1986 Cadillac Fleetwood Brougham D Elegance , 11,386 Actual Miles, Pristine !! on 2040-cars

Pompano Beach, Florida, United States

Cadillac Fleetwood for Sale

1968 cadillac fleetwood brougham sedan 4-door 7.7l

1968 cadillac fleetwood brougham sedan 4-door 7.7l 1993 cadillac fleetwood brougham sedan 4-door 5.7l low miles

1993 cadillac fleetwood brougham sedan 4-door 5.7l low miles 1981 cadillac fleetwood brougham d'elegance 6.0l, 80k miles, wire wheels

1981 cadillac fleetwood brougham d'elegance 6.0l, 80k miles, wire wheels 1960 cadillac fleetwood 75 series limousine a/c div car. very much original(US $14,500.00)

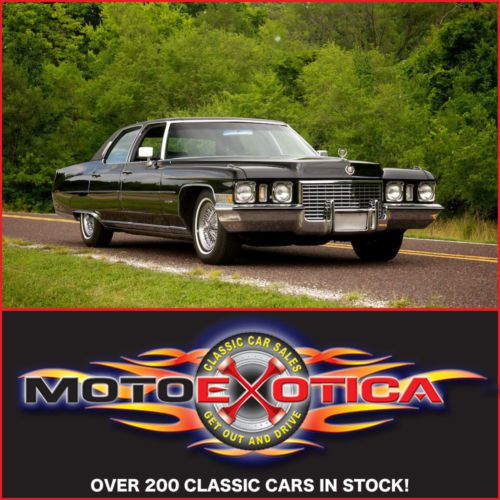

1960 cadillac fleetwood 75 series limousine a/c div car. very much original(US $14,500.00) 1972 cadillac fleetwood 60 special brougham -24,092 actual mileage - 472ci v8 !!

1972 cadillac fleetwood 60 special brougham -24,092 actual mileage - 472ci v8 !! 1993 cadillac fleetwood , a true one owner in showroom condition

1993 cadillac fleetwood , a true one owner in showroom condition

Auto Services in Florida

Z Tech ★★★★★

Vu Auto Body ★★★★★

Vertex Automotive ★★★★★

Velocity Factor ★★★★★

USA Automotive ★★★★★

Tropic Tint 3M Window Tinting ★★★★★

Auto blog

de Nysschen pushes to separate Cadillac, GM

Wed, Aug 12 2015Cadillac President Johan de Nysschen continues his push to separate his brand from General Motors. After controversially picking up shop and moving to New York's trendy SoHo neighborhood, de Nysschen has now gone on record as saying that within two years, the brand will enjoy "a far higher degree of autonomy and self sufficiency." That autonomy will include the brand reporting its own financial results, independent of GM. But what would such a move do for Cadillac? Well, as de Nysschen explained it to Automotive News, "Cadillac at this state makes a very sizeable contribution to the overall profit at General Motors." If that's truly the case, separating financial announcements serves to emphasize the prosperous character de Nysschen seems so keen on attaching to his brand. But that's only one phase of Cadillac's push to distance itself from GM. De Nysschen is eager to revamp the company's dealership model so that it stands out from other GM brands, calling it a "very profound focus." Those moves, according to AN, including a change to the current dealer incentive model with a particular emphasis on building the brand rather than nailing sales figures. "If you aren't strengthening the brand perception, you should have less reward," de Nysschen told AN. While his goals seem clear, de Nysschen's statements have left us wondering whether they're also somewhat counterintuitive. Emphasizing Caddy's prosperity to potential consumers while incentivizing dealers to move less metal seems more like a tactical move rather than a strategic one. And there's no telling how the new dealership model will impact de Nysschen's goal to hit 500,000 global sales by 2020. Related Video:

The UAW's 'record contract' hinges on pensions, battery plants

Thu, Oct 12 2023DETROIT - After nearly four weeks of disruptive strikes and hard bargaining, the United Auto Workers and the Detroit Three automakers have edged closer to a deal that could offer record-setting wage gains for nearly 150,000 U.S. workers. General Motors, Ford Motor and Chrysler parent Stellantis have all agreed to raise base wages by between 20% and 23% over a four-year deal, according to union and company statements. Ford and Stellantis have agreed to reinstate cost-of-living adjustments, or COLA. The companies have offered to boost pay for temporary workers and give them a faster path to full-time, full-wage status. All three have proposed slashing the time it takes a new hire to get to the top UAW pay rate. The progress in contract talks follows the first-ever simultaneous strike by the UAW against Detroit's Big Three automakers. The union began the strike on Sept. 15 in hopes of forcing a better deal from each major automaker. But coming close to a deal is not the same thing as reaching a deal. Big obstacles remain on at least two major UAW demands: restoring the retirement security provided by pre-2007 defined benefit pension plans, and covering present and future joint- venture electric vehicle battery plants under the union's master contracts with the automakers. On retirement, none of the automakers has agreed to restore pre-2007 defined-benefit pension plans for workers hired after 2007. Doing so could force the automakers to again burden their balance sheets with multibillion-dollar liabilities. GM and the former Chrysler unloaded most of those liabilities in their 2009 bankruptcies. The union and automakers have explored an approach to providing more income security by offering annuities as an investment option in their company-sponsored 401(k) savings plans, people familiar with the discussions said. Stellantis referred to an annuity option as part of a more generous 401(k) proposal on Sept. 22. Annuities or similar instruments could give UAW retirees assurance of fixed, predictable payouts less dependent on stock market ups and downs, experts said. Recent changes in federal law have removed obstacles to including annuities as a feature of corporate 401(k) plans, said Olivia Mitchell, a professor at the University of Pennsylvania Wharton School and an expert on pensions and retirement. "Retirees want a way to be assured they won't run out of money," Mitchell said.

Cadillac Escalade gets $5,000 discount to ward off Lincoln Navigator

Wed, Nov 8 2017General Motors apparently isn't going to let early good reception for the redesigned Lincoln Navigator steal thunder from its own luxury SUV without a fight. It's offering a $5,000 discount on the purchase or lease of the Cadillac Escalade this month to any buyer who trades in a 1999 or newer Lincoln model, Bloomberg reports. GM spokesman Jim Cain told Bloomberg the incentive is being offered to keep prices competitive for the Escalade. The 2018 Navigator starts at $72,055, compared to $73,995 for the Escalade, but the outgoing version of the Navigator is selling for an average of around $53,000, compared with more than $80,000 on average for the Escalade, he said. The Escalade was the top-selling domestic luxury SUV in October and No. 4 in the segment, according to Motor Intelligence. It far outsold the Navigator, which last saw a refresh in 2015 and a full redesign in 2007. But Ford is hoping to gain back some ground with the new Navigator and updated Expedition, which also trails the Chevrolet Tahoe and Chevy Suburban in its segment. Bloomberg notes that one Morgan Stanley analyst estimates that GM owns a $2 billion annual pretax profit edge in the lucrative luxury sport utility segment. Our recent First Drive review called the new Navigator "far superior to its primary competitor, the Cadillac Escalade."Related Video: