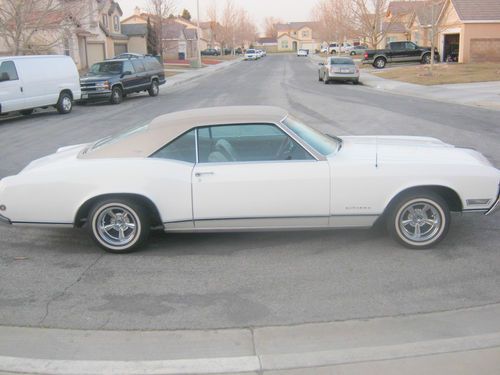

1968 Buick Riviera Base Hardtop 2-door 7.0l on 2040-cars

Lancaster, California, United States

Engine:7.0L 430Cu. In. V8 GAS Naturally Aspirated

Vehicle Title:Clear

Body Type:Hardtop

Fuel Type:GAS

For Sale By:Private Seller

Mileage: 85,375

Make: Buick

Exterior Color: White

Model: Riviera

Interior Color: Tan

Trim: Base Hardtop 2-Door

Drive Type: U/K

Options: Leather Seats, 8-track player

Number of Cylinders: 8

Safety Features: Driver Airbag

Power Options: Power Windows, Power Seats

All original with original radio that works. Supreme rims on all four tires. Runs great, looks great. Any questions call Mike@661-317-1418.

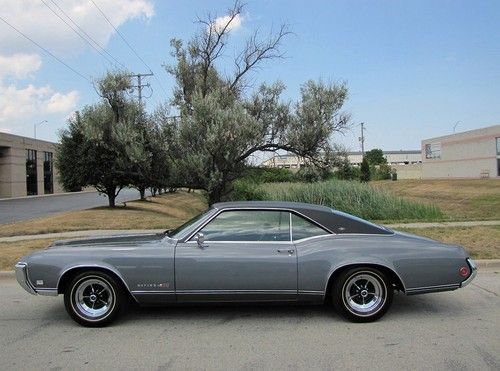

Buick Riviera for Sale

1967 buick riviera custom - lower reserve-one of a kind!-automatic 2-door coupe(US $22,000.00)

1967 buick riviera custom - lower reserve-one of a kind!-automatic 2-door coupe(US $22,000.00) 1969 buick riviera gs - one owner, documentation and only 41k miles

1969 buick riviera gs - one owner, documentation and only 41k miles 1972 buick riviera gs grand sport

1972 buick riviera gs grand sport 1964 buick rivera shaved bagged 65 style grill conversion 401 nailhead(US $10,000.00)

1964 buick rivera shaved bagged 65 style grill conversion 401 nailhead(US $10,000.00) 1970 buick riviera custom! new paint, interior, 20" wheels, classy, no reserve!

1970 buick riviera custom! new paint, interior, 20" wheels, classy, no reserve! 56 buick special riviera custom restored show winner 322 nailhead

56 buick special riviera custom restored show winner 322 nailhead

Auto Services in California

Zip Auto Glass Repair ★★★★★

Z D Motorsports ★★★★★

Young Automotive ★★★★★

XACT WINDOW TINTING & 3M CLEAR BRA PAINT PROTECTION ★★★★★

Woodland Hills Honda ★★★★★

West Valley Machine Shop ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Buick to kill Verano as early as 2017

Mon, May 9 2016The Buick Verano's days are allegedly numbered. Citing unnamed sources, Automotive News is reporting that Buick will kill its Delta-platform-based sedan. The company offered the typical "no comment." According to AN, Buick is expecting 70 percent of its sales to come from the Encore, Envision, and Enclave once the Envision goes on sale. And it doesn't take a professor of economics to recognize that when half the vehicles you build account for just 30 percent of the sales, it's time to trim. But the case for killing the Verano is a weird one, because the problem isn't a lack of demand. Struggling sales might be the reason to kill a car, but the Verano is – and has consistently been – Buick's second best-selling sedan. It's beaten the slightly larger, more expensive Regal by at least 12,000 units in each of the last four years. Hell, in 2013, Buick sold 45,000 Veranos to fewer than 19,000 Regals. So why not kill the Regal? Well, the Verano's raison d'etre is irrelevant today. Buick launched its smallest sedan at a time when premium compact four-doors weren't a thing and gas prices were high enough that consumers were still hesitant to tie themselves to a CUV's fuel bill. And while it was roughly the same size as the Chevrolet Cruze that it shared GM's Delta platform with, it had enough unique equipment to stand apart and warrant its price premium. Today, fuel prices are cheap and consumers are flocking to crossovers while Buick is stuck sharing the premium compact pie with much more prestigious names ( Mercedes-Benz and Audi). And because it's sharing showroom space with the super-popular Encore, even the Verano's affordable pricing has become a liability. Today, a lightly equipped Verano is the same price as a base Encore, and they offer broadly similar features (rear-view cameras, a seven-inch touchscreen with Intellilink, Bluetooth, etc.). And if the Encore is too small, there's probably a GMC Terrain sitting in the same showroom, offering more utility and equal equipment to the Verano for a similar price. As one dealer told AN, "For not much more money, customers can get an SUV." Killing the Verano might risk 30,000 to 40,000 sales, but it's a move that proves Buick has tremendous confidence in its CUV lineup – clearly the company thinks the Encore can do the job of luring customers into showrooms. AN's sources claim the Verano will survive through 2017, so we'll be waiting a few years to find out if that faith is misplaced. Related Video:

Black Friday could power record November sales

Thu, Nov 26 2015Black Friday allows some shoppers to line up in the wee hours for doorbuster deals on laptops and TVs, but the day after Thanksgiving could mean huge profits for automakers this year, too. Multiple industry analysts predict record growth for the industry for November, and the upcoming incentives could help those numbers. TrueCar predicts that Black Friday incentives could provide a major boost, and it estimates a November sales jump of 3.9 percent from last year to a record for the month at over 1.35 million vehicles. As examples of potential deals, Chevrolet, Buick, and GMC plan to offer up to 20 percent off some models, and FCA US has no-interest financing for up to 75 months from its brands. "Consumers are excited about Black Friday promotions and these month-long events appear to be resonating with car buyers." Eric Lyman, TrueCar's vice president of industry insights, said in the report. Black Friday only recently became a big day for auto sales, according to an analysis from Edmunds. Last year, Thanksgiving weekend posted double the sales as any other weekend in the month. The company predicts a sales volume of over 1.33 million vehicles for November. If that happens, it would be the beat the previous record of 1.32 million sales for the same month in 2001. Some forecasts temper the gains for November but only slightly. Kelley Blue Book predicts flat year-over-year sales at 1.3 million vehicles, but that's largely because there are two fewer sales days in 2015 versus in 2014. "Black Friday deals on vehicles have grown in popularity in recent years, and should be a big contributor to this month's sales results," said analyst Tim Fleming in the study. The combined research from J.D. Power and LMC Automotive have the lowest November prediction among this group at just over 1.279 million sales for the month versus 1.299 million in 2014. However, once the researchers adjust the figures for the two fewer selling days, 2015 could actually be seven percent higher than last year. TrueCar Finds New Auto Sales in November to Reach Monthly Record Black Friday promotions bolster sales gains; industrywide incentives up 6% from last year November 24, 2015 12:11 PM Eastern Standard Time SANTA MONICA, Calif.--(BUSINESS WIRE)--TrueCar, Inc. (NASDAQ: TRUE) projects total new vehicle sales, including fleet deliveries, will reach 1,352,500 units in November, a 3.9 percent increase from a year ago and the highest ever for the month.