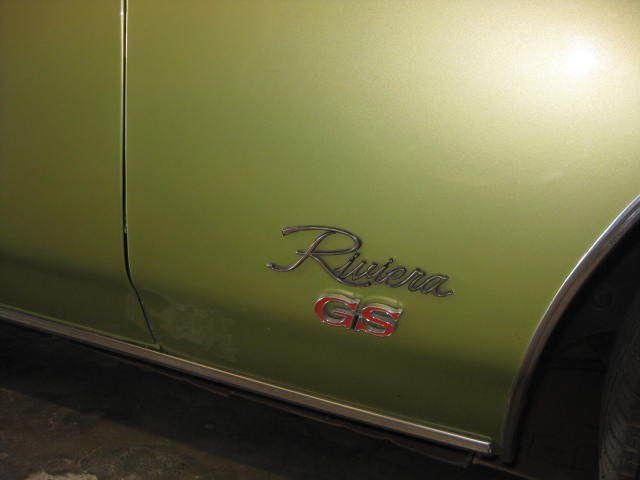

1971 Buick Riviera on 2040-cars

Naches, Washington, United States

New custom tri color interior with custom full length console with cup holders and glove box. Billet Specialties

steering wheel. 17" Foose chrome wheels, new Cooper tires. Air conditioning works excellent. 1 re-paint in 1998

original factory color (Willow Mist).Original radio with 8 track. New quadrojet carburetor, new Edelbrock aluminum

manifold, new 110 amp chrome alternator. All glass good, driver's window has a scratch. Doesn't use oil and runs

cool.

Buick Riviera for Sale

Buick other brown(US $10,000.00)

Buick other brown(US $10,000.00) Buick riviera base(US $2,000.00)

Buick riviera base(US $2,000.00) Buick riviera base hardtop 2-door(US $3,000.00)

Buick riviera base hardtop 2-door(US $3,000.00) Buick riviera coupe(US $2,000.00)

Buick riviera coupe(US $2,000.00) Buick riviera base hardtop 2-door(US $2,000.00)

Buick riviera base hardtop 2-door(US $2,000.00) Buick riviera base hardtop 2-door(US $2,000.00)

Buick riviera base hardtop 2-door(US $2,000.00)

Auto Services in Washington

Z Sport ★★★★★

Woodinville Auto Repair ★★★★★

West Hills Honda ★★★★★

Walther`s Garage ★★★★★

Timex Automotive ★★★★★

The Pit Stop Auto Service & Detail ★★★★★

Auto blog

2024 Buick Encore GX First Drive: Fresh from cosmetic surgery

Thu, May 25 2023About a year ago, Buick showed us its stunning Wildcat EV concept. While that sporty coupe might never see the end of a production line, it signaled a new direction for the brand’s design. For 2024, Buick gave its most popular model in North America, the Encore GX small SUV, a fairly substantial visual refresh. While it doesnÂ’t get the WildcatÂ’s electric powertrain, the refreshed ute is the first in the lineup to borrow its design cues. It also finally gets the Avenir trim, the epitome of style and luxury previously applied to other Buick models, along with some tech upgrades. So while weÂ’re still not able to get behind the wheel of an electric Buick, the Â’24 Encore GX Avenir AWD landing in our driveway gave us the chance to see what a nip and a tuck can do to elevate this baby Buick crossover. This new face is easy on the eyes, looking more modern and athletic than the previous version. Gone is the somewhat frumpy and bulbous old fascia. Now, we get a sharp nose emblazoned with an all-new logo — the encore GX is the first production car to sport this fresh take on the Buick shields. Below that is the new grille in all its unbroken mesh glory, surrounded by shiny chrome in this Avenir trim. A pair of swoopy winged LED headlights reside just below the elegantly creased hood. From the side, the Avenir gets big, 19-inch aluminum wheels in a Pearl Nickel finish, with that new logo in the center. It also gets body-color fenders as opposed to the black on some of the other trims. In back, we see the new logo repeated prominently again, with the LED taillights looking almost as if theyÂ’re pointing it out. Below that is the brand name spelled out large. At the bottom is what looks like a black diffuser, but we canÂ’t imagine it does much but make the car look sporty. Inside, the big news is the new dual-display “virtual cockpit”, with two screens under a single sheet of glass. On the right side is the 11-inch infotainment touchscreen, on the left is an 8-inch digital instrument cluster. We like the layout of the infotainment home screen, which is easy to use and configurable. Certain information in the infotainment can be sent to the driverÂ’s display — if you want to keep close tabs on your battery voltage, for instance. Prefer the familiarity of your phone? Wireless Apple CarPlay and Android Auto are standard across trim levels. Praise be.

Buick unveils 2020 Encore and Encore GX in Shanghai

Mon, Apr 15 2019As expected, Buick pulled the covers off its refreshed Encore and brand-new Encore GX at the 2019 Shanghai Motor Show. It's not surprising that Buick would unveil these crossovers in China considering that's the automaker's largest market, but we expect at least one of these crossovers to come to the States to replace our current Encore, which has been Buick's best-selling model for the last three years. Buick hasn't yet release a whole lot of information about its new Encore twins besides coyly describing the GX as a longer-wheelbase version of the Encore. In reality, we think there's quite a bit of difference between these two Encores. The regular Encore is similarly sized to the current version, which is heavily based on the Opel Mokka, and it's probably based on an updated version of GM's Gamma II platform called GEM, which stands for Global Emerging Markets. 2020 Buick Encore for China View 2 Photos The larger Encore GX is likely sitting atop GM's newer VSS-F platform. We don't know exactly how much bigger the GX is than the regular Encore, but we wouldn't be surprised if it's this larger version that will be sold Stateside. An unknown range of four-cylinder Ecotec engines will be offered in China, paired to either a nine-speed automatic or optional continuously variable transmission. Regardless of what's underneath, these two Encore models share the same sense of style, and it's a look we can get behind. A wide winged grille is bisected by a chrome strip that carries the Buick Tri-Shield emblem front and center. The rest of the sheetmetal is taut and crisp, with concave bodysides and muscular flanks. We'll have to wait and see what tweaks are made to the American Encore, what powertrain it will feature, and when exactly it will go on sale. In the meantime, feel free to check out the gallery up above.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.