1976 Chevy C10 "trailering Special" Longbed Pickup, Restored, 66k Miles on 2040-cars

Homer Glen, Illinois, United States

Body Type:Pickup Truck

Vehicle Title:Clear

Engine:454 V8

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chevrolet

Model: C-10

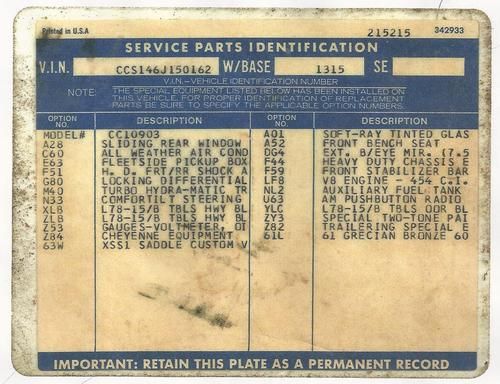

Trim: Cheyenne "Trailering Special"

Options: Cassette Player

Drive Type: Auto Matic, Locking Differential

Power Options: Air Conditioning

Mileage: 66,528

Exterior Color: Grecian Bronze

Interior Color: Saddle

Warranty: Vehicle does NOT have an existing warranty

Chevrolet C-10 for Sale

Nice restoration base good shape hot rod pickup truck

Nice restoration base good shape hot rod pickup truck 1983 chevrolet c-10 pickup 2wd solid nc truck custom deluxe factory ac truck

1983 chevrolet c-10 pickup 2wd solid nc truck custom deluxe factory ac truck 1966 chevy short bed c10 truck step side needs paint

1966 chevy short bed c10 truck step side needs paint 1986 c10 silverado in mint condition

1986 c10 silverado in mint condition 1969 chevy truck rat rod project

1969 chevy truck rat rod project 1970 chevrolet c10 pickup 350/th350 pb ps ac lowered over $25k invested

1970 chevrolet c10 pickup 350/th350 pb ps ac lowered over $25k invested

Auto Services in Illinois

Youngbloods RV Center ★★★★★

Village Garage & Tire ★★★★★

Villa Park Auto Clinic ★★★★★

Vfc Engineering ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Muffler & Brake ★★★★★

Auto blog

Chevrolet Silverado, GMC Sierra could get independent rear suspension

Fri, Jan 3 2020The Chevrolet Silverado and the GMC Sierra could reportedly receive a variant of the four-link independent rear suspension found under the new Tahoe and Suburban. While that's not a surprise, a recent report suggests electrification, not comfort, convinced General Motors to make the change. Replacing the time-tested solid rear axle with an independent suspension will improve comfort, handling and off-road prowess, while adding weight, and likely making the trucks a little bit more expensive. It's a fair trade-off, but GM Authority learned the real reason for the swap is that at least one of the pickups will spawn an electric model, and it's more difficult to package a bulky battery pack around a solid rear axle. The independent rear suspension takes up far less space, even if it has more moving parts. General Motors will build its first regular-production electric pickup on an evolution of the Silverado's T1 platform named BT1, according to the same source. The b stands for -- you guessed it -- batteries. The firm reportedly doesn't want to make two suspensions for cost reasons, so the independent setup will come standard regardless of whether the truck runs on gasoline, diesel, or electricity. As a bonus, Chevrolet and GMC could choose to offer their T1-based trucks with Magnetic Ride Control or an air suspension, options available on the 2021 Suburban and Tahoe. The independent rear suspension will also find its way to the next-generation GMC Yukon due to be revealed January 14, and to the 2021 Cadillac Escalade scheduled to make its debut February 4. The long-rumored, born-again Hummer will get it, too, because it will arrive as an electric model built on the BT1 platform. It's worth noting none of this is official, and General Motors has remained quiet about what's next for its new suspension design, and what will be under its electric truck's sheet metal. If the GM Authority report is accurate, the Silverado (pictured) and the Sierra could ditch their solid rear axle for the 2021 model year. The change will likely be accompanied by other tweaks inside and out. Featured Gallery 2019 Chevrolet Silverado 1500 View 16 Photos Chevrolet GMC Truck

Mustang retakes monthly pony car sales crown from Camaro

Wed, Dec 3 2014Going back to their origins in the Swinging '60s, the Ford Mustang and Chevrolet Camaro have been fierce rivals for fans' hearts and dollars. Historically, the Ford often led in volume, but Chevy took the muscle car top spot in 2009 upon the Camaro's rebirth. However, with the launch of the latest Blue Oval pony car, the tide is turning back in Ford's favor. November was the first full month of sales for the new 2015 Mustang, and according to TheDetroitBureau.com, the model did spectacularly well. The Blue Oval shifted 8,728 of them, up 62 percent from same month last year, with the automaker proclaiming it the model's best November sales since 2006. Conversely, 4,385 units of the Camaro were delivered, down 13.5 percent year-over-year, meaning its sales were roughly half that of the new-generation Mustang. Ford is understandably happy with the results, and product development director Raj Nair even hinted to TDB that another version of the Mustang might be unveiled at January's North American International Auto Show. Rumor has it that the model will be the even more potent Shelby Mustang GT350R. Despite the Mustang's November success, the Camaro outsells it year to day. So far in 2014, Ford has sold 73,124 Mustangs versus 79,669 examples of the Camaro. With December offering the last chance for an overtake, the Bowtie may yet remain king for this year's sales crown. A new Camaro is peeking over the horizon, as well. It's reportedly moving to the Alpha platform used by the Cadillac ATS, and production could start in late 2015. Prototypes are already testing at the Nurburgring, and camouflaged examples have been spotted weirdly being compared to its '80s forefather.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.