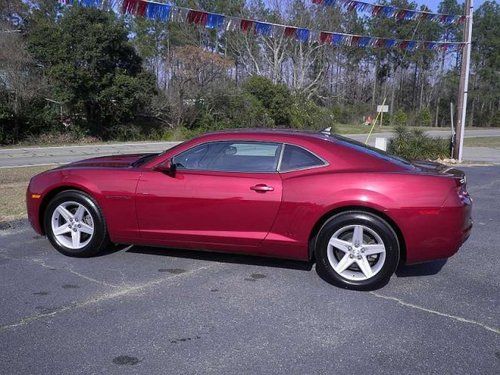

2013 Chevrolet Camaro on 2040-cars

Brattleboro, Vermont, United States

Engine:6.2L 376Cu. In. V8 GAS OHV Naturally Aspirated

Transmission:Manual

Body Type:Convertible

Fuel Type:GAS

Make: Chevrolet

Options: Leather Seats, CD Player, Convertible

Model: Camaro

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Trim: SS Convertible 2-Door

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Number of Doors: 2

Drive Type: RWD

Drivetrain: RWD

Mileage: 14

Sub Model: Ss

Exterior Color: Red

Number of Cylinders: 8

Interior Color: Black

Warranty: Vehicle has an existing warranty

Chevrolet Camaro for Sale

1971 camaro z28 pro touring number matching 350ci 330hp lt1 engine rebuilt

1971 camaro z28 pro touring number matching 350ci 330hp lt1 engine rebuilt 1971 ss camaro 4 spd 43k original miles - matching #'s - all documented(US $32,500.00)

1971 ss camaro 4 spd 43k original miles - matching #'s - all documented(US $32,500.00) 1968 red camaro ss style 350ci sbc automatic overdrive transmission musclecar(US $29,900.00)

1968 red camaro ss style 350ci sbc automatic overdrive transmission musclecar(US $29,900.00) 2000 chevrolet camaro z28 convertible 2-door 5.7l

2000 chevrolet camaro z28 convertible 2-door 5.7l 1971 chevrolet camaro 350 4 speed

1971 chevrolet camaro 350 4 speed 2010 chevrolet camaro lt v6 auto(US $17,250.00)

2010 chevrolet camaro lt v6 auto(US $17,250.00)

Auto Services in Vermont

Napa Auto Parts ★★★★★

Groton Garage Main ★★★★★

Everything Automotive & Tires ★★★★★

Blackfork Emergency Services ★★★★★

Abair`s Quality Car Care ★★★★★

Rpm Motor Sales ★★★★

Auto blog

2014 Chevrolet Corvette Stingray priced from $51,995*

Fri, 26 Apr 2013After months of speculation, Chevrolet has finally revealed the official starting price of the 2014 Corvette Stingray. The base MSRP for the 450-horsepower Stingray Coupe will be $51,995, while the Stingray Convertible will go for $56,995 (*both prices include a $995 destination fee). This means that the price increase from 2013 to 2014 is just $1,400 for the coupe and $2,395 for the convertible - pretty modest increases considering the upgrade in specifications. Of course, neither price accounts for the sort of dealer markup that might grace early C7 window stickers, especially since less than a third of all Chevrolet dealers will be allocated Corvette models to sell at the car's launch.

Now, these prices are for the base car, so if you're wondering how much a fully loaded Stingray will run, Chevy has given us a good indication of that as well. The coupe we saw on display at the Detroit Auto Show (shown above), for example, would run $73,360 including options such as the $2,800 Z51 Performance Package, $2,495 competition sport seats and the $1,795 Magnetic Ride Control option - just to name a few. Stepping up to the 3LT trim level that brings a full leather interior will run an extra $8,005 over the base price.

While $20,000 in options may seem like a lot, this "as-tested" price still has the C7 competitively priced against rival coupes like the Porsche 911 and Nissan GT-R. Speaking of price comparisons, Chevrolet also points out that the C7 Stingray Z51 costs $2,200 less than the C6 Grand Sport while delivering better acceleration (0-60 mph in less than four seconds) and improved track performance (including more than 1 g in cornering).

GM extends production cuts, affects Cadillacs, Camaro and Acadia

Thu, Apr 8 2021General Motors is extending production cuts at some of its North America factories due to a chip shortage that has roiled the global automotive industry, the U.S. carmaker said on Thursday. The move's impact has been baked into GM's prior forecast that the shortage could shave up to $2 billion off this year's profit. GM's Lansing Grand River assembly in Michigan will extend its downtime through the week of April 26. The plant makes Chevrolet Camaros and Cadillac CT4 and CT5 sedans. It has been out of action since March 15. GM's Spring Hill assembly in Tennessee will shut down for two weeks starting the week of April 12. The plant makes the Cadillac XT5, XT6 and GMC Acadia. The company said it has not taken downtime or reduced shifts at any of its more profitable full-size truck or full-size SUV plants due to the shortage. The news was first reported by CNBC. Reporting by Ankit Ajmera in Bengaluru; Editing by Maju Samuel and Sriraj Kalluvila

Camaro SS, Hellcat Widebody, and an Airstream camper | Autoblog Podcast #545

Fri, Jun 29 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Green Editor John Beltz Snyder and Senior Editor Alex Kierstein. We talk about a lot of American stuff, including the Chevy Camaro SS 1LE and the new Blazer, Dodge Challenger Hellcat Widebody, Ford's new train station and a diesel F-150 towing an Airstream trailer, as well as some Tesla pickup news. Somehow the Kia Stinger also made its way into this red, white and blue episode (because it's great, and it's our new long-termer). This week, we try something a little different in the "Spend My Money" segment. Autoblog Podcast #545 Your browser does not support the audio element. Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we've been driving: Chevrolet Camaro SS 1LE, Dodge Challenger SRT Hellcat Widebody, Kia Stinger AWD Visiting Ford's new train station in Detroit Camping with a Ford F-150 Diesel and an Airstream Basecamp Chevy unveiled the new Blazer New Tesla pickup truck details Spend my money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Green Podcasts Chevrolet Dodge Ford Kia Truck Coupe Crossover Electric Future Vehicles Performance Sedan RVs/Campers chevy blazer michigan central station