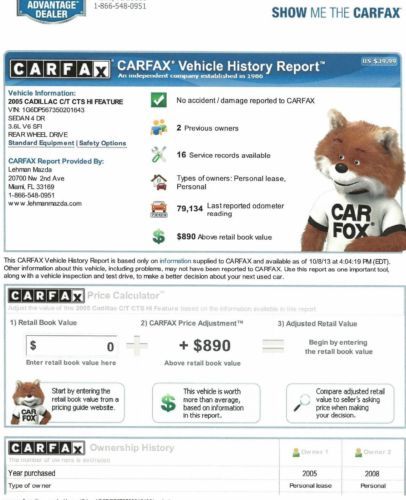

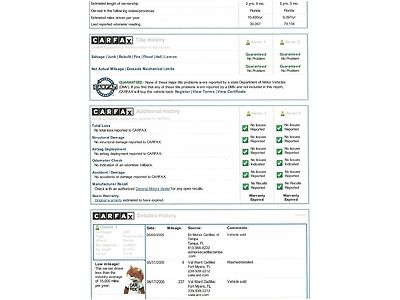

2005 Cts 3.6 Leather Sunroof Carfax Certified Spotless Florida Beauty Mint on 2040-cars

Hollywood, Florida, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Cadillac

Warranty: Vehicle does NOT have an existing warranty

Model: CTS

Mileage: 82,203

Options: Sunroof

Sub Model: 4dr Sdn 3.6L

Safety Features: Anti-Lock Brakes

Exterior Color: White

Power Options: Power Windows

Interior Color: Tan

Number of Cylinders: 6

Vehicle Inspection: Inspected (include details in your description)

Cadillac CTS for Sale

2007 cadillac cts v6 sedan 3.6l(US $6,300.00)

2007 cadillac cts v6 sedan 3.6l(US $6,300.00) Cts-v black diamond tricoat ultra view moonroof midnight sapele wood 1 owner(US $55,750.00)

Cts-v black diamond tricoat ultra view moonroof midnight sapele wood 1 owner(US $55,750.00) We finance!!! 2012 cadillac cts luxury pano roof heated seats 10k mi texas auto(US $27,998.00)

We finance!!! 2012 cadillac cts luxury pano roof heated seats 10k mi texas auto(US $27,998.00) Cadillac cts premium 3.6l awd navigation moon roof 19" wheels all options!!(US $29,500.00)

Cadillac cts premium 3.6l awd navigation moon roof 19" wheels all options!!(US $29,500.00) 2010 cadillac cts-v sunroof supercharged 2 keys

2010 cadillac cts-v sunroof supercharged 2 keys Performance, 3.6l v6, heatd leather, bose, backup cam, hdd

Performance, 3.6l v6, heatd leather, bose, backup cam, hdd

Auto Services in Florida

Yesterday`s Speed & Custom ★★★★★

Wills Starter Svc ★★★★★

WestPalmTires.com ★★★★★

West Coast Wheel Alignment ★★★★★

Wagen Werks ★★★★★

Villafane Auto Body ★★★★★

Auto blog

Johan responds to critics again about Cadillac's NY move

Wed, 15 Oct 2014Cadillac's new President Johan de Nysschen has faced a fair amount of criticism since assuming his position at the head of the American luxury manufacturer. From the company's move to New York City to a controversial new naming scheme, the first few months of his tenure have not been smooth sailing. Now, the embattled exec is firing back against his critics, notably Automotive News Editor-in-Chief Keith Crain, in a new column running in AN.

De Nysschen countered Crain's claim that the move to the Big Apple, "can only mean that someone wants to live in New York."

"The relocation decision is entirely unrelated to the personal living preferences of any Cadillac executive. No corporation would tolerate such indulgence by its leadership," de Nysschen wrote. "It is about structurally entrenching a challenge to the status quo by reinforcing the psychological and physical separation in business philosophy between the mainstream brands and GM's luxury brand."

May 2016: FCA wins, Ford and GM stumble on weak car volumes

Wed, Jun 1 2016The May 2016 sales numbers are in, and it looks as though FCA is getting some vindication for boldly cancelling two slow-selling car models. Meanwhile, Ford saw overall sales dip and GM's May volume took a big dive versus the same month in 2015. While Marchionne's decision to axe the Chrysler 200 and Dodge Dart has drawn criticism as being short-sighted, it's working for FCA so far. Although the Dart and 200 aren't out of production yet and no capacity has been shifted to crossover or trucks, May's numbers show that the emphasis on Jeep and Ram models makes sense right now. FCA's US sales rose 1 percent last month compared to May 2015, putting the year-to-date total at 955,186 vehicles, an increase of 6 percent compared to the same period last year. Standouts included the Jeep Renegade, Compass, and Patriot, and the Fiat 500X. Ram pickup sales were down 3 percent. And your fun fact is that Alfa Romeo sales were up precisely 10 percent, for a total of 44 4Cs sold versus 40 in the same month last year. At FoMoCo, the Ford brand took a hit to the tune of 6.4 percent from May 2015 to 2016, registering 226,190 sales last month. Lincoln showed improvement on its modest numbers, going from 9,174 to 9,807, a 6.9 percent increase. Overall, Ford was down 5.9 percent for the month to 235,997; despite the slump, year-to-date total Ford sales are up 4.2 percent to 1,112,939. Strong sellers included Escape, Expedition, F-Series, and Transit - big stuff. Most small and/or efficient models (Fiesta, Focus, Fusion, C-Max) saw sales slides. Fusion sales were also down, likely due to effects of model changeover to the freshened 2017 model. Ford has promised four new crossovers and SUVs by 2020 and if things keep trending this way the company will be able to sell them, but things could change in the next four years. GM saw the worst of it for domestic brands. Retail and fleet sales were down for each of the four divisions, with the May 2016 total dropping 18 percent to 240,450 vehicles. GM's year-to-date sales are down 5.0 percent in 2016 to 1,183,705. Both the Sierra and Silverado were down significantly, and the majority of Chevy, Buick, GMC, and Cadillac nameplates saw sales decreases, with both small cars and larger utilities included. Not even big stuff could help GM this month, it seems. We'll have more on the rest of the industry's May sales as those figures trickle in.

2017 Cadillac CT6 Plug-in Hybrid is the most efficient and torquey CT6 of all

Tue, Nov 15 2016Cadillac is returning to the hybrid game after discontinuing the ill-fated ELR, this time with an existing car and a new drivetrain. The company has taken its CT6 flagship and given it a turbocharged 2.0-liter four-cylinder, a pair of motors, and a big battery pack. The result of this combination is a CT6 that manages a rating of 65 MPGe, can go 30 miles on a full electric charge or 400 miles combined with the engine. The powertrain produces 335 horsepower and 432 lb-ft of torque. That's the same amount of power as the 3.6-liter V6 CT6, and more torque than that engine or the twin-turbo 3.0-liter V6. Cadillac claims the CT6 plug-in is capable of hitting 60 miles per hour in 5.2 seconds and reaching a top speed of 150 mph. The green and grunty CT6 plug-in will be available this coming spring, and it will have a premium price of $76,090. Cadillac says that its equipment list is comparable to the CT6 Premium Luxury trim level, which starts at $64,590 with the 3.6-liter V6, and $68,590 with the twin-turbo V6. However, in addition to the hybrid powertrain, Cadillac throws in a number of features that are options on the conventional gasoline models. To get the hybrid's rear seat infotainment system and enhanced night vision, a buyer would have to add $5,800 in option packages. That still leaves the twin-turbo model $1,700 shy of the hybrid, but that's not a terrible trade for the option of fuel-free driving for at least some of the time. Related Video: Featured Gallery 2017 Cadillac CT6 Plug-in Hybrid View 15 Photos Image Credit: Cadillac Green LA Auto Show Cadillac Hybrid Luxury Sedan cadillac ct6 2016 LA Auto Show