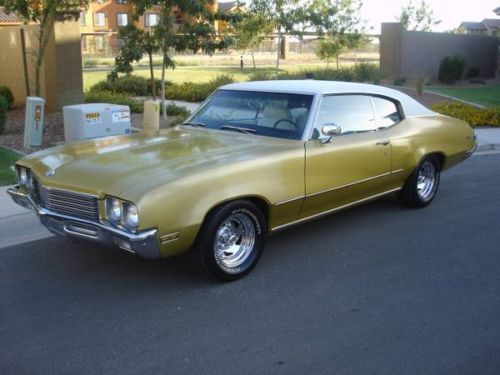

1972 Buick Skylark 350 5.7l on 2040-cars

Hampton, Virginia, United States

|

Took in trade for rent! Car is not currently running. It is missing the carburetor. 2 door hardtop with a/c. Less than 110K original miles. Buyer responsible for pick up or shipping.

|

Buick Skylark for Sale

One-of-a-kind custom build, hidden navigation, 4-link, over 200k invested!!(US $73,995.00)

One-of-a-kind custom build, hidden navigation, 4-link, over 200k invested!!(US $73,995.00) 1967 buick skylark convertible (455ci 7.5l)(US $22,500.00)

1967 buick skylark convertible (455ci 7.5l)(US $22,500.00) "look" at this 1965 buick skylark gs - low reserve

"look" at this 1965 buick skylark gs - low reserve 1971 buick skylark custom convertible 2-door 5.7l

1971 buick skylark custom convertible 2-door 5.7l 1995 buick skylark gran sport sedan 4-door 3.1l v6 75k miles

1995 buick skylark gran sport sedan 4-door 3.1l v6 75k miles 1972 buick skylark 350 5.7l(US $9,000.00)

1972 buick skylark 350 5.7l(US $9,000.00)

Auto Services in Virginia

Virgil`s Automotive ★★★★★

Valley Collision Repair Inc ★★★★★

Valley Collision Repair Inc ★★★★★

Transmissions of Stafford ★★★★★

Tonys Auto Repair & Sale ★★★★★

The Body Works of VA INC ★★★★★

Auto blog

Buick Avenir Concept saunters into Detroit [w/video]

Mon, Jan 12 2015We'd never accuse the most recent crop of Buicks of being ugly. Then again, we'd also never argue that they're overly pretty. Instead, they waltz along a middle ground, not standing out while not causing offense. The Buick Avenir Concept occupies no such middle ground – it's gorgeous. A long hood and a short deck fit well with an evolved form of Buick's long-running design language, while traditional highlights such as the waterfall grille and portholes mingle nicely with newer touches, like a beautiful, curvaceous set of rear haunches that bleed into the rear decklid. The cabin, meanwhile, is solidly in the concept realm, with a prominent 12-inch touchscreen as its centerpiece. Like the exterior, the Avenir's cabin is an evolution of current Buick designs, with a curve that tops the dash and feeds into the doors. A higher center console is finished in buffed wood, although the majority of the interior materials appear to be fine leather. Check out our gallery of live images of the new Avenir, at the Buick stand at the 2015 Detroit Auto Show. Show full PR text Buick Explores Future with Avenir Concept New design proportion, device integration, rejuvenating interior push brand forward DETROIT – Buick introduced the Avenir concept today in advance of the North American International Auto Show – a flagship sedan exploring progressive design with new levels of passenger well-being and technology integration. The Avenir – French for future – is distinguished by its premium sports proportions and all-new interpretations of traditional Buick cues. It is the creation of a global team of Buick designers and sculptors who were inspired by historic Buick concepts, which pushed traditional boundaries, shaped future Buick models and influenced the entire auto industry. "Avenir embodies Buick design, which centers on effortless beauty and presence without pretense," said Ed Welburn, vice president of General Motors Global Design. "It demonstrates the growing international reach of Buick and offers an exciting vision of where it can go." The Avenir's sculptural surfacing, expressive proportion and Buick's signature sweep-spear bodyside visually cue an exceptional driving experience that awaits inside. "The interior is designed with the driver and passengers' comfort and well-being in mind," said Welburn.

GM cutting vehicle trim options to save money for electrification

Sun, Mar 1 2020Information continues to filter out about GM's plans based on comments the automaker made during its Capital Markets Day event in February. GM President Mark Reuss said the company's push to save money by rationalizing the number of build combinations will continue in 2020, carrying on the work done in 2019. As GM Authority covers, last year, the carmaker cut 3,500 components across model lines, a 12% drop in the number of parts it needed to stock in its plants. Reuss used the next-generation Chevolet Equinox and GMC Terrain as examples for more cost efficiencies, saying build possibilities — which include international markets and their options — will be cut by more than 50%, and use more shared parts. "We will reduce total trim levels on Equinox and Terrain from eight to six," Reuss said, "reduce engine variants from 11 to 5, reduce build combinations from more than 200 to less than 100 per program, and see significant cost savings of an already paid-for architecture that took the mass out, helping us self-fund electrification programs." GM will plow a large amount of the money it saves into its ambitious EV program. In 2017, the automaker said it intends to have 20 electric vehicles on the market by the end of 2023, some of which could be shared between brands. An automotive analyst at Seeking Alpha and a piece in Automobile attempted to put specifics to what we should expect. As Automobile points out, the first two EVs in the 20-car program are already on sale, being the Ariv Meld and Ariv Merge eBikes available in Belgium and The Netherlands. We've seen the Cruise Origin autonomous rideshare taxi, although we don't know when it will hit the road. The next three, which we should see in the metal shortly, are two Cadillac EVs and the GMC Hummer EV pickup. The Cadillac pair are expected to be sized like the XT4 and XT5, and along with the Hummer, should hit the market starting in late 2021.

2018 Buick Regal TourX starts right around $30,000

Wed, Jun 28 2017The all-new Buick Regal is coming, and it's ditching the sedan bodystyle in favor of two liftback variants. This week, CarsDirect reported pricing on the more interesting of the two, the Regal TourX. While we're waiting on an official confirmation from Buick, at $29,995 (presumably before destination), the lifted-wagon will significantly undercut competitors from BMW, Volvo, and Audi. With standard all-wheel drive and a powerful turbocharged inline-four, the Regal TourX has the potential to steal som sales from the Europeans. CarsDirect bases its report on the latest Buick order guides. All versions of the Regal TourX come with all-wheel drive and a turbocharged 2.0-liter inline-four making 250 horsepower and 265 pound-feet of torque. The only available transmission is an eight-speed automatic. Push-button start, active-noise cancellation, and 18-inch wheels are part of the package. The Regal TourX Preferred bumps the price to $33,575. For the extra few hundred dollars, you get an auto-dimming rearview mirror, leather-wrapped steering wheel, power driver's seat, and door sill plates. There are also more colors available than on the base model. Further options include a $1,240 driver's assistance package with blind-spot monitoring, rear park assist, and cross-traffic alert, and a $1,200 panoramic moonroof. A fully loaded, top-trim Regal TourX rings in at $38,860. Direct competitors are difficult to name. The pricing is above something like the Volkswagen Golf Alltrack, but far less than the Audi A4 Allroad, Volvo V60 Cross Country, or a BMW 3 Series wagon. It ought to offer more power and refinement than a Subaru Outback, but we'll have to wait to drive it before we can make a final call. Related Video: Featured Gallery 2018 Buick Regal TourX: New York 2017 View 12 Photos News Source: CarsDirectImage Credit: AOL Buick Wagon buick regal tourx