1948 Buick Roadmaster Convertible Series 70 Excellent Condition on 2040-cars

Lewisville, North Carolina, United States

Body Type:Convertible Coupe

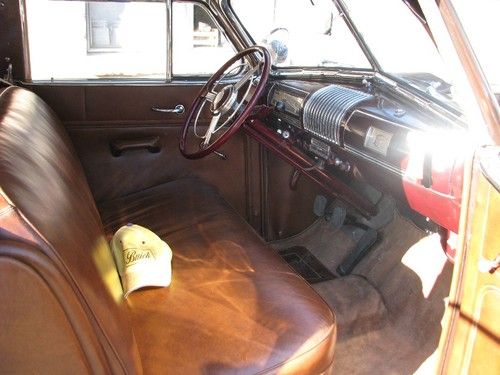

Engine:320cc Fireball Dynaflash straight 8

Vehicle Title:Clear

For Sale By:Private Seller

Interior Color: Dark Green

Make: Buick

Number of Cylinders: 8

Model: Roadmaster

Trim: Convertible

Drive Type: Rear wheel

Options: Leather Seats, Convertible

Mileage: 52,965

Power Options: Power Windows, Power Seats

Sub Model: Convertible Series 70

Exterior Color: Aztec Green

Warranty: None

Buick Roadmaster for Sale

4 door(US $55,000.00)

4 door(US $55,000.00) 1994 buick roadmaster estate wagon wagon 4-door 5.7l(US $5,000.00)

1994 buick roadmaster estate wagon wagon 4-door 5.7l(US $5,000.00) 1995 buick roadmaster wagon - 55k - no reserve

1995 buick roadmaster wagon - 55k - no reserve Collectors edition final year for roadmaster estate wagon/super low miles/ mint!

Collectors edition final year for roadmaster estate wagon/super low miles/ mint! 1996 buick roadmaster limited collector's edition sedan 4-door 5.7l

1996 buick roadmaster limited collector's edition sedan 4-door 5.7l 1954 buick roadmaster(US $34,500.00)

1954 buick roadmaster(US $34,500.00)

Auto Services in North Carolina

Walkers Auto Repair ★★★★★

Viking Imports Foreign Car Parts & Accessories Inc ★★★★★

Vans Tire & Automotive ★★★★★

Union Automotive Services Inc ★★★★★

Triangle Service ★★★★★

Todd`s Tire Service Inc ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

2014 Buick Regal GS

Mon, 09 Sep 2013A few months ago I drove the 2014 Buick LaCrosse and wrote up a First Drive review of it. For all of my quibbles with that sedan (and I had a fair number), I understand that it speaks to the heart of what new Buick loyalists like in a car; it's roomy, has a cushy ride and is as placid as a summer's morning at highway speeds.

Those qualities, while undeniably desirable, don't mean a whole lot to me personally. I prefer sedans that conjure up words like "nimble," "punchy" or even "raucous" on occasion. So, directionally, the high-performance GS version of the 2014 Buick Regal is more my cup of tea than any other car in the company's current range.

In fact, I'd already come to know the Regal GS from its 2012 model year introduction, and grown more than a little fond of the sporting sedan in its original front-wheel-drive, six-speed-manual guise. The fast, sweet-handling car with well-sorted controls may have suffered from a slight identity crisis in terms of pricing (and may still), but it was undeniably fun to drive. So, when I heard that the GS was coming to market for 2014 with optional all-wheel drive (albeit only in combination with a six-speed automatic transmission), I was stoked to have another go and concentrated my driving impressions on the AWD car.

Despite strong profits, GM still fighting flat market share

Fri, Jan 17 2014Looking at the progress General Motors has made since it entered bankruptcy, it's easy to forget that the company still has a long way to go before it's the juggernaut it once was. A recent report from Reuters points out that, while GM is making money, it isn't making any gains in terms of US market share. Quite the opposite, really. Consider this factoid: In 1963, nearly half of the cars sold in the United States were from Chevrolet, Cadillac, Buick, GMC or Pontiac. Now, the company's US market share is stagnant at 17.9 percent. That same number is half of just Chevy's 1963 market share. This is all despite GM going on a binge replacing or updating its models. "Market share increases are not instantaneous," Mark Reuss told Reuters at the 2014 Detroit Auto Show. "We've got a lot of baggage. Don't underestimate what people though of us, or these brands, through these hardships and 30 years." The reasons for the stagnant market share are numerous. Reuters points out that retooling of factories and a focus on limiting incentives are both good things for profit, but not necessarily for market share. There's also the troubling turnover of the brand's marketing department. These issues don't change the fact that Chevrolet has lost 1.4 percent of its market share in two years, and that Cadillac - arguably GM's most improved brand overall - has lost 1.2 percent in the same period. Part of that can be blamed on GM's avoidance of fleet sales in favor of more profitable customer sales. "Our focus has really been on retail and that's where we've got the growth," said Alan Batey, GM's interim global marketing boss. "We want to grow GM and that means growing market share and profits, but it's not at all costs," Reuss said. News Source: ReutersImage Credit: paul bica - Flickr CC 2.0 Earnings/Financials Buick Cadillac GM GMC sales profits