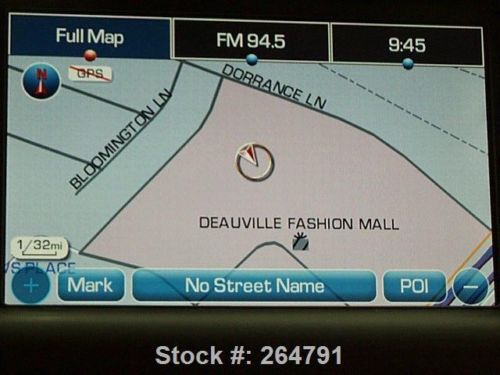

2008 Cadillac Escalade Awd Sunroof Nav Dvd 22's 56k Mi Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Engine:See Description

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Body Type:SUV

Certified pre-owned

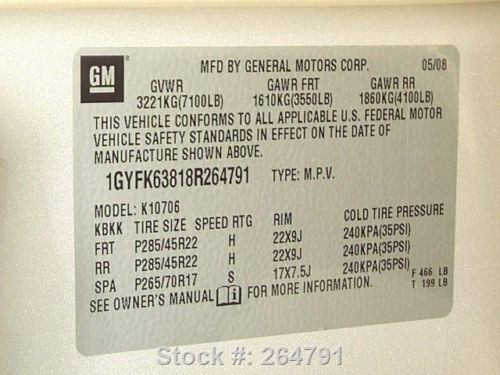

Year: 2008

Warranty: Vehicle has an existing warranty

Make: Cadillac

Model: Escalade

Options: Sunroof, 4-Wheel Drive

Power Options: Power Seats, Power Windows, Power Locks, Cruise Control

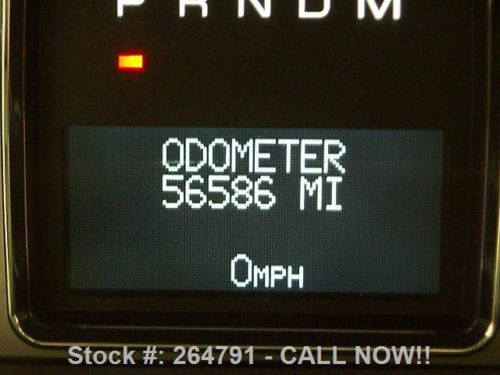

Mileage: 56,586

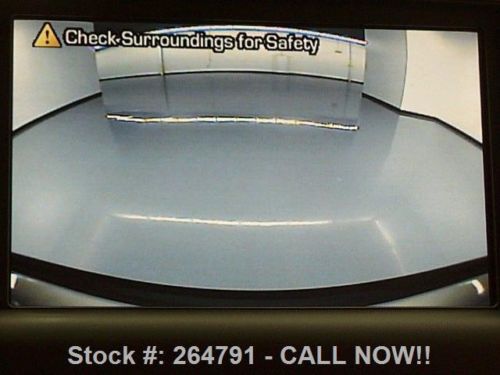

Sub Model: REARVIEW CAM

Exterior Color: Gold

Number Of Doors: 4

Interior Color: Tan

Inspection: Vehicle has been inspected

Number of Cylinders: 8

CALL NOW: 832-310-2223

Seller Rating: 5 STAR *****

Cadillac Escalade for Sale

11 cadillac escalade awd 72k miles navigation leather quad seats tow package

11 cadillac escalade awd 72k miles navigation leather quad seats tow package 12 escalade esv awd 25k miles leather roof navi heated & cooled seat financing

12 escalade esv awd 25k miles leather roof navi heated & cooled seat financing 2009 cadillac escalade ext navigation sunroof bose bluetooth sat radio

2009 cadillac escalade ext navigation sunroof bose bluetooth sat radio 2007 cadillac escalade awd htd leather dvd 24's 87k mi texas direct auto(US $23,980.00)

2007 cadillac escalade awd htd leather dvd 24's 87k mi texas direct auto(US $23,980.00) Certified navigation camera blind spot dvd heated/cooled seats bose pdc xm 22s(US $35,895.00)

Certified navigation camera blind spot dvd heated/cooled seats bose pdc xm 22s(US $35,895.00) 2011 cadillac escalade ext premium awd sunroof nav dvd texas direct auto(US $37,980.00)

2011 cadillac escalade ext premium awd sunroof nav dvd texas direct auto(US $37,980.00)

Auto Services in Texas

Yale Auto ★★★★★

World Car Mazda Service ★★★★★

Wilson`s Automotive ★★★★★

Whitakers Auto Body & Paint ★★★★★

Wetzel`s Automotive ★★★★★

Wetmore Master Lube Exp Inc ★★★★★

Auto blog

GM will expand Super Cruise to entire U.S. lineup after 2020

Wed, Jun 6 2018General Motors plans to bring its Super Cruise semi- autonomous highway driving technology to its entire U.S. lineup after it rolls it out to all Cadillac vehicles in 2020. Mark Reuss, GM's executive vice president for global product development, made the announcement at the Intelligent Transportation Society of America conference in Detroit. Automotive News reports he also announced plans to offer vehicle-to-everything (V2X) communication in a high-volume Cadillac crossover by 2023 — technology that will also eventually spread across the luxury brand's portfolio. Super Cruise is GM's semi-autonomous, lane-centering driving system that uses lidar mapping, GPS, cameras and sensors. The system offers hands-free driving on the highway, with an infrared camera and lights that track the driver's head position to make sure the driver is paying attention, ready to take over when needed, and not nodding off. If it senses the driver is unresponsive, it can bring the vehicle to a stop on the shoulder and activate OnStar. Super Cruise is already an option on the 2018 CT6 and standard on the Platinum trim model. You can read our First Drive review of the technology here. Meanwhile, Cadillac launched vehicle-to-vehicle technology in the 2017 CTS sedan, allowing equipped Cadillacs to share information regarding speed, direction and location at distances of up to 980 feet to help avoid collisions. By going one step further with V2X, Cadillac can tip off drivers to hazardous road conditions, the status of traffic lights, work zones and threats of crashes. It's the first major announcement from the luxury brand since the departure of former CEO Johan de Nysschen and his replacement by Steve Carlisle in April. Related Video: Image Credit: Cadillac Cadillac GM Technology Emerging Technologies Autonomous Vehicles cadillac ct6 vehicle to vehicle communications Super Cruise

Cadillac HQ has a New York address

Sun, 16 Nov 2014The new home of Cadillac will be in the 330 Hudson building in New York City's Hudson Square, putting the luxury marque smack dab in the middle of three of the city's hippest areas, SoHo, Greenwich Village and Tribeca.

The announcement is yet another milestone in the company's controversial decision to relocate administrative and marketing operations away from Detroit and into the Big Apple.

"The addition of a headquarters office in New York is a key step in Cadillac's ongoing global expansion," Cadillac boss Johan de Nysschen said, according to The Detroit Free Press. "There is no better atmosphere in which to better immerse ourselves into luxury consumer and brand expertise."

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.044 s, 7960 u