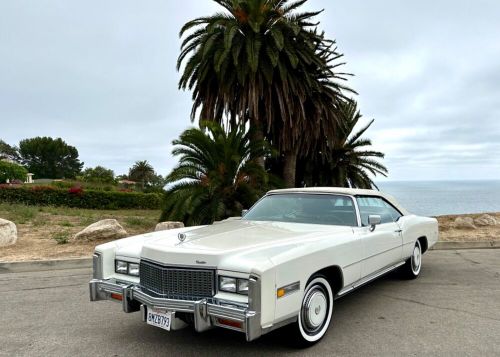

1976 Cadillac Eldorado on 2040-cars

Lawndale, California, United States

Mileage: 101000

Model: Eldorado

Make: Cadillac

Cadillac Eldorado for Sale

1958 cadillac eldorado(US $18,100.00)

1958 cadillac eldorado(US $18,100.00) 2001 cadillac eldorado convertible coach builder's limited(US $19,995.00)

2001 cadillac eldorado convertible coach builder's limited(US $19,995.00) 1984 cadillac eldorado(US $2,975.00)

1984 cadillac eldorado(US $2,975.00) 1964 cadillac eldorado(US $15,400.00)

1964 cadillac eldorado(US $15,400.00) 2000 cadillac eldorado 2dr coupe esc(US $10,990.00)

2000 cadillac eldorado 2dr coupe esc(US $10,990.00) 1973 cadillac eldorado convertible 500ci v8 automatic(US $20,000.00)

1973 cadillac eldorado convertible 500ci v8 automatic(US $20,000.00)

Auto Services in California

Yes Auto Glass ★★★★★

Yarbrough Brothers Towing ★★★★★

Xtreme Liners Spray-on Bedliners ★★★★★

Wolf`s Foreign Car Service Inc ★★★★★

White Oaks Auto Repair ★★★★★

Warner Transmissions ★★★★★

Auto blog

2015 Cadillac ATS Coupe

Thu, 30 Oct 2014Cadillac has become a very, very different company since the dawn of the new millenium. Its turn-of-the-century lineup, consisting of staid offerings like the Seville, DeVille and Eldorado, represented the Old Cadillac. These cars were plagued with Old GM quality issues and catered to a more elderly audience. Since the company's Art and Science design language arrived, though, we've seen Cadillac flesh out its lineup in a big way, introducing notable and (so far) enduring products, like the the CTS, SRX and most recently, the ATS.

With the CTS tackling the 5 Series segment and the SRX duking it out with the Lexus RX and its classmates, the ATS has been left with the tough task of battling the BMW 3 Series, Audi A4 and Mercedes-Benz C-Class, among others. Critically, at least, it has excelled in this role, but it's still working on finding its feet sales-wise. On paper, broadening the model range by adding a two-door personal luxury coupe could help.

After a week with the ATS Coupe, though, we've found a car that, while retaining the standard model's excellent driving character, doesn't quite offer enough visual excitement to stand up to other cars in its segment.

Crowd lifts Cadillac to free pedestrian after two vehicles barrel toward him

Wed, May 17 2017An elderly Missourian is lucky to be alive today after a car that had pinned him to the ground was lifted off him by witnesses. According to WDAF, Orlando Gentry and Troy Robertson were working at a Kansas City, Mo., clothing store when a stolen minivan careened through a red light at 35th and Prospect and was immediately T-boned by a woman driving a gold Cadillac. The impact drove both vehicles up onto the sidewalk at the corner, side by side, directly at pedestrian Carlos Green. "We was out here with our kids, and we was at work, and the next thing we heard was a boom!" Gentry told WDAF. "Man, those cars came out of nowhere, and Carlos was just helpless," Robertson said. Gentry tried to escape but was caught between the vehicles and pinned beneath the Caddy. Then a light pole punctuated the crash by falling on top of the Caddy - and almost on top of Carlos Green. "Yeah, he tried to jump out of the way, but he just got pinned underneath the Cadillac. He definitely hurt his right leg. When I saw all that, I screamed, 'Somebody help me help get this car off Carlos,'" Robertson said. He, Gentry and passersby lifted the heavy Caddy off Green so he could crawl free. Thankfully, Green wasn't seriously injured. He was discharged from an area hospital bruised, with one leg in a cast, but ultimately healthy. The woman driving the Cadillac was unhurt, but the two men driving the minivan ran off during the confusion. Kansas City police are looking for the escaped car thieves. This is the second time in as many weeks that people banded together to lift a car off someone. On May 9 in Philadelphia, a group of good Samaritans lifted an SUV off a little girl who had been run down and pinned beneath an SUV tire. Related Video:

2016 Cadillac ATS-V blasts into LA

Tue, 18 Nov 2014The first details about the 2016 Cadillac ATS-V recently hit the web ahead of the official debut at the 2014 Los Angeles Auto Show. Now, the latest model to wear Caddy's high-performance V moniker is officially official, and the specs are even better than initial rumors suggested.

The latest figures actually give the ATS-V a hair more power than first believed, with 455 horsepower and 445 pound-feet of torque pumping out of the twin-turbocharged 3.6-liter V6. With a standard electronic limited-slip differential keeping rear wheels in check, Cadillac claims that the model sprints to 60 miles per hour in 3.9 seconds and on to a top speed of 185 mph. Buyers have two transmission choices that both offer launch control: a six-speed manual featuring Active Rev Match and no-lift shifting, or an eight-speed automatic.

Thoroughly revised suspension and braking systems should also mean that the ATS-V excels at more than just going in a straight line. The chassis itself receives extra bracing to boost overall stiffness by 25 percent over lesser ATS models. On top of that, a host of suspension upgrades front and rear, including third-generation Magnetic Ride Control dampers, mean quicker steering response and a tighter ride. Plus, Brembo six-piston calipers up front and four-pistons in the rear should bring rapid deceleration. To tune it all to the driver's whim, the Performance Traction Management system gives five settings to choose from for stability and traction control.