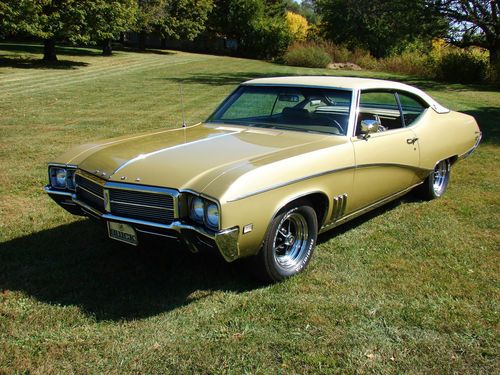

1969 Buick Skylark Custom With 455 on 2040-cars

San Jose, California, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:455 7.5L

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Buick

Model: Skylark

Trim: Custom

Drive Type: Automatic TH350

Mileage: 150,000

Number of Doors: 2

Exterior Color: Black Primer style

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Burgundy

Buick Skylark for Sale

1970 buick skylark custom convertible 2-door 5.7l

1970 buick skylark custom convertible 2-door 5.7l 1965 buick skylark

1965 buick skylark 1971 buick gs 4 speed with numbers matching engine and transmission

1971 buick gs 4 speed with numbers matching engine and transmission 70 buick skylark gs stage one triple black convertible w/ docs, loaded project(US $39,000.00)

70 buick skylark gs stage one triple black convertible w/ docs, loaded project(US $39,000.00) 445 wildcat, show-stopper midnight blue, fresh resto, ps, pb, owners manual(US $29,995.00)

445 wildcat, show-stopper midnight blue, fresh resto, ps, pb, owners manual(US $29,995.00) Buick 1969 skylark custom level coupe

Buick 1969 skylark custom level coupe

Auto Services in California

Yuki Import Service ★★★★★

Your Car Specialists ★★★★★

Xpress Auto Service ★★★★★

Xpress Auto Leasing & Sales ★★★★★

Wynns Motors ★★★★★

Wright & Knight Service Center ★★★★★

Auto blog

GM SUV window switch recall urges owners to park vehicles outside

Thu, 07 Aug 2014It's not unusual for there to be a lag between an automaker announcing a recall and the official documentation showing up on the National Highway Traffic Safety Administration website. So it's no surprise that a recent GM campaign took about a month to appear in its official capacity. However, there appears to be some big differences between the two reports with potential safety implications.

In late June, GM announced that it needed to recall 181,984 examples of the Chevrolet Trailblazer, Buick Rainier, GMC Envoy, Isuzu Ascender and Saab 9-7x from the 2005-2007 model years, plus the 2006 Chevy Trailblazer EXT and 2006 GMC Envoy XL. The new documents paint a slightly different picture with 184,611 needing repaired and different model years listed.

The reason for the fix is still the same, though. It's possible for fluid to contact the master power window switch module in the driver's door, which can corrode the part. Eventually this could cause a short circuit, leaving the buttons inoperable and potentially leading to a fire. But the new NHTSA documents add an important note: "A fire could occur even while the vehicle is not in use. As a precaution, owners are advised to park outside until the remedy has been made."

Repo man pays off elderly couple's car just in time for Thanksgiving

Mon, Nov 28 2016Repo men get bad raps for a good reason; no one likes having their car taken away. At least one guy in the repossession game proved folks in his profession aren't all bad when he helped an elderly couple hold on to their wheels right before Thanksgiving. According to the Belleville News-Democrat, unexpected bills and the rising cost of prescription medications pushed Stanford and Patty Kipping's fixed income to the breaking point. Unable to keep up with the $95 dollar a month payment on their 1998 Buick, they fell into arrears and the bank sent a repo man out to their home in Red Bud, Illinois to reclaim the car. Jim Ford, co-owner of Illini Recovery Inc., hooked up the old Buick and dragged it away, but later that night his conscience caught up with him. "When I got home that night, I said to myself, 'They are a real nice elderly couple. I gotta do something. I can't just take their car,'" Ford told the News-Democrat. Ford did do something, something surprisingly humane. He set up a GoFundMe and, within just a few short hours, he raised more than $3,500 dollars. This was enough money to pay off the Kipping's loan with a little left over for some maintenance. Ford and a friend then hooked the car back up and towed it back to the Kipping's home. Ford presented the couple with their trusty Buick, and threw in a thousand dollars in an envelope and a frozen turkey for Thanksgiving. "It was a miracle come true," Patty told the paper. "We didn't know what we were going to do." "I got up this morning and I looked up at the sun and I said, 'I hope we get our car back,'" added Stanford. "It's just unbelievable."Related Video: News Source: Belleville News-Democrat Auto News Weird Car News Buick repossession repo man

Buick reveals wild GL8 minivan concept and Smart Pod concept in China

Fri, Nov 19 2021Buick, being the hit in China that it is, decided to unveil a couple of concept vehicles at the Guangzhou Auto Show. One is the GL8 Flagship Concept, and the other is the Smart Pod Concept. Since an actual minivan is far more interesting than any “Smart Pod,” weÂ’ll start with the GL8 Flagship Concept. The exterior is meant to be luxurious and “dynamic” looking with its mix of colors, glass canopy roof, wing-shaped headlights and highly-sculpted body. ThereÂ’s hardly a piece on the car that isnÂ’t making a statement, and the highlights continue when you open the doors. It becomes fairly clear right away that this minivan is not one for family use, as itÂ’s only rocking four seats. That said, everybody in those four seats is guaranteed to be comfortable. Buick says itÂ’s using “zero gravity” lounge seats inside, and the cabin as a whole is inspired by Chinese mountain and water landscapes. That could explain the multi-color floor, as the blue section looks like it could be the water at the base of a mountain, surrounded by a beach. Features include a tea tray, 30-inch driver display, touchscreen on the steering wheel, full windshield-width head-up display and a new audio system that features speakers in the headrests. Buick says all of the carÂ’s functions can be controlled by voice, too. Beyond the obviously futuristic touches, this Buick minivan is just plain gorgeous. Its gold, blue and cream color combo and various materials used throughout look like top-notch luxury. WeÂ’d love to see some of this attention to detail and luxury trickle down into some of BuickÂ’s production cars. Smart Pod Concept Buick Smart Pod Concept View 17 Photos Unlike the GL8, the Smart Pod was designed in the U.S. It uses the electric Ultium platform and what Buick is calling the VIP electric architecture. The exterior design is basically what Buick has called it — a pod. Its lights use micro-LED tech to make them as sleek as possible. On the inside, Buick designed the Pod to be as spacious and airy as can be. It has a glass roof, a fully reclining and dedicated sleep seat and a modular seating layout. Other features include deployable tables, noise-cancelation tech, an air purifying system and a 50-inch LED screen. It is powered by an AI assistant that employs voice commands, eye-tracking technology, integration with your mobile devices and machine learning to adapt to the user.