1961 Cadillac Rat Rod Custom Classic Hot Lead Sled Hotrod Bagged on 2040-cars

Oklahoma City, Oklahoma, United States

Mileage: 999,999

Make: Cadillac

I have tried to list everything I can think of about this car. Please do not hesitate to ask more details about the car.

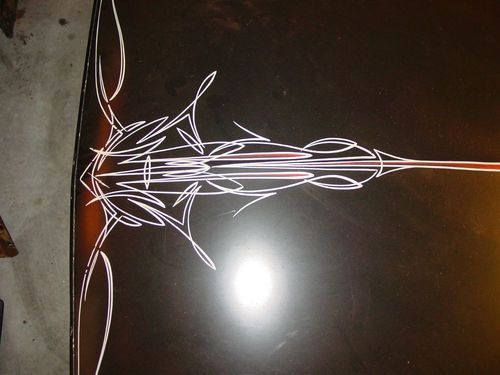

This is a project it runs but is not drivable. The brakes lose fluid over time. Not sure where they are leaking from possibly master cylinder or distribution block. The GM 350 motor sounds good but the automatic transmission leaks. Paint is a flat black with faded pin striping. The black paint is chipping off and cracking in spots. There appears to be paint underneath the black. Interior is faded and needs some pieces put back in. The side roll up windows are all cracked but they are flat. Air bags need compressors wired up.

Clear title, Air bags with 8 electric valves and 2 compressors. Painted black wheels with white wall tires. Dash has been fiber glassed, painted and flamed. New ball joints and bushings on front suspension. Rubber brake lines at wheels have been replaced. Mileage is unknown.

You will need a trailer for this car so don't bid if you cannot get one. A deposit of 500 will be required within 3 days of auction end. Car should be picked up within two weeks of sale ending unless arrangements are made prior to sale end.

Cadillac DeVille for Sale

Pearl white low miles local nc trade in call today 866-299-2347 wont last 4,900!(US $4,900.00)

Pearl white low miles local nc trade in call today 866-299-2347 wont last 4,900!(US $4,900.00) 1999 cadillac deville d'elegance 4dr

1999 cadillac deville d'elegance 4dr Gorgeous 35,400 actual mile coupe deville - super clean - runs & drives awesome!(US $21,900.00)

Gorgeous 35,400 actual mile coupe deville - super clean - runs & drives awesome!(US $21,900.00) 1957 cadillac coupe deville, rust free, original, stored 29 years

1957 cadillac coupe deville, rust free, original, stored 29 years 1960 cadillac sedan deville 63,400 original miles(US $21,000.00)

1960 cadillac sedan deville 63,400 original miles(US $21,000.00) 1962 cadillac deville convertible

1962 cadillac deville convertible

Auto Services in Oklahoma

Valley Body Shop ★★★★★

Shade-Makers ★★★★★

Safelite AutoGlass ★★★★★

Precision Auto ★★★★★

Owasso Automotive Care ★★★★★

Nicoma Park Muffler ★★★★★

Auto blog

Cadillac scraps three-row CUV plans

Fri, 23 May 2014Crossovers are one of the hottest automotive segments on the planet. Apparently, the idea of mixing the practicality of a station wagon with the looks of an SUV appeals to people whether they are in Cleveland or Shanghai because nearly every automaker is jumping into the market. So it was no surprise when early rumors suggested Cadillac was planning two, new CUVs to fit above and below the SRX. But things might have changed since then.

New rumblings indicate Caddy is taking a different route. Instead of two crossovers, only the compact is on the way, and the larger, three-row CUV on the Lambda platform to sit between the SRX and Escalade may be a goner. According to Ward's Auto, General Motors thinks that the other three-row, Lambda vehicles like the Buick Enclave and GMC Acadia compete too closely with the proposed Cadillac. The decision comes fairly close to the 2017 intended production date.

As far back as 2010, this Lambda-platform based CUV was considered highly likely for production. However, Cadillac Senior Vice President Bob Ferguson was somewhat cooler about it when he discussed the new crossover briefly last year. He said the model could use the Escalade name, despite its unibody chassis, but no decision had been made yet to actually produce it.

2021 Cadillac Escalade price increases take starting price to $77,490

Wed, Apr 15 2020Update: This story has been updated with official pricing from Cadillac that includes the destination charge and pricing for the long wheelbase ESV model. The modified story continues below. As the 2021 Cadillac Escalade prepares behind-the-scenes for duty in front of real-life red carpets, more information on the brand new fifth-generation SUV bubbles to the surface. GM Authority got its hands on some MSRP figures the other day, but we have the official pricing from Cadillac now. GM kept pricing of the other full-sized SUV family — the Tahoe, Suburban, and Yukon — unchanged or close to the outgoing models. Escalade intenders will be happy to know the same goes here, the 2021 example priced at $77,490 after a $1,295 destination charge is added in, only $1,000 more that the soon-to-be retired 2020 Escalade for a fancier cabin and lots of new tech inside and out. Cadillac reworked the trim walk for 2021 to its Y-trim configuration, splitting into Luxury and Sport models above the base trim. There were four options in 2020, not including all-wheel-drive versions: Base, Luxury, Premium Luxury, and Platinum. There are five for the new year: Luxury, Premium Luxury, Sport, Premium Luxury Platinum, and Sport Platinum. The switcheroo makes it hard to compare all but the bottom and top trims, but the price walk for rear-wheel-drive versions goes: Luxury: $77,490 Premium Luxury: $84,290 Sport: $86,890 Premium Luxury Platinum: $101,290 Sport Luxury Platinum: $101,290 Add $3,000 to any of those trim prices, and you'll have the corresponding long wheelbase ESV price. Four wheel drive is a similar $3,000 charge on any trim. That means the base price on the top trim Escalade ESV with four-wheel drive is $107,290. The 2021 Platinum models are $7,700 more than the 2020 Escalade Platinum. The standard engine is the 6.2-liter V8, shifting through a 10-speed transmission. And the 3.0-liter Duramax diesel is a no-cost option, so take your pick. Customers could end up waiting for the Escalade as well, depending on when every kind of manufacturing can restart in earnest to serve the Arlington, Texas, plant all the parts it needs to build the new SUV. Related Video:   Â

Cadillac Super Cruise, a hands-off review

Fri, Oct 6 2017Cadillac Super Cruise won't let you eat breakfast behind the wheel, climb in the back seat or any of the other stupid human tricks displayed on YouTube by Tesla owners. It even won't allow the car to change lanes on its own, like Tesla Autopilot. But it's a big step on the road to full autonomy, a huge convenience on long-distance road trips and a substantial technological triumph for Cadillac. In the simplest terms, Super Cruise is a lane-centering enhancement to adaptive cruise control (ACC). But Super Cruise is anything but simple. Its technical complexity — hence its long delay after first being unveiled five years ago — belies its straightforward operation and intuitive user interface, which I discovered on an almost 750-mile, 11-hour drive in a 2018 Cadillac CT6 between Dallas and Santa Fe to test the system. LOADS OF LIMITATIONS First, let's dispense with the details and disclaimers. Super Cruise is standard on the 2018 CT6 Platinum and a $5,000 option on other trim levels. Because Super Cruise is supported by OnStar — an OnStar operator will call to find out if first responders need to be sent in a worst-case scenario — a three-year OnStar Super Cruise Package is included with the system. Super Cruise has loads of limitations that are probably more concerning to GM's legal counsel than they were to me during my long drive. Some are no-brainers, such as not for use in construction zones or for driving on the shoulder. But the system can also be stymied by adverse weather, poor visibility and faded lane markings. Super Cruise only works on freeways with on and off ramps and a center divider. ACC and forward collision warning also need to be engaged, and the system's cameras and radar sensors can't be obstructed. To keep drivers from looking away from the road for too long — and to keep the system active — an infrared camera on top of the steering column keeps an electronic eye on the driver's seat. GM has over 100 patents alone on this Driver Attention System, including an algorithm that triangulates the nose, eyes and ears in case the camera can't see through sunglasses to make sure you're not nodding off. In addition to the car's visible sensors, another major component of the system is something you don't see: mapping software. But not the kludgy kind that powers in-dash navigation systems.