2013 Cts-v Wagon Only 100 Miles, Recaro Seats, Utra View Roof, Black Diamond!!!! on 2040-cars

Scottsdale, Arizona, United States

Vehicle Title:Clear

Engine:6.2L 376Cu. In. V8 GAS OHV Supercharged

For Sale By:Dealer

Body Type:Wagon

Fuel Type:GAS

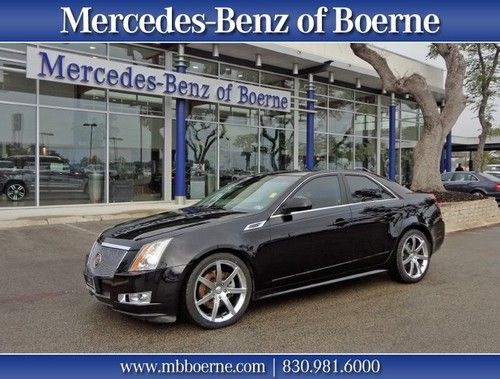

Make: Cadillac

Warranty: Vehicle has an existing warranty

Model: CTS

Trim: V Wagon 4-Door

Options: CD Player

Power Options: Power Locks

Drive Type: RWD

Mileage: 107

Sub Model: 5dr Wgn

Number of Cylinders: 8

Exterior Color: Black

Interior Color: Black

Cadillac CTS for Sale

Red 2008 cadillac cts 49k awd, 4 wheel drive, park senesors, keyless, chrome!

Red 2008 cadillac cts 49k awd, 4 wheel drive, park senesors, keyless, chrome! 2012 cts coupe awd performance luxury only 5200 miles(US $46,900.00)

2012 cts coupe awd performance luxury only 5200 miles(US $46,900.00) 2012 cadillac cts-v coupe only 3000 miles! black

2012 cadillac cts-v coupe only 3000 miles! black 2010 cadillac cts 3.5l premium sedan

2010 cadillac cts 3.5l premium sedan 2010 cts white diamond premium - loaded. wholesale reserve!(US $27,200.00)

2010 cts white diamond premium - loaded. wholesale reserve!(US $27,200.00) 2011 cts-v- supercharged 6.2l- 550hp- navigation, rear camera, bose, one owner!

2011 cts-v- supercharged 6.2l- 550hp- navigation, rear camera, bose, one owner!

Auto Services in Arizona

yourcarguyaz.com ★★★★★

VW & Audi Independent Service and Repair Specialist ★★★★★

USA Auto Glass Repair ★★★★★

Truck And Trailer Parts Incorporated ★★★★★

Tony`s Auto Repair ★★★★★

TintAZ.com Mobile Window Tinting ★★★★★

Auto blog

Chevy's low-cost pedestrian avoidance to debut on 2016 Malibu

Tue, Jul 28 2015The mainstreaming of safety technologies that began on luxury vehicles will get a big boost from General Motors later this year. The General says it plans to offer 22 driver assistance systems across its product portfolio of 2016 models, starting with the redesigned Chevrolet Malibu - the one that we know will keep tabs on teenagers for the benefit of parents. Pedestrian avoidance will be another of its available options. Instead of kitting the sedan out with numerous and expensive radar arrays, the GM system uses the camera mounted next to the rearview mirror that is already used for the lane-keeping function. New software lets it detect pedestrians, and when it detects a potential collision with one, it can alert the driver and brake autonomously if the driver doesn't react. Eventually, engineers want to give it the ability to do the same with cyclists. Because it uses existing hardware updated with new code, GM says the application costs "a few hundred dollars." GM demonstrated the Front Pedestrian Braking preventing a crash with a dummy pedestrian at speeds up to 15 miles per hour. Automotive News reports that it will reduce the severity of impact up to 40 miles per hour, but "may not be of much use in collisions at higher speeds." That feature will also join the options list of the Cadillac CT6. The press release below has more on GM's driver tech soon on the way. Related Video: GM Paving Way to Smarter and Safer Driving at All-New Active Safety Test Area 22 crash-avoidance technologies offered on 2016 Chevrolet, Buick, GMC and Cadillac models MILFORD, Mich. 2015-07-24 – Chevrolet, Buick, GMC and Cadillac will offer 22 different active safety technologies across their 2016 model year U.S. lineups, ranging from driver alerts to those that automatically intervene and assist the driver in critical situations. Safety engineers will develop and test these and other safety technologies for products around the world at GM's new, 52-acre Active Safety Test Area at its Milford Proving Ground near Detroit. The $14 million facility officially opened Friday. "Our comprehensive safety strategy of helping customers before, during and after a crash continues," said Jeff Boyer, vice president of GM Global Vehicle Safety.

Cadillac reveals more 2015 Escalade details, launches colorizer

Mon, 30 Dec 2013Cadillac has opened up a mini-site to entice you into its all-new 2015 Escalade, and begun talking about more of its features and trim levels. While all versions of the new daddy Caddy will be powered by a 6.2-liter V8 with 420 horsepower and 460 pound-feet of torque routed through a six-speed automatic, there will be three trim packages you can wrap around that powertrain and seven exterior colors available to make it pop.

Features common to all trims include leather throughout, heated and cooled front seats, a 12-inch reconfigurable dash cluster, a quieter interior thanks to Bose active noise cancellation and the brand's love/hate CUE infotainment system. The base trim comes with adaptive remote start, hands-free tailgate, rear-view camera, park assist, Magnetic Ride Control and sits on 20-inch wheels. Moving up to the Luxury spec increases your stature with 22-inch wheels and adds a reconfigurable, color head-up display, a sunroof, power fold-and-tumble second row seating, Intellibeam headlights and a Driver Awareness Package with active crash-avoidance technology like Safety Alert Seat, lane departure warning and forward collision alert.

The top Premium trim gets a Driver Assist Package that includes Automatic Collision Preparation, automatic braking and adaptive cruise control, rear-seat entertainment, along with exterior touches like illuminated door handles.

11 vehicles from Barrett-Jackson Las Vegas worth watching

Fri, 26 Sep 2014This weekend will see the world's collector car crowds descend on Las Vegas, NV for one of the biggest shows on Barrett-Jackson's popular auction circuit. There are hundreds of vehicles up for bidding, ranging from a brand-new Lamborghini Aventador to a spattering of Art Deco classics and a huge swath of classic muscle cars.

While it's virtually impossible to assemble an inarguable list of the best cars coming during the three-day, 700-plus vehicle auction, we've sifted through the listings for this year's show - it was a tough assignment, we promise - and assembled a list of what we think will be some of the most interesting lots. We'll admit, it's a bit heavy on American iron, but if you browse BJ's listings, you'll come to a similar conclusion. Still, scroll down for our list of what we think will be the most interesting vehicles at the upcoming auction.