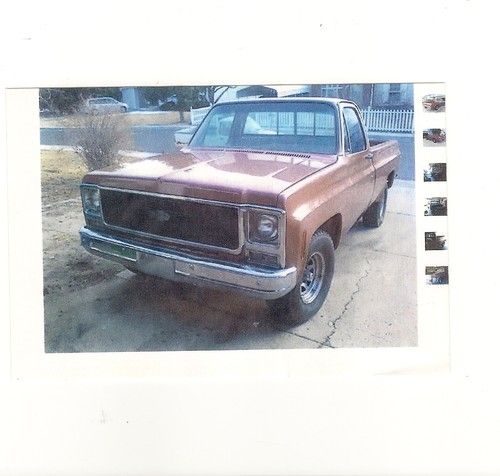

1970 Gold Chevrolet Pick-up, 4.1l on 2040-cars

El Paso, Texas, United States

Engine:4.1L, 250 cu. in.

Body Type:Pickup Truck, side step

Vehicle Title:Clear

Exterior Color: Gold

Make: Chevrolet

Interior Color: Black

Model: C-10

Number of Cylinders: 6

Trim: pick-up, two door, side step

Drive Type: rear two wheel drive

Mileage: 129,000

- 1970 Gold Chevrolet Pick-Up Side Step

- Second owner

- 129,000 miles

- Everything is original, painted only once!

- 250 cu. in. motor, 3 speed, standard, 6 cylinder, 4.1

- Minimal rust, side step, shift on steering column.

Chevrolet C-10 for Sale

Auto Services in Texas

Your Mechanic ★★★★★

Yale Auto ★★★★★

Wyatt`s Discount Muffler & Brake ★★★★★

Wright Auto Glass ★★★★★

Wise Alignments ★★★★★

Wilkerson`s Automotive & Front End Service ★★★★★

Auto blog

GM’s move to Woodward is the right one — for the company and for Detroit

Wed, May 1 2024Back in 2018, Chevy invited me to attend the Detroit Auto Show on the company dime to get an early preview of the then-newly redesigned Silverado. The trip involved a stay at the Renaissance Center — just a quick People Mover ride from the show. IÂ’d been visiting Detroit in January for nearly a decade, and not once had I set foot inside General MotorsÂ’ glass-sided headquarters. I was intrigued, to say the least. Thinking back on my time in the buildings that GM will leave behind when it departs for the new Hudson's site on Woodward Avenue, two things struck me. For one, its hotel rooms are cold in January. Sure, itÂ’s glass towers designed in the 1960s and '70s; I calibrated my expectations accordingly. But when I could only barely see out of the place for all the ice forming on the inside of the glass, it drove home just how flawed this iconic structure is. My second and more pertinent observation was that the RenCen doesnÂ’t really feel like itÂ’s in a city at all, much less one as populous as Detroit. The complex is effectively severed from its surroundings by swirling ribbons of both river and asphalt. To the west sits the Windsor tunnel entrance; to the east, parking lots for nearly as far as the eye can see. To its north is the massive Jefferson Avenue and to its south, the Detroit River. You get the sense that if Henry Ford II and his team of investors had gotten their way, the whole thing would have been built offshore with the swirling channel doubling as a moat. This isnÂ’t a building the draws the city in; itÂ’s one designed to keep it out. Frost on the inside of the RenCen hotel glass. Contrasted with the new Hudson's project GM intends to move into, a mixed-use anchor with residential, office, retail and entertainment offerings smack-dab in Detroit's most vibrant district, the RenCen is a symbol of an era when each office in DetroitÂ’s downtown was an island in a rising sea of dilapidation. Back then, those who fortified against the rapid erosion of DetroitÂ’s urban bedrock stood the best chance of surviving. This was the era that brought us ugly skyways and eventually the People Mover — anything to help suburban commuters keep their metaphorical feet dry. The RenCen offered — and still offers — virtually any necessity and plenty of nice-to-haves, all accessible without ever venturing outside, especially in the winter, but those enticements are geared to those who trek in from suburbia to toil in its hallways.

There are still 6,000 first-gen Chevy Volts on dealer lots

Sun, May 24 2015The next-gen 2016 Chevrolet Volt looks to be a pretty fantastic vehicle with more electric driving range, better fuel economy than its predecessor, and a lower starting price. However, if you're looking for a deal, the 2015 model of the plug-in hybrid might not be a bad place to check because Chevy has a ton of them to get rid of. According to The Detroit Free Press, there are around 6,000 examples of the 2015 Volts that are still sitting on dealer lots. That might not sound like a lot, but Chevy only sold 905 of them in April and 2,779 through that month in 2015. It moved 18,805 of the PHEVs for all of 2014. Buyers are in a pretty good spot to haggle at the moment, too, with the a new Volt right around the corner. According to The Detroit Free Press based on TrueCar figures, the current average closing price for a 2015 model is $30,607 before any federal or state tax credits. You can also lease one for 39 months for $299 a month and $1,649 due at signing. In April, Chevy was reportedly offering customers 2.9-percent financing for 48 months and leases with no money down for buyers trading in a vehicle from a competitor. Of course, there's also always the option to buy a pre-owned example. Just a few months ago, prices for used Volts were reportedly as low as $13,000 at auction.

Weekly Recap: The implications of strong new car sales

Sat, Jun 6 2015New car sales are on a roll in the United States this year, and analysts are optimistic the industry will maintain its torrid pace. Sales increased 1.6 percent in May and reached an eye-popping seasonally-adjusted selling rate of 17.8 million, the strongest pace since July 2005, according TrueCar research. That positions the industry for one of its strongest years ever, as consumer confidence, low interest rates, low fuel costs, and an influx of new products propel gains. In addition to the positive economic factors, May also featured warmer weather across much of the US, an extra weekend, and it came on the heels of relatively weak April sales. Analysts suggest income tax refunds and the promise of summer driving and vacations also traditionally help May sales. "While 2015 will be one of the best years in the history of the US industry, in some ways it may be the very best ever," IHS Automotive analyst Tom Libby wrote in a commentary. "Not only are new vehicle registration volumes approaching the record levels of the early 2000s, but now registrations and production capacity are much more closely aligned so the industry is much more healthy." Capacity, an indicator of the auto sector's health, is also expected to grow. Morgan Stanley predicts it will eventually hit at least 20 million units per year, as many companies, including General Motors, Ford, Tesla, and Volvo are investing in new or upgraded factories. "The best predictor of US auto sales is the growth in capacity, and frankly, we're losing count of all of the additions – there's literally something new and big every week," Morgan Stanley said in a research note. Transaction prices, another telling indicator, also continue to show strength. They rose four percent in May to $32,452 per vehicle, and incentives dropped $10 per vehicle to $2,661, TrueCar said. "New vehicle sector and segment preference indicates consumers are confident about the economy and their finances," TrueCar president John Krafcik said in a statement. Still, Morgan Stanley noted the robust sales did little to immediately impact automaker stock prices and suggested it might be a prime time to sell if sales reach the 18-million pace. "Perhaps the biggest reason may be that investors have seen this movie before," the firm wrote.

1976 red chevy c10

1976 red chevy c10 New paint,rebuilt 350 eng.,350 trans,seat covers,new carpetp/s,p/b no a/c

New paint,rebuilt 350 eng.,350 trans,seat covers,new carpetp/s,p/b no a/c 1978 stepside 2wd dark green with only 33,800 original miles

1978 stepside 2wd dark green with only 33,800 original miles 1963 chevrolet c10 complete restoration

1963 chevrolet c10 complete restoration 1969 chevrolet c-10 stepside pickup

1969 chevrolet c-10 stepside pickup Chevy c10 1964

Chevy c10 1964