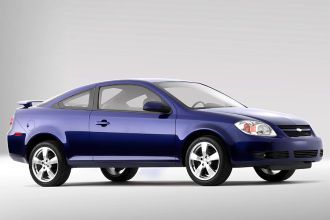

2005 Chevrolet Cobalt Ls on 2040-cars

4510A West Washington Street, Indianapolis, Indiana, United States

Engine:2.2L I4 16V MPFI DOHC

Transmission:4-Speed Automatic

VIN (Vehicle Identification Number): 1G1AL12F557632664

Stock Num: A1

Make: Chevrolet

Model: Cobalt LS

Year: 2005

Exterior Color: Silver

Interior Color: Gray

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 72156

************NOTE** At Indy Auto, we certify that we do not advertise low ball prices to lure customers in and then magically add more $$$ behind the deal. Our vehicles are affordable, dependable and reliable. We sell all makes and models with integrity and trust; backed with extraordinary experience. We offer various financing options including -Buy Here Pay Here, and to even make it better, we offer warranties on every single vehicle that we sell. Visit Indy Auto Land LLC online at www.indyautoland.com to see more pictures of this vehicle or call our office at 888-409-3023

Chevrolet Cobalt for Sale

2006 chevrolet cobalt ls(US $6,500.00)

2006 chevrolet cobalt ls(US $6,500.00) 2009 chevrolet cobalt lt(US $9,450.00)

2009 chevrolet cobalt lt(US $9,450.00) 2006 chevrolet cobalt ls(US $6,591.00)

2006 chevrolet cobalt ls(US $6,591.00) 2006 chevrolet cobalt ls(US $6,591.00)

2006 chevrolet cobalt ls(US $6,591.00) 2010 chevrolet cobalt lt(US $7,991.00)

2010 chevrolet cobalt lt(US $7,991.00) 2005 chevrolet cobalt ls(US $4,991.00)

2005 chevrolet cobalt ls(US $4,991.00)

Auto Services in Indiana

Wilson`s Transmission ★★★★★

Westside Motors ★★★★★

Tom Roush Mazda ★★★★★

Tom & Ed`s Autobody Inc ★★★★★

Seniour`s Auto Salvage ★★★★★

Ryan`s Radiator & Auto Air Service ★★★★★

Auto blog

Sunday Drive: Subaru Ascends up to the hottest market segment in America

Mon, Feb 19 2018Utility vehicles – in other words, crossovers and SUVs – are so hot right now. Two of our top stories from last week revolve around the utilitarian vehicle, but besides their jacked-up, five-door bodystyles, they couldn't be more different. The 2019 Subaru Ascent is headed into an extremely crowded and competitive segment, where it'll have to go up against industry stalwarts like the Toyota Highlander and Honda Pilot, not to mention upstart contenders like the Volkswagen Atlas. The Mercedes-AMG G63, on the other hand, has very little competition – there simply aren't very many ultra-luxurious, off-road-ready SUVs in the world vying to attract the dollars of the wellest-to-do customers across these United States. Moving on from crossovers and SUVs, our readers remain attracted to classic front-engine, rear-wheel-drive sportscars. The Toyota Supra's upcoming rebirth earns two places on our list of stories worth highlighting from the week that was; one with leaked information from a Japanese magazine, and another with rumors indicating that maybe we shouldn't be quite so excited. And finally, there's the strange case of the long-lost 2009 Chevy Corvette Z06 that one lucky individual happened to find squirreled away in a storage container with just 720 original miles. A high-horsepower head scratcher if we've ever seen one. As always, stay tuned to Autoblog this week for all the latest automotive news that's fit to print. 2019 Subaru Ascent vs Honda Pilot vs Toyota Highlander: How they compare on paper 2019 Mercedes-AMG G63 set to bare its 577-horsepower heart in Geneva Toyota Supra leaks in Japanese magazine ahead of Geneva debut Toyota Supra to be little more than a rebodied BMW Z4? Forgotten 720-mile 2009 Corvette Z06 emerges from storage Chevrolet Mercedes-Benz Subaru Toyota Coupe Crossover SUV Luxury Off-Road Vehicles Performance barn find sunday drive subaru ascent mercedes-amg g63

What if the mid-engine Corvette is really a Cadillac?

Tue, Jun 28 2016Call me crazy, but I'm not convinced the mid-engine Corvette is the next Corvette. The rumor is strong, yes. And, contrary to some of the comments on our site, Car and Driver - leader of the mid-engine Corvette speculation brigade - has a pretty good record predicting future models. But it's another comment that got me thinking: or maybe it's a Cadillac. There is clearly something mid-engine going on at GM, and I think it makes sense for the car to be a Cadillac. First off, check out how sweet the 2002 Cadillac Cien concept car still looks in the photo above. Second, there are too many holes in the mid-engine Corvette theory. There are too many holes in the mid-engine Corvette theory. The C7 is relatively young in Corvette years, starting production almost three years ago as a 2014 model. Showing a 2019 model at the 2018 North American International Auto Show would kill sales of a strong-selling car before its time. Not to mention it would only mean a short run for the Grand Sport, which was the best-selling version of the previous generation. More stuff doesn't add up. Mid-engine cars are, in general, more expensive. Moving the Vette upmarket leaves a void that the Camaro does not fill. There's not much overlap between Camaro and Corvette customers. Corvette owners are older and enjoy features like a big trunk that holds golf clubs. Mid-engine means less trunk space and alienating a happy, loyal buyer. Also, more than 60 years of history. The Corvette is an icon along the likes of the Porsche 911 and Ford Mustang. I'm not sure the car-buying public wants a Corvette that abandons all previous conventions. And big changes bring uncertainty - I don't think GM would make such a risky bet. Chevrolet could build a mid-engine ZR1, you might say, and keep the other Corvettes front-engine. Yes they could, and it would cost a ton of money. And they still need to fund development of that front-engine car. I highly doubt the corporate accountants would go for that. But a Cadillac? Totally. Cadillac is in the middle of a brand repositioning. GM is throwing money at this effort. A mid-engine halo car is the just the splash the brand needs to shake off the ghosts of Fleetwoods past. And it's already in Cadillac President Johan De Nysschen's playbook. He was in charge of Audi's North America arm when the R8 came out. A Caddy sports car priced above $100,000 isn't that unreasonable when you can already price a CTS-V in that range.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.