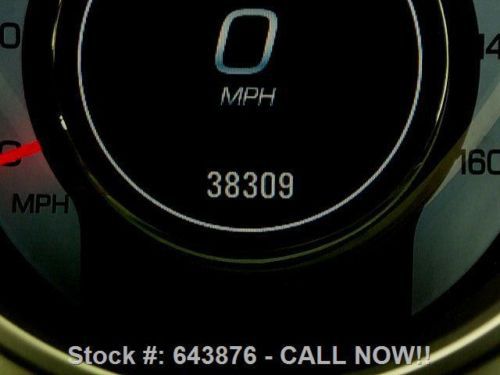

2011 Cadillac Srx Leather Bose Audio 18" Wheels 38k Mi Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Cadillac SRX for Sale

2012 cadillac srx lux collection pano sunroof nav 19k texas direct auto(US $28,980.00)

2012 cadillac srx lux collection pano sunroof nav 19k texas direct auto(US $28,980.00) 2011 cadillac srx4 lux awd pano sunroof navigation 27k texas direct auto(US $26,980.00)

2011 cadillac srx4 lux awd pano sunroof navigation 27k texas direct auto(US $26,980.00) 2014 cadillac srx luxury package.(US $36,990.00)

2014 cadillac srx luxury package.(US $36,990.00) 2012 cadillac srx w/ nys salvage certificate project car wrecked!(US $12,500.00)

2012 cadillac srx w/ nys salvage certificate project car wrecked!(US $12,500.00) 2011 cadillac srx premium collection v6 3.0l/183 6-spd auto w/od fwd white/tan(US $29,500.00)

2011 cadillac srx premium collection v6 3.0l/183 6-spd auto w/od fwd white/tan(US $29,500.00) 10 srx turbo performance awd 77k miles rear dvd ent navigation(US $22,942.00)

10 srx turbo performance awd 77k miles rear dvd ent navigation(US $22,942.00)

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

2016 Cadillac ATS-V Sedan Beauty-Roll

Mon, Oct 5 2015For those of you paying attention, we've really ramped up the old Autoblog video game these days. Our new series Car Club USA joins Translogic and The List, and there are more Daily Drivers and Short Cuts than ever. But sometimes, all you care about is the car. The Autoblog Beauty-Roll video series has one goal: bring you glossy video images of cars, and nothing but. We're collecting moving pictures of all the cars we test, inside and out. Each episode comes with a hit of engine sound Ė start-up and with a few revs ¬Ė to round out the package. Set your resolution to max, kick it into full-screen, turn up the sound, and enjoy today's subject, the 2016 Cadillac ATS-V Sedan. Oh, and if you'd like more Beauty-Roll, click here to see the back catalog.

GM investing $2 billion in Tennessee plant to build Cadillac Lyriq, other EVs

Tue, Oct 20 2020DETROIT ó General Motors said on Tuesday it will invest $2 billion to convert its Spring Hill,¬†Tennessee, factory to produce electric vehicles, starting with the new Cadillac Lyriq, alongside existing combustion-engine Cadillacs. Spring Hill will be¬†GM's third U.S. electric vehicle factory, along with existing plants in Detroit and Orion Township, Michigan. The¬†Tennessee¬†plant was built in 1990 as the exclusive source for¬†GM's now-defunct Saturn brand. The Cadillac Lyriq crossover is slated to go into production in Spring Hill in late 2022, according to AutoForecast Solutions (AFS), which tracks industry production plans. AFS said it expects some electric vehicle production will be announced at a later date for a factory in Mexico. Among additional investments,¬†GM¬†on Tuesday said it will spend $32 million at its truck plant in Flint, Michigan, to increase production of the Chevrolet Silverado and¬†GMC Sierra heavy-duty pickups. GM¬†will spend $100 million to shift production of the redesigned¬†GMC Acadia crossover from Spring Hill to a plant near Lansing, Michigan. Spring Hill will continue to build the gas-engine Cadillac XT5 and XT6 crossovers. The plant also will build other future electric vehicles in addition to the Lyriq. The automaker's plans for investing in U.S. factories comes with two weeks left in the U.S. presidential election campaign. President Donald Trump and Democratic rival Joe Biden are competing for support from auto workers in Midwestern swing states. GM¬†Chief Executive Mary Barra has outlined plans to invest $20 billion by 2025 in new electric vehicles and battery technology. The automaker is spending $2.2 billion to overhaul and retool its Detroit-Hamtramck factory to build a¬†GMC Hummer EV electric pickup truck in late 2021, followed by an automated robotaxi and other electric vehicles. GM¬†builds its electric Chevrolet Bolt at a large assembly plant north of Detroit.

Combative de Nysschen defends Cadillac move, naming change

Mon, 29 Sep 2014

Johan de Nysschen isn't afraid of taking quick, decisive actions, even if they are criticized. Since taking the wheel at Cadillac, he instigated moving the luxury division's base of operations to Manhattan's SoHo neighborhood and introduced a new naming scheme for the future of the brand, like he did at Infiniti. The polarizing boss recently explained his feelings about the future of Cadillac in more depth on his Facebook page, but unfortunately only his friends could read it. Thankfully, Daily Kanban posted much of the strongly worded missive for the whole world to see.

Much of the message examines the decision to move some employees to New York. De Nysschen claims that it's all about giving Cadillac distance from Detroit to reshape itself. It allows for, "No distractions. No side shows. No cross-brand corporate considerations. No homogenized lowest common denominator approach. Just pure, unadulterated, CLASS."