1999 Cadillac Deville Base Sedan 4-door 4.6l on 2040-cars

Keithsburg, Illinois, United States

|

runs and drives great near new tires new battery garage kept uses no oil

|

Cadillac DeVille for Sale

1970 cadillac deville(same owner since 1973)pretty nice old car

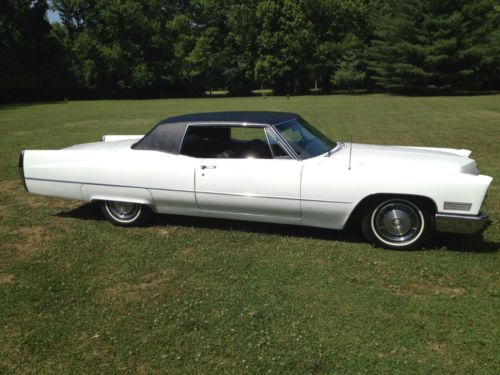

1970 cadillac deville(same owner since 1973)pretty nice old car 1967 cadillac deville base hardtop 2-door 7.0l

1967 cadillac deville base hardtop 2-door 7.0l 1975 cadillac deville base coupe 2-door 8.2l(US $4,800.00)

1975 cadillac deville base coupe 2-door 8.2l(US $4,800.00) 90+ pictures! '01 deville dts sunroof heated seats looks & runs great!(US $3,850.00)

90+ pictures! '01 deville dts sunroof heated seats looks & runs great!(US $3,850.00) 1997 cadillac deville very very clean 66kmls(US $3,500.00)

1997 cadillac deville very very clean 66kmls(US $3,500.00) 2002 cadillac deville 4.6l v8 auto low mileage certified pre owned warranty(US $6,300.00)

2002 cadillac deville 4.6l v8 auto low mileage certified pre owned warranty(US $6,300.00)

Auto Services in Illinois

X Way Auto Sales ★★★★★

Twins Auto Body Shop ★★★★★

Trevino`s Transmission & Auto ★★★★★

Thompson Auto Supply ★★★★★

Sigler`s Auto Ctr ★★★★★

Schob`s Auto Repair ★★★★★

Auto blog

Which electric cars can charge at a Tesla Supercharger?

Sun, Jul 9 2023The difference between Tesla charging and non-Tesla charging. Electrify America; Tesla Tesla's advantage has long been its charging technology and Supercharger network. Now, more and more automakers are switching to Tesla's charging tech. But there are a few things non-Tesla drivers need to know about charging at a Tesla station. A lot has hit the news cycle in recent months with regard to electric car drivers and where they can and can't plug in. The key factor in all of that? Whether automakers switched to Tesla's charging standard. More car companies are shifting to Tesla's charging tech in the hopes of boosting their customers' confidence in going electric. Here's what it boils down to: If you currently drive a Tesla, you can keep charging at Tesla charging locations, which use the company's North American Charging Standard (NACS), which has long served it well. The chargers are thinner, more lightweight and easier to wrangle than other brands. If you currently drive a non-Tesla EV, you have to charge at a non-Tesla charging station like that of Electrify America or EVgo — which use the Combined Charging System (CCS) — unless you stumble upon a Tesla charger already equipped with the Magic Dock adapter. For years, CCS tech dominated EVs from everyone but Tesla. Starting next year, if you drive a non-Tesla EV (from the automakers that have announced they'll make the switch), you'll be able to charge at all Supercharger locations with an adapter. And by 2025, EVs from some automakers won't even need an adaptor. Here's how to charge up, depending on which EV you have: Ford 2021 Ford Mustang Mach-E. Tim Levin/Insider Ford was the earliest traditional automaker to team up with Tesla for its charging tech. Current Ford EV owners — those driving a Ford electric vehicle already fitted with a CCS port — will be able to use a Tesla-developed adapter to access Tesla Superchargers starting in the spring. That means that, if you own a Mustang Mach-E or Ford F-150 Lightning, you will need the adapter in order to use a Tesla station come 2024. But Ford will equip its future EVs with the NACS port starting in 2025 — eliminating the need for any adapter. Owners of new Ford EVs will be able to pull into a Supercharger station and juice up, no problem. General Motors Cadillac Lyriq. Cadillac GM will also allow its EV drivers to plug into Tesla stations.

GM doubles miles open to its Super Cruise technology

Wed, Aug 3 2022DETROIT — General Motors said on Wednesday owners of certain vehicles equipped with its Super Cruise assisted driving system will now be able to use it on 400,000 miles (643,740 km) of North American roads, doubling the current operating area as Tesla and other automakers race to deploy hands-free cruising technology. GM's Super Cruise system, like Tesla's Autopilot system, is a driver assistance system, and does not enable true autonomous driving. Spurred by Tesla's aggressive deployment of Autopilot, and Tesla Chief Executive Elon Musk's promises of a more advanced "Full Self Driving" system, GM, Ford, Volkswagen and Mercedes-Benz are racing to deploy competing partial automation technology in major markets. At the same time, safety regulators are showing concern that drivers do not understand that Autopilot and similar systems are not designed to take over driving in every circumstance. The GM system's sensors and software allow a motorist to cruise with hands off the wheel on highways that have been mapped in detail. But the driver is expected to stay alert and ready to take over the car. GM uses technology to monitor the driver, and Super Cruise will sound alarms or slow the car to a stop if it detects that a driver is not responding. Starting later this year, GM plans to enable vehicles equipped with Super Cruise and the company's latest vehicle electronic system to operate hands-free on major, undivided highways in the United States and Canada, as well as additional miles of divided, interstate highways. Currently, Super Cruise operates only on interstate, divided highways. The expansion, enabled by wider digital mapping, will allow owners of properly equipped GM vehicles to cruise hands-free on stretches of Route 66 and the Pacific Coast Highway in the U.S. West or the Trans-Canada highway in Western Canada, GM said. Many of the new roads GM has mapped are in rural, heartland states where GM pickup trucks are popular. GM plans to offer Super Cruise as an option on its Chevrolet Silverado and GMC Sierra large pickups later this year. GM has said previously it intends to offer Super Cruise as an option on 22 models by the end of 2023. Depending on the model, Super Cruise costs $2,200 to $2,500 to add as an option. (Reporting by Joe White in Detroit; Editing by Matthew Lewis) Related video: Cadillac Chevrolet GM GMC Technology Super Cruise

Cadillac drops the base engine in the 2017 ATS

Tue, Jun 28 2016Cadillac, in an effort to boost sales of the slow moving ATS, is making some changes to the 2017 model. Most notably, the luxury manufacturer is dropping the base 2.5-liter normally-aspirated four-cylinder engine from the lineup, leaving the 272 hp 2.0-liter turbocharged four as the base engine. The base 2.0-liter ATS will start at $35,590, $1,380 more than the 2016 model, though that's partially offset by more standard equipment. The base model now comes standard with Cadillac's controversial CUE infotainment system with an 8-inch touchscreen display, a Bose surround-sound speaker system, and a backup camera. Despite the bump in price for the base model, all other ATS trim levels will see prices reduced between $650 and $1,100, depending on the model. The ATS was designed to be Cadillac's answer to the BMW 3-Series and Mercedes-Benz C-Class. Though the ATS was originally released at a time where the Germans were slightly off their game, it's never quite matched up in terms of performance or customer perception posting disappointing sales figures compared to the competition. Cadillac has had problems getting customers into cars, and few ATS customers are converts from luxury competition. In order to offload inventory and lure in new customers, the company has previously been forced to offer big lease deals. Many of these customers have come over from more mainstream brands like Chevrolet and Ford. ATS sales have fallen 23 percent through May versus 2015. The car's market share has fallen every year since 2013, currently occupying just 4.5 percent of the compact luxury market. Unless Cadillac can offer some truly amazing deals, we don't expect many shoppers to buy American over the strong German competition. Related video: Cadillac Luxury Sedan