Clean Carfax, V8, Leather, Moon, Chromes, Am/fm/cd, Onstar on 2040-cars

Cleveland, Ohio, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:4.6L 281Cu. In. V8 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

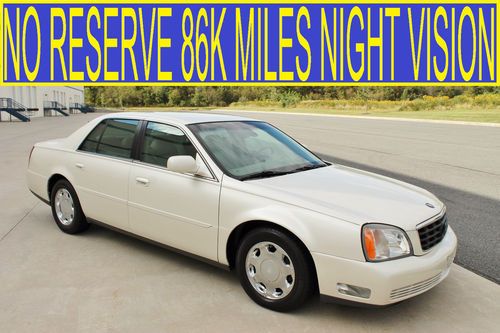

Make: Cadillac

Model: DeVille

Warranty: Unspecified

Trim: Base Sedan 4-Door

Options: Leather Seats

Drive Type: FWD

Power Options: Power Windows

Mileage: 108,000

Exterior Color: Black

Interior Color: Black

Number of Doors: 4

Number of Cylinders: 8

Cadillac DeVille for Sale

No reserve 86k miles night vision amazing service/ condition dts dhs 02 03 04 05

No reserve 86k miles night vision amazing service/ condition dts dhs 02 03 04 05 1979 cadillac sedan deville original owner garage kept 85k original

1979 cadillac sedan deville original owner garage kept 85k original 1971 cadillac coupe deville custom 22" wheels baby blue

1971 cadillac coupe deville custom 22" wheels baby blue 1955 cadillac series 62 yellow brown top complete, a/c car original make offer!(US $4,750.00)

1955 cadillac series 62 yellow brown top complete, a/c car original make offer!(US $4,750.00) 2002 cadillac deville low miles 2 owner moon roof loaded(US $4,950.00)

2002 cadillac deville low miles 2 owner moon roof loaded(US $4,950.00)

Auto Services in Ohio

West Side Garage ★★★★★

Wally Armour Chrysler Dodge Jeep Ram ★★★★★

Valvoline Instant Oil Change ★★★★★

Tucker Bros Auto Wrecking Co ★★★★★

Tire Discounters Inc ★★★★★

Terry`s Auto Service ★★★★★

Auto blog

Cadillac ELR update delayed over autonomous drive systems issues

Fri, Nov 28 2014Rumors had been circulating that the 2016 Cadillac ELR would bow in Los Angeles recently, featuring, in Cadillac's own words, "engineering enhancements." The rumors and that quote are as far as it got – the updated ELR pulled a no-show in LA, and no one outside of the brand appears to know when it will appear. GM Inside News says its sources at Cadillac pinned the ELR's absence on some autonomous driving features not being ready to reveal. According to GMI, Cadillac insiders say the upgraded ELR will be a "highly autonomous vehicle," and the company needs more time to gets its systems polished. The site says "it's not unreasonable to assume that ELR will be [the] vehicle" that gets Cadillac's Super Cruise technology, but that seems a lot more involved than "engineering enhancements," and in September Cadillac said we'd see it sometime in the next two years. It's possible the wait for the 2016 ELR and its secrets might only be a couple of months: the next-generation Chevrolet Volt, which shares a platform with the ELR and whose engineering updates we know quite a bit about, is scheduled to appear at the 2015 Detroit Auto Show in January.

Autoblog Podcast #318

Tue, 29 Jan 2013Toyota back on top, Barrett Jackson, Crowdsourcing your Dodge Dart payments, Nissan and Toyota double down on pickups

Episode #318 of the Autoblog Podcast is here, and this week, Dan Roth, Zach Bowman and Michael Harley talk about Toyota regaining the No. 1 sales crown, getting your friends and family to buy you a Dodge Dart, Barrett-Jackson, and Toyota and Nissan remaining committed to their pickup trucs. We wrap with your questions, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Keep reading for our Q&A module for you to scroll through and follow along, too. Thanks for listening!

Autoblog Podcast #318:

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.