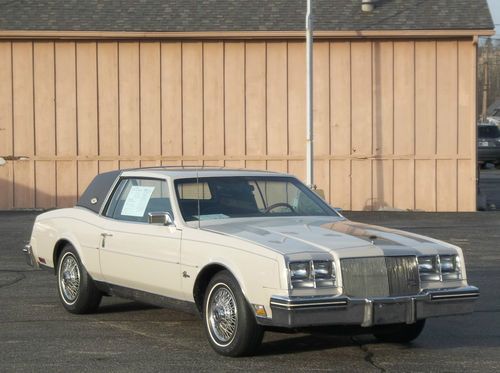

1984 Buick Riviera on 2040-cars

Richmond, Indiana, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:5.0 Litre

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Make: Buick

Model: Riviera

Trim: 2DR

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Drive Type: Front Wheel Drive

Mileage: 106,374

Sub Model: Riviera

Disability Equipped: No

Exterior Color: Beige

Number of Doors: 2

Interior Color: Brown

Warranty: Vehicle does NOT have an existing warranty

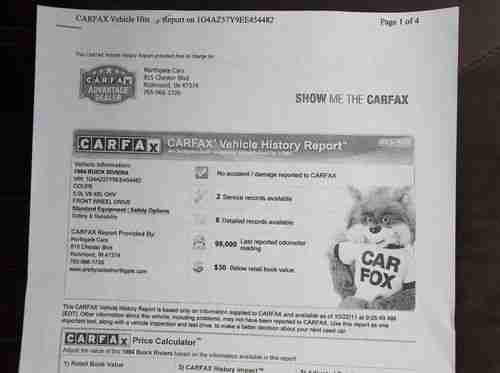

Extremely nice and clean 1984 Buick Riviera - only 106,000 actual and true miles!!! - a local trade in right here at our dealership, the previous owner was a non smoker, no dings, no dents, no scratches, clean as new condition both inside and out. Serviced, inspected, road tested, and an accident free carfax history report, this Riviera is solid. An original condition car, the paint is 95% original ..... the vinyl top is original and very nice ..... the interior is all original and in great condition ..... under the hood and in the trunk is original condition and nice ..... factory original wire wheel covers with Cooper all season tires. Loaded with options and ready for the road. A gorgeous car for a great price. Offered for sale on Ebay, the internet, and from our sales lot - therefore we do reserve the right to end this auction should this vehicle sell. We are offering a buy it now price of $3850.00 for the ready to buy person or the auction style bidding for those wishing to bid. We will be happy to answer any and all questions. We do collect 7% sales tax that is credited back to the buyers home state - you are not taxed twice - any and all tax collected is credited to your state. We do collect $119.00 document fee - the document fee provides a 31 temporary license plate for transportation and all necessary paperwork. Thanks for looking and good luck.

Buick Riviera for Sale

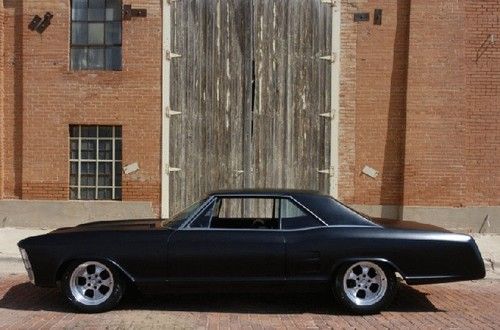

1969 baby blue riviera gs

1969 baby blue riviera gs 1969 buick riviera

1969 buick riviera 1999 buick riviera silver arrow #56 of 200

1999 buick riviera silver arrow #56 of 200 1973 riviera 'undocumented' gs stage one car~no rust~no accidents~great driver!(US $17,500.00)

1973 riviera 'undocumented' gs stage one car~no rust~no accidents~great driver!(US $17,500.00) 1983 buick riviera xx anniversary edition coupe 2-door 5.0l

1983 buick riviera xx anniversary edition coupe 2-door 5.0l 1964 buick riviera 2 door hardtop fully customized hollywood car(US $24,500.00)

1964 buick riviera 2 door hardtop fully customized hollywood car(US $24,500.00)

Auto Services in Indiana

Wood`s Battery & Auto Elctrc ★★★★★

Wilsons Auto Repair ★★★★★

Tread Express Tires Inc ★★★★★

The Zone Honda Kawasaki ★★★★★

Ted Brown`s Quality Paint & Body Shop ★★★★★

Swinehart Auto Service ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Mixed sales results, but automaker stocks rise on need for cars in Houston

Fri, Sep 1 2017DETROIT — The Big Three Detroit automakers on Friday reported better-than-expected August sales and issued optimistic outlooks for demand as residents of the Houston area replace flood-damaged cars and trucks after Hurricane Harvey, sending their stocks higher. General Motors, Ford and Fiat Chrysler posted mixed August U.S. sales, with GM up 7.5 percent and Ford and Fiat Chrysler down. Japanese automaker Toyota improved sales by nearly 7 percent, while Honda fell 2.4 percent. Still, analysts focused on the potential for Detroit automakers to cut inventories and stabilize used vehicle prices as residents of Houston, the fourth largest city in the United States, are forced to replace tens of thousands, perhaps hundreds of thousands, of vehicles after the devastation from Hurricane Harvey. Mark LaNeve, Ford's U.S. sales chief, told analysts on Friday that following Hurricane Katrina in 2005 "we saw a very dramatic snapback" in demand. That said, Ford sales fell 2.1 percent in August. It sold 209,897 vehicles in the United States, compared with 214,482 a year earlier. Sales were down 1.9 percent in the Ford division and off 5.8 percent at Lincoln. Demand was down for cars, crossovers and SUVs. It was not clear how many vehicles in the Houston area will be scrapped, LaNeve said, saying he had seen estimates ranging from 200,000 to 400,000 to 1 million. Ford's Houston dealers may have lost fewer than 5,000 vehicles in inventory, he said. Ford is the No. 1 automaker in the Houston market, with 18 percent share, according to IHS Markit. The company plans to ship used vehicles to Houston dealers and has "every indication we would have to add some production" of new vehicles to meet demand, LaNeve said. Investor concerns about inventories of unsold vehicles and falling used car prices have weighed on Detroit automakers' shares most of this year. Now, automakers can anticipate a jolt of demand from a big market that is a stronghold for Detroit brand trucks and SUVs. "It's got to be a positive for the industry," LaNeve said. Investors appeared to agree. GM shares rose as much as 3.3 percent to their highest since early March. Ford increased 2.8 percent at $11.34, and Fiat Chrysler's U.S.-traded shares were up 5.2 percent $15.91, hitting their highest in more than five years. GM reported a 7.5 percent increase in U.S. auto sales in August, helped by robust sales of crossovers across its four brands.

2014 Buick Regal GS

Mon, 09 Sep 2013A few months ago I drove the 2014 Buick LaCrosse and wrote up a First Drive review of it. For all of my quibbles with that sedan (and I had a fair number), I understand that it speaks to the heart of what new Buick loyalists like in a car; it's roomy, has a cushy ride and is as placid as a summer's morning at highway speeds.

Those qualities, while undeniably desirable, don't mean a whole lot to me personally. I prefer sedans that conjure up words like "nimble," "punchy" or even "raucous" on occasion. So, directionally, the high-performance GS version of the 2014 Buick Regal is more my cup of tea than any other car in the company's current range.

In fact, I'd already come to know the Regal GS from its 2012 model year introduction, and grown more than a little fond of the sporting sedan in its original front-wheel-drive, six-speed-manual guise. The fast, sweet-handling car with well-sorted controls may have suffered from a slight identity crisis in terms of pricing (and may still), but it was undeniably fun to drive. So, when I heard that the GS was coming to market for 2014 with optional all-wheel drive (albeit only in combination with a six-speed automatic transmission), I was stoked to have another go and concentrated my driving impressions on the AWD car.