***** Highway Miles ************* on 2040-cars

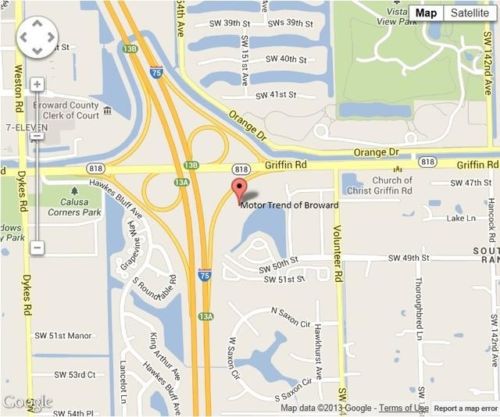

Fort Lauderdale, Florida, United States

Cadillac SRX for Sale

4dr suv 3.0l leather sunroof onstar fwd abs 6-speed a/t(US $31,100.00)

4dr suv 3.0l leather sunroof onstar fwd abs 6-speed a/t(US $31,100.00) 2014 cadillac srx luxury collection warranty clean carfax sun/roof leather

2014 cadillac srx luxury collection warranty clean carfax sun/roof leather 2013 performance collection used 3.6l v6 24v automatic front wheel drive suv

2013 performance collection used 3.6l v6 24v automatic front wheel drive suv 2012 cadillac srx fwd 4dr premium collection navigation(US $33,995.00)

2012 cadillac srx fwd 4dr premium collection navigation(US $33,995.00) 2010 cadillac srx performance collection nav panoramic 20 wheels bose

2010 cadillac srx performance collection nav panoramic 20 wheels bose 2012 cadillac srx luxury sport utility 4-door 3.6l(US $24,500.00)

2012 cadillac srx luxury sport utility 4-door 3.6l(US $24,500.00)

Auto Services in Florida

Yow`s Automotive Machine ★★★★★

Xtreme Car Installation ★★★★★

Whitt Rentals ★★★★★

Vlads Autobahn LLC ★★★★★

Village Ford ★★★★★

Ultimate Euro Repair ★★★★★

Auto blog

GM earnings rise 1% as buyers pay more for popular pickups

Thu, Aug 1 2019DETROIT — General Motors said Thursday that higher prices for popular pickup trucks and SUVs helped overcome slowing global sales and profit rose by 1% in the second quarter. The Detroit automaker said it made $2.42 billion, or $1.66 per share, from April through June. Adjusting for restructuring costs, GM made $1.64 per share, blowing by analyst estimates of $1.44. Quarterly revenue fell 2% to $36.06 billion, but still beat estimates. Analysts polled by FactSet expected $35.97 billion. Global sales fell 6% to 1.94 million vehicles led by declines in North America and Asia Pacific, Middle East and Africa. The company says sales in China were weak, and it expects that to continue through the year. In the United States, customers paid an average of $41,461 for a GM vehicle during the quarter, an increase of 2.2%, as buyers went for loaded-out pickups and SUVs, according to the Edmunds.com auto pricing site. The U.S. is GM's most profitable market. Chief Financial Officer Dhivya Suryadevara said she expects the strong pricing to continue, especially as GM rolls out a diesel pickup and new heavy-duty trucks in the second half of the year. "We think the fundamentals do remain strong, especially in the truck market," she said, adding that strength in the overall economy and aging trucks now on the road should help keep the trend going. Light trucks accounted for 83.1% of GM's sales in the quarter, and pickup truck sales rose 8.5% as GM transitioned to new models of the Chevrolet Silverado and GMC Sierra, according to Edmunds, which provides content to The Associated Press. As usual, GM made most of its money in North America, reporting $3 billion in pretax earnings. International operations including China broke even, while the company spent $300 million on its GM Cruise automated vehicle unit. Its financial arm made $500 million in pretax income. Suryadevara said GM saw $700 million in savings during the quarter from restructuring actions announced late last year that included cutting about 8,000 white-collar workers through layoffs, buyouts and early retirements. The company also announced plans to close five North American factories, shedding another 6,000 jobs. About 3,000 factory workers in the U.S. whose jobs were eliminated at four plants will be placed at other factories, but they could have to relocate. GM expects the restructuring to generate $2 billion to $2.5 billion in annual cost savings by the end of this year.

GM follows Ford and Honda in skipping SEMA

Fri, May 20 2022The list of automakers skipping SEMA has become longer. First reported by Muscle Cars and Trucks, and confirmed to us by a company representative, General Motors will not have an official presence at the aftermarket show. It joins Ford and Honda in leaving the show. It will be a large hole in the show, with the GM brands typically filling a significant swath of available show space in one of the main halls. GM hasn't provided much explanation for the move, either. The GM representative provided Autoblog with the same statement that Muscle Cars and Trucks got: "GM has made the decision not to participate in the 2022 SEMA Show. The SEMA show has always inspired us, and accessories and performance parts remain an important part of our business." We also asked if we would see any sort of announcements around the time of the show — Ford said it has plans to share some things around that time — however, the GM representative said that the company has no immediate plans for announcements. Certainly things could change between now and the November show, though. SEMA had previously noted that other exhibitors would help fill in some of the space vacated by these major OEMs. Another OEM, Volkswagen, is returning to the show after an absence, which will also help with the display deficit. Related Video:

Teaching autonomous vehicles to drive like (some) humans

Mon, Oct 16 2017While I love driving, I can't wait for fully autonomous vehicles. I have no doubt they'll reduce car accidents, 94 percent of which are caused by human error, leading to more than 37,000 road deaths in the U.S. last year. And if it means I can fly home at night in winter and get safely shuttled to my house an hour-plus away — and not have to endure a typical white-knuckle drive in the dark with torrential rain and blinding spray from 18-wheelers on Interstate 84 — sign me up. Autonomous technology will also take some of the stress, tedium and fatigue out of long highway drives, as I recently discovered while testing Cadillac Super Cruise. AVs are also supposed to eventually help increase traffic flow and reduce gridlock. But according to a recent Automotive News article, as the first wave of AVs are being tested on public roads, they're having the opposite effect. Part of the problem is they drive too cautiously and are programmed to strictly follow the written rules of the road rather than going with the flow of traffic. "Humans violate the rules in a safe and principled way, and the reality is that autonomous vehicles in the future may have to do the same thing if they don't want to be the source of bottlenecks," Karl Iagnemma, CEO of self-driving technology developer NuTonomy, told Automotive News. "You put a car on the road which may be driving by the letter of the law, but compared to the surrounding road users, it's acting very conservatively." I get it that, like teen drivers, AVs need a ramp up period to learn the unwritten rules of the road and that a skeptical public has to be convinced of the technology's safety. But this is where I become less of a champion on AVs, since where I live in the Pacific Northwest we already have more than our share of overly cautious human drivers. Since moving here 12 years ago, I've found it's an interesting paradox that a region famous for its strong coffee, where you'd think most drivers would be jacked up on caffeine, is also the home to annoyingly measured motorists. As an auto-journo colleague living in Seattle so aptly put it: "People in the Pacific Northwest drive as if they have nowhere to go." If you drive like me and always have somewhere to go — and usually are in a hurry to get there — it's absolutely maddening.