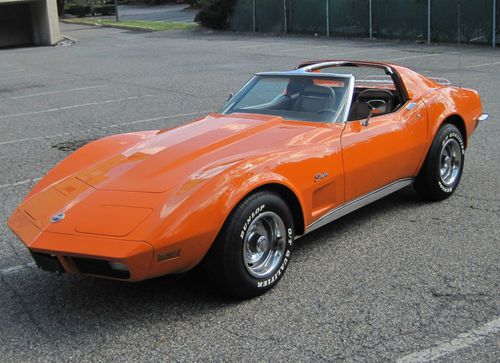

2008 chevrolet corvette z06 coupe 2-door 7.0l loaded car navigation(US $51,500.00) Bright orange l48 t-top coupe

Bright orange l48 t-top coupe Low reserve a driver, not much to make it perfect, two t-tops (mirror & painted)

Low reserve a driver, not much to make it perfect, two t-tops (mirror & painted) 2006 chevrolet corvette one owner leather low mileage(US $31,500.00)

2006 chevrolet corvette one owner leather low mileage(US $31,500.00) 2009 chevrolet corvette base convertible 2-door 6.2l

2009 chevrolet corvette base convertible 2-door 6.2l

Auto Services in Florida

Yokley`s Acdelco Car Care Ctr ★★★★★

Wing Motors Inc ★★★★★

Whitt Rentals ★★★★★

Weston Towing Co ★★★★★

VIP Car Wash ★★★★★

Vargas Tire Super Center ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM profit dips on truck changeover, but beats estimates

Thu, Apr 26 2018DETROIT — General Motors on Thursday reported a higher-than-expected quarterly profit despite a drop in production of high-margin pickup trucks, as it gears up for new models that are expected to boost profits next year. Like rivals Ford and Fiat Chrysler Automobiles, GM is banking on highly-profitable Chevy Silverado and GMC Sierra pickup trucks to lift profits, as consumers shift away from traditional passenger cars in favor of these larger, more comfortable trucks, SUVs and crossovers. During the first quarter, the process of changing over to GM's new pickups resulted in a drop in production of 47,000 units. GM Chief Financial Officer Chuck Stevens said the production drop had resulted in a drop in pre-tax profit of up to $800 million. Earlier this year, GM said its 2018 profits would be flat compared with 2017, but expected its all-new pickup trucks would boost margins starting in 2019. On Thursday, GM reiterated its full-year 2018 forecast for adjusted earnings in a range from $6.30 to $6.60 per share. The automaker said capital expenditures were more than $500 million higher in the quarter because of investments its new pickup trucks and a family of low-cost vehicles under development with Chinese partner SAIC Motor Corp. On Wednesday, rival Ford said it would stop investing in most traditional passenger sedans in North America. CFO Stevens told reporters on Thursday that GM has "already indicated that we will make significantly lower investments on a go-forward basis" in sedans. 2019 GMC Sierra View 21 Photos GM benefited from a lower effective tax rate in the quarter, but adjusted pre-tax margin fell to 7.2 percent from 9.5 percent a year earlier. Stevens said the company's profit margin should hit 10 percent or higher in the second quarter and for the full year. GM said material costs were $700 million higher in the first quarter, and it expects those costs to continue rising. The automaker said it would counter those increases with cost cutting measures. "It is a more difficult environment than it was three or four months ago," Stevens said when asked about rising commodity prices from potential steel and aluminum tariffs announced by the Trump administration. "But we are confident we can continue to offset that." The company reported quarterly net income of $1.05 billion or $1.43 per share, a drop of nearly 60 percent from $2.61 billion or $1.75 per share a year earlier. Analysts had on average expected earnings per share of $1.24.

GM to trim Russian output, raise prices amid currency woes

Thu, Feb 5 2015General Motors is shutting down its factory in Russia's second largest city, St. Petersburg, from the middle of March until the middle of May as the country's currency, the ruble, continues to give economists fits. The ruble's value has plunged due not only to western sanctions, but a precipitous fall in oil prices. We knew these factors were already impacting the auto industry there, as Ford reported in its 2014 earnings statement, and now they're forcing GM to cut production at the factory, shown above, that is responsible for production of the Chevrolet Cruze and Opel Astra. Meanwhile, Automotive News is citing Russian outlet Kommersant as saying that GM has hiked its prices in the country by an average of 20 percent over the past two months. While a GM spokesman confirmed the St. Petersburg plant would be shut down for the two-month span reported by Kommersant and AN, he would not confirm the price increase. News Source: Automotive News - sub. req.Image Credit: Alexander Nikolayev / AFP / Getty Images Earnings/Financials Plants/Manufacturing Chevrolet GM Opel opel astra