65 Chevelle Ss on 2040-cars

Oxford, Georgia, United States

Engine:283

For Sale By:Private Seller

Interior Color: Black

Model: Chevelle

Warranty: Vehicle does NOT have an existing warranty

Trim: ss

Drive Type: turbo 350

Mileage: 100,000

Exterior Color: Purple

65 chevelle ss true 138 car 283 with turbo 350 and 12 bolt also has ac,pb,ps .full payment is due be for car leaves 1000.00 at end of auction by paypal only do not bid if you have lower then 10 feed back buy is responsible for shipping.

Chevrolet Chevelle for Sale

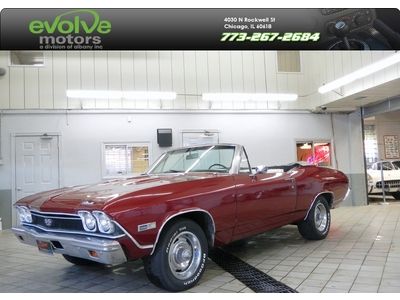

1968 chevelle ss 396 convertible ss396 automatic numbers matching super sport

1968 chevelle ss 396 convertible ss396 automatic numbers matching super sport 1970 chevrolet chevelle ss 396 a/t with a/c(US $23,000.00)

1970 chevrolet chevelle ss 396 a/t with a/c(US $23,000.00) 1969 chevolet chevelle ss396 coupe 4 speed(US $20,000.00)

1969 chevolet chevelle ss396 coupe 4 speed(US $20,000.00) 1967 chevy chevelle ss

1967 chevy chevelle ss 1970 chevelle with new 496ho 400 auto 3speed

1970 chevelle with new 496ho 400 auto 3speed 1970 chevelle 2 door restoration project

1970 chevelle 2 door restoration project

Auto Services in Georgia

ZBest Cars ★★★★★

Woods Automotive ★★★★★

Wellington Auto Sales ★★★★★

Volvotista ★★★★★

US Auto Sales - Covington ★★★★★

US Auto Sales ★★★★★

Auto blog

UAW to vote on strike at Kentucky Corvette plant

Tue, 08 Apr 2014The current wait time for a new Chevrolet Corvette Stingray is well, not short. With word of a strike at the Bowling Green, KY factory responsible for seventh-generation sports car, though, that wait time could end up growing substantially.

Now, a strike is still a ways off. UAW Local 2164, which represents the 800 workers responsible for screwing the Corvette together, is set to vote on authorizing a strike today, but even if the employees give the action a go, it's far from a sure thing. According to The Tennessean, both regional and national union officials would need to put their stamp of approval on strike action.

"The membership has to vote to strike, but it's just a step in the process," said Gary Casteel, the UAW's Region 8 director and one of the people that would need to authorize a strike action. Casteel told The Tennessean, "It's purely a local situation, though. They are having some issues with the local management."

CA Chevy dealer allegedly adds $50K 'market value adjustment' to 2015 Z06

Fri, Jan 9 2015It seems to happen with every eagerly anticipated new car – dealerships, recognizing that crushing demand far outstrips the initial limited supply of a new model, inflate the price via a so-called "market value adjustment." We've seen it in the past with a number of new models, and now it's happening again with one of the Detroit 3's hottest vehicles. A dealership in Roseville, CA, outside of Sacramento, has allegedly attached a staggering $49,995 market value adjustment to a 2015 Corvette Z06. We say allegedly because, despite the evidence uncovered by BoostAddict, John L. Sullivan Chevy's online inventory listing doesn't display the price premium of the Z06 in question, a (normally) $93,965 model with the top-end 3LZ trim. It's unclear if either of the dealer's other Z06s, both 3LZs, one of which is in transit, will receive similar price adjustments. Now, legally, Sullivan Chevy isn't doing anything wrong here. Dealerships are under no obligation to observe a manufacturer's suggested retail price, a point General Motors' spokesperson Ryndee Carney pointed out to Autoblog via email. "For the Corvette Z06, Chevrolet has established a Manufacturer's Suggested Retail Price we feel is right for the market. Actual transaction prices, however, are the province of the dealer," Carney said, adding that a dealer zone manager will be discussing the price hike with the dealership. While we also reached out to the dealership over both the market value adjustment and the price of the Z06 as it appears on the company's website, we've yet to hear back as of this writing. Should they reply to our inquiries, we'll be sure to update you. Until then, we'd like to hear what you think about this case. Is Sullivan Chevy simply pricing the cars as high as it thinks the market can bear, or is this a cash grab for an hotly anticipated product? Have your say in Comments.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.