2009 Cadillac Cts Base Sedan 4-door 3.6l on 2040-cars

Utica, Michigan, United States

Body Type:Sedan

Vehicle Title:Clear

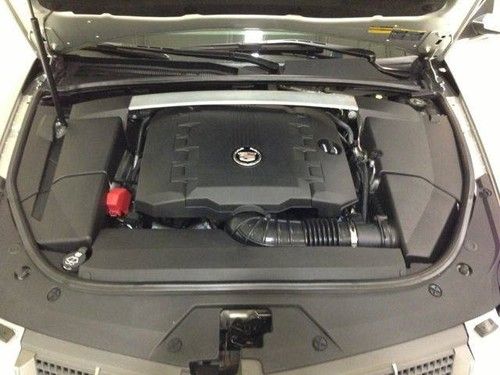

Engine:3.6L 217Cu. In. V6 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Make: Cadillac

Model: CTS

Trim: Base Sedan 4-Door

Options: Heated Seats, XM Radio, Sunroof, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: AWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 24,624

Exterior Color: Silver

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

Number of Doors: 4

Cadillac CTS for Sale

2007 cadillac cts base sedan 4-door 2.8l(US $12,500.00)

2007 cadillac cts base sedan 4-door 2.8l(US $12,500.00) 2011 cadillac cts luxury sedan 4-door 3.0l

2011 cadillac cts luxury sedan 4-door 3.0l 2008 cts 3.6l v6 24v automatic awd sedan panoramic sunroof leather remote start(US $23,500.00)

2008 cts 3.6l v6 24v automatic awd sedan panoramic sunroof leather remote start(US $23,500.00) 2004 cadillac cts cts-v one owner, very low miles

2004 cadillac cts cts-v one owner, very low miles 2013 cadillac cts v supercharged sunroof nav recaro 11k texas direct auto(US $53,780.00)

2013 cadillac cts v supercharged sunroof nav recaro 11k texas direct auto(US $53,780.00) 2009 cadillac cts v sedan 4-door 6.2l(US $39,000.00)

2009 cadillac cts v sedan 4-door 6.2l(US $39,000.00)

Auto Services in Michigan

Zaharion Automotive ★★★★★

Woodland-Kawkawlin Trailers ★★★★★

W L Frazier Trucking ★★★★★

Valvoline Instant Oil Change ★★★★★

Urka Auto Center ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Cadillac Elmiraj has production potential

Tue, 20 Aug 2013There are many reasons to love the Cadillac Elmiraj Concept, but not the least of which is how production-ready this big coupe appears to be. Take out the overly fancy interior and a few conceptual elements of the exterior, and this looks like a coupe that could be in dealers now as the successor to the Eldorado.

On top of that, Automotive News is quoting Bob Ferguson, Cadillac senior vice president, as saying that a production version of this car is "very doable." AN adds that if the Monterey showstopper gets the green-light, this car would compete against the upcoming Mercedes-Benz S-Class Coupe and would based on Cadillac's upcoming rear-wheel-drive flagship sedan due out in 2015. The range-topping coupe would debut sometime after the sedan model. Cross your fingers.

2022 Cadillac CT5-V Blackwing will get carbon fiber seat backs

Wed, Sep 30 2020Cadillac is putting the finishing touches on the 2022 CT5-V Blackwing, the high-performance sedan that will pick up where the CTS-V left off. It announced the model will be available with carbon fiber front seat backs. Presumably found on the list of extra-cost options, the weight-saving carbon fiber seat backs will stand out with a book-matched design and a laser-etched V-Series logo that will remind the passengers sitting in the back that they're not riding in a regular CT5-V. Interestingly, Cadillac noted the seats will also boast "other customer-centric innovations and features" that will be detailed closer to the sedan's on-sale date. Chairs are hardly on the front lines of automotive innovation, so we're looking forward to learning more about what Cadillac has in store. Drivers will have carbon fiber in front of them, too, because the multi-function steering wheel's bottom spokes will be made with the composite material. Cadillac hinted the sedan's top speed will lie in the vicinity of 200 mph. 2021 Cadillac CT5-V Blackwing spied View 15 Photos Nearly everything else we know about the CT5-V Blackwing comes from a diverse selection of rumors, industry murmurings, and spy shots. We learned earlier in 2020 that it might receive an updated version of the 6.2-liter V8 that powered its predecessor, not the 4.2-liter Blackwing engine it's named after, and leaked images strongly suggest a manual transmission will be available, though we assume Cadillac will also offer an automatic. It might be a six-speed stick, or Cadillac could use a version of the Chevrolet Corvette's seven-speed manual. Our questions will be answered when the 2022 Cadillac CT5-V Blackwing finally makes its debut. It's scheduled to go on sale in the summer of 2021, so its unveiling is likely a couple of weeks away, and Cadillac warned availability will be limited. The smaller CT4 which replaced the ATS, is also in line to get the Blackwing treatment.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.