Very Nice Low Mileage on 2040-cars

Vernon, New York, United States

|

Thank you for viewing my 1977 Cadillac Coupe Deville. I purchased this car in the spring of 2012 in Akron, OH where it was being sold by an auto gallery. I originally saw it online, but was able to view it in person before making the purchase. It may be the most well-preserved unrestored car I've ever seen, and it drives just the way a low mileage car should. The only items I've had to attend to during my ownership were the A/C, a new water pump and an alternator, which all work flawlessly now. This Cadillac would be great for regular use on nice days or it could just as well be saved for Sunday cruising. If you are able to come see the car in person, I strongly recommend it. It is really beautiful. I've included many more photos at the link below: http://www.flickr.com/photos/97286492@N06/sets/72157634655972906/

|

Cadillac DeVille for Sale

1975 cadillac coupe fuel injected 500ci socal car very clean all leather low mls

1975 cadillac coupe fuel injected 500ci socal car very clean all leather low mls 1992 cadillac deville base sedan 4-door 4.9l(US $2,500.00)

1992 cadillac deville base sedan 4-door 4.9l(US $2,500.00) 1966 cadillac deville convertible(US $12,500.00)

1966 cadillac deville convertible(US $12,500.00) 1966 cadillac deville bagged slammed 22" rims stereo system 472 engine nice ride

1966 cadillac deville bagged slammed 22" rims stereo system 472 engine nice ride 1964 cadillac sedan deville, black plate, california car, garaged, no reserve

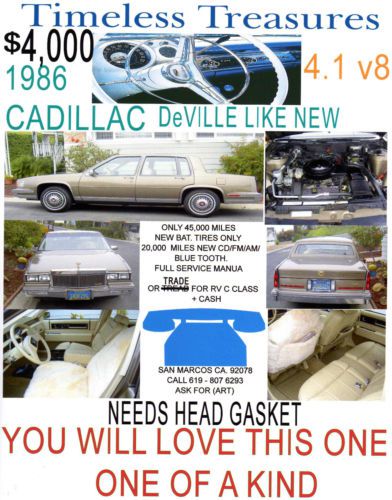

1964 cadillac sedan deville, black plate, california car, garaged, no reserve 1986 cadillac deville touring sedan 4-door 4.1l(US $4,000.00)

1986 cadillac deville touring sedan 4-door 4.1l(US $4,000.00)

Auto Services in New York

Youngs` Service Station ★★★★★

Whos Papi Tires ★★★★★

Whitney Imports ★★★★★

Wantagh Mitsubishi ★★★★★

Valley Automotive Service ★★★★★

Universal Imports Of Rochester ★★★★★

Auto blog

GM's latest production delays: Colorado/Canyon, Cadillac CT4/CT5, Camaro

Wed, Mar 24 2021DETROIT ó General Motors Co extended production cuts in North America on Wednesday due to a worldwide semiconductor chip shortage that has impacted the auto sector. The U.S. automaker said its Wentzville, Missouri, assembly plant would be idled during the weeks beginning March 29 and April 5. It will extend down time at its plant in Lansing, Michigan, which has been idled since March 15, by two weeks. The action was factored into GM's prior forecast that it could shave up to $2 billion off this year's profit, spokesman David Barnas said. GM did not disclose how much volume would be lost by the move, but said it intended to make up as much lost production as possible later in the year. The chip shortage came as North American auto plants were shut for two months during the COVID-19 pandemic last year and chip orders were canceled, and as demand surged from the consumer electronics industry as people worked from home and played video games. That's now left carmakers competing for chips. Semiconductors are used extensively in cars, including to monitor engine performance, manage functions for everything from steering to automatic windows, and in sensors used in parking and entertainment systems. Vehicles affected by the GM production cuts include the mid-sized pickup trucks, the Chevrolet Colorado and GMC Canyon in Missouri, and the Cadillac CT4 and CT5 and Chevy Camaro cars in Michigan. Meanwhile, GM said its San Luis Potosi, Mexico, assembly plant, idled since Feb. 8, will resume production with two shifts beginning the week of April 5. Last week, GM said it was building certain 2021 light-duty full-size pickups without a fuel management module, hurting their fuel economy performance by one mile per gallon. Exacerbating the shortage is a recent fire at a Renesas Electronics chip plant in Japan. Barnas said GM was assessing the impact of the fire. ¬†

Hotter Cadillac CT5-V prototype spotted with a manual transmission

Tue, Mar 10 2020Fans of the old Cadillac CTS-V (and high-performance sedans in general) may have something to be excited about. A series of interior photos leaked Tuesday reveal that prototypes of the forthcoming higher-output variant of the CT5-V Sedan have been equipped with a manual gearbox. Exclusive: Photos show the wilder Cadillac CT5-V will have a manual transmissionhttps://t.co/Ta8hZ804eg ó The Drive (@thedrive) March 10, 2020 Photos obtained by our friends at The Drive show a partially camouflaged CT5-V prototype with a full interior and what appears to be a manual gear selector. While the shifter and its boot are partially obscured by a plastic covering, it's obvious that the knob is not the same one paired with Cadillac's automatic gearboxes, such as the one featured in our expertly augmented photo above.¬† This is not the first time the potential for a stick-shift option in the new, higher-end "V" cars has been floated. Rumors suggesting that the as-yet-unnamed higher-output CT4-V and CT5-V models might be so-equipped (at least optionally) circulated late in 2019. This, in addition to significantly higher power outputs and revised suspensions will set them apart dramatically from the base CT4-V and CT5-V, which are intended to compete with the likes of the Audi "S" line of vehicles.¬† CT4-V spied View 40 Photos GM has been quite cagey when it comes to details about these new models. We know they'll follow in the footsteps of previous-generation "V" cars, which were aimed squarely at Europe's powerhouse sport sedans. The hotter CT5 variant is expected to employ the automaker's 6.2-liter supercharged V8, which made 640 horsepower in the now-dead CTS-V.¬† We reached out to Cadillac for comment and were told by a spokesperson, "The ultra-performance variants of our Cadillac CT5-V and CT4-Vs are still under development. ¬†We will have more details to share in the next few weeks and the CT5-V and CT4-V ultra-performance versions will debut later this year. Until then, I can only confirm that these cars will build on V-Series¬í respected legacy." Hopefully, GM won't make us wait too much longer for official details of these new high-performance models, including what we should expect in terms of powertrain availability and launch timing. Stay tuned. Related Video:

Season 9 of Comedians in Cars Getting Coffee teases us with BMWs and Volvos

Thu, Dec 22 2016Jerry Seinfeld's successful online show Comedians in Cars Getting Coffee is heading into its ninth season, returning January 5th. It should be no surprise that the list of actors and comedians is impressive, with Kristen Wiig, Christoph Waltz, and more making appearances. Seinfeld has lined up an equally impressive list of cars for the new season. Porsche, BMW, and Volvo all have beautiful machines lined up to shuttle Seinfeld and his guest to different coffee shops. As always, it's a mix of light humor packed into a relatively short and, most importantly, free video. Catch up on the previous eight seasons now on Crackle. Related Video: News Source: YouTubeImage Credit: YouTube Celebrities Humor Acura BMW Cadillac Porsche Volvo Convertible Coupe Luxury Performance Classics Videos Sedan trailer jerry seinfeld comedians in cars getting coffee seinfeld