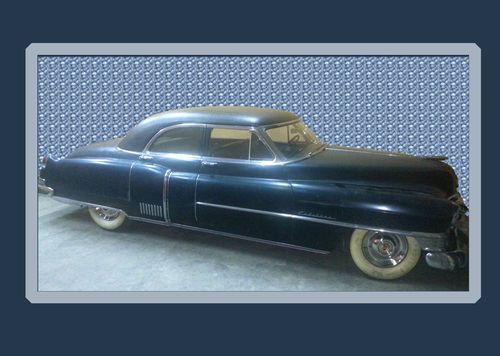

1958 Cadillac Fleetwood 60 Special Very Sharp Like 1957 1959 Look!!! on 2040-cars

NY, United States

Fuel Type:Gasoline

Engine:365

Drive Type: ayto

Make: Cadillac

Mileage: 92,000

Model: Fleetwood

Trim: sixty special

Here is a very good looking 1958 Cadillac Fleetwood Sixty Special. This car is rock solid and no rust on body or underneath. No patches all original trunk, floors and body.Its from South Dakota and out of long storage.New fuel pump,New brakes,new exhaust.Was repainted sometime in the mid 70's and is faded but still gets thumbs up and turns heads all the time.It runs and drives good.Brakes are good.Windows work as do all the lights.Gas gauge shows full all the time.Chrome is good.Interior is in good shape.Front seat is a little worn and so is the carpet by drivers feet. Dash has a nice cover on top.In all its a very sharp driver, not a show car.You don't see many 1958 Fleetwoods anywhere let alone for sale.Bid to win. It will be sold!!!!

Cadillac Fleetwood for Sale

1981 black hearse cadillac fleetwood low mileage

1981 black hearse cadillac fleetwood low mileage 1978 original cadillac fleetwood brougham d' elegance

1978 original cadillac fleetwood brougham d' elegance 1950 cadillac short wheel based limousine gm tech center experimental concept

1950 cadillac short wheel based limousine gm tech center experimental concept 1970 cadillac superior royale combination coach (hearse)(US $3,500.00)

1970 cadillac superior royale combination coach (hearse)(US $3,500.00) 1996 cadillac fleetwood brougham !!!like new !!!

1996 cadillac fleetwood brougham !!!like new !!!

Auto blog

These are the fastest-selling new cars of 2024

Thu, Apr 25 2024Automakers finally appear to be back on their feet after a few years of severe instability, but that hasn’t helped all of them in the sales department. iSeeCars recently released its study on the fastest- and slowest-selling new vehicles and found that some companies are moving vehicles off dealersÂ’ lots at more than twice the pace of others. Toyota was the fastest-selling new car brand between October 2023 and March 2024, moving vehicles in an average of 39.6 days. Surprisingly, Alfa Romeo came second, averaging 41.8 days on the market. Last year, we saw a list of the fastest-selling individual nameplates overall, as opposed to this study that's ranked by brand. Fastest-selling new cars of 2024 Toyota: 39.6 days on the market Alfa Romeo: 41.8 Cadillac: 43.4 Honda: 44.2 Jaguar: 44.4 Kia: 47 Hyundai: 47.1 Subaru: 49 BMW: 49.1 Mazda: 53.1 The brands moving inventory the fastest show a strong value and desirability for buyers. iSeeCars executive analyst Karl Brauer noted, “Fast-selling brands like Toyota and Honda represent mainstream consumers seeking maximum value for their new-car dollar. Conversely, high-ranking luxury, low-volume brands like Alfa Romeo, Cadillac, and Jaguar reflect both their limited supply as well as high demand from affluent buyers willing to snap these models up shortly after they arrive on dealer lots.” Of course, there is no light without darkness, and on the other side of the list are a handful of brands struggling to move inventory. Lincoln was the slowest-selling new car company, with an average of 82.6 days to sell. Infiniti was close behind at 79.8 days, and Buick took an average of 79 days to move units. iSeeCars noted that new EVs take much longer to sell than their hybrid counterparts, at an average of 70.6 days on the market in March 2024, compared to just 49.5 for hybrids. Some of the fast-selling new brands also made the used car list. Used Hondas sold the fastest, only sitting on dealersÂ’ lots for an average of 26.1 days. LexusÂ’ used cars sat for 26.3 days, and Toyota moved its used inventory in an average of 27.4 days. By the Numbers Green Alfa Romeo Cadillac Toyota Car Buying

A pair of different but awesome Hondas star in the latest Forza Horizon 3 car pack

Mon, Feb 6 2017Forza Horizon 3's ever-expanding car list grows again with its latest downloadable car pack. This time it packs a pair of Hondas from opposite ends of history. In fact they use opposite drive wheels, too. The first, representing the modern day and front-wheel drive, is the previous generation, 300-horsepower, 2016 Honda Civic Type R. From the early days of Honda automobiles, and with rear-wheel-drive, is the 1970 Honda S800. It has substantially less than 300 horsepower. The Civic Type R isn't the only hot hatch in the pack either. The Vauxhall Corsa VXR provides a European counterpoint to the Honda, albeit a bit smaller. It features less power – about 200 hp in all – but should be an excellent match to the Fiesta ST. The pack also features a couple of high-dollar, high-horsepower machines in the form of the 2017 Aston Marin DB11 and the 2016 Cadillac ATS-V. Plus, for fans of older cars, there's the rear-engined Renault Alpine GTA Le Mans, and a Holden with a really long name: the 1985 HDT VK Commodore Group A. View 7 Photos As usual, the pack is included with the Forza Horizon 3 Car Pass. Or, if you don't have the pass, the pack can be purchased on its own. Related Video: Image Credit: Turn10 Studios / Playground Games Toys/Games Aston Martin Cadillac Honda Videos aston martin db11 cadillac ats-v forza horizon 3 vauxhall corsa

Best car infotainment systems: From UConnect to MBUX, these are our favorites

Sun, Jan 7 2024Declaring one infotainment system the best over any other is an inherently subjective matter. You can look at quantitative testing for things like input response time and various screen load times, but ask a room full of people that have tried all car infotainment systems what their favorite is, and you’re likely to get a lot of different responses. For the most part, the various infotainment systems available all share a similar purpose. They aim to help the driver get where they're going with navigation, play their favorite tunes via all sorts of media playback options and allow folks to stay connected with others via phone connectivity. Of course, most go way beyond the basics these days and offer features like streaming services, in-car performance data and much more. Unique features are aplenty when you start diving through menus, but how they go about their most important tasks vary widely. Some of our editors prefer systems that are exclusively touch-based and chock full of boundary-pushing features. Others may prefer a back-to-basics non-touch system that is navigable via a scroll wheel. You can compare it to the phone operating system wars. Just like some prefer Android phones over iPhones, we all have our own opinions for what makes up the best infotainment interface. All that said, our combined experience tells us that a number of infotainment systems are at least better than the rest. WeÂ’ve narrowed it down to five total systems in their own subcategories that stand out to us. Read on below to see our picks, and feel free to make your own arguments in the comments. Best infotainment overall: UConnect 5, various Stellantis products Ram 1500 Uconnect Infotainment System Review If thereÂ’s one infotainment system that all of us agree is excellent, itÂ’s UConnect. It has numerous qualities that make it great, but above all else, UConnect is simple and straightforward to use. Ease of operation is one of the most (if not the single most) vital parts of any infotainment system interface. If youÂ’re expected to be able to tap away on a touchscreen while driving and still pay attention to the road, a complex infotainment system is going to remove your attention from the number one task at hand: driving. UConnect uses a simple interface that puts all of your key functions in a clearly-represented row on the bottom of the screen. Tap any of them, and it instantly pulls up that menu.