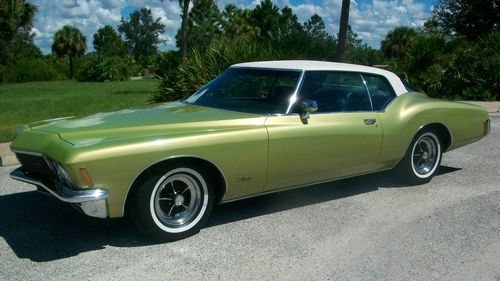

1967 Buick Riviera Base Hardtop 2-door 7.0l on 2040-cars

Chicago, Illinois, United States

Body Type:Hardtop

Engine:7.0L 7047CC 430Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 8

Make: Buick

Model: Riviera

Trim: Base Hardtop 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: U/K

Mileage: 999,999

Exterior Color: Blue

Power Options: Air Conditioning, Power Windows

Interior Color: Black

1967 buick riviera front lowerd door poppers new carpet intior pieces in trunk needs water pump for more info call dennis 847 521 9442

Buick Riviera for Sale

1984 buick riviera t-type grand national turbo v6

1984 buick riviera t-type grand national turbo v6 1970 buick riviera 455 automatic loaded(US $12,500.00)

1970 buick riviera 455 automatic loaded(US $12,500.00) 1971 buick rivera boat tail one of the nicest around(US $15,000.00)

1971 buick rivera boat tail one of the nicest around(US $15,000.00)

1964 buick riviera loaded showing 49k miles call 516-425-1121

1964 buick riviera loaded showing 49k miles call 516-425-1121 1983 buick riviera convertible 5.0 v8 auto w/ pwr top only 16k miles *1 owner*

1983 buick riviera convertible 5.0 v8 auto w/ pwr top only 16k miles *1 owner*

Auto Services in Illinois

X Way Auto Sales ★★★★★

Twins Auto Body Shop ★★★★★

Trevino`s Transmission & Auto ★★★★★

Thompson Auto Supply ★★★★★

Sigler`s Auto Ctr ★★★★★

Schob`s Auto Repair ★★★★★

Auto blog

GM may kill 6 car models as it works with UAW to tackle sales slump

Fri, Jul 21 2017The president of the United Auto Workers union said on Thursday the union is talking with General Motors about the potential threat to plants and jobs from slumping U.S. car sales. GM's response will be more trucks and SUVs, and sources say at least six slow-selling car models may be killed off. "We are talking to (GM) right now about the products that they currently have" at underused car plants such as Hamtramck in Michigan and Lordstown in Ohio, and whether they might be replaced with newer, more popular vehicles such as crossovers, Dennis Williams told reporters. "We are tracking it (and) we are addressing it," Williams added. GM has cut shifts at several U.S. plants this year as inventories of unsold cars have ballooned. Industry analysts said more jobs could be at risk as the automaker wrestles with permanently shrinking production of small and midsized sedans. GM is reviewing whether to cancel at least six passenger cars in the U.S. market after 2020, including the Chevrolet Volt hybrid, which could be replaced in 2022 with a new gasoline-electric crossover model, Reuters has learned from people familiar with the plans. Other GM cars at risk include the Buick LaCrosse, Cadillac CT6, Cadillac XTS, Chevrolet Impala and Chevrolet Sonic, sources said. Some analysts have singled out GM's Hamtramck plant in Detroit as one of the most vulnerable because of plummeting car sales. The plant, which opened in 1985, builds four slow-selling models: Buick LaCrosse, Chevrolet Impala, Cadillac CT6 and Chevrolet Volt. In the first half, it built fewer than 35,000 cars, down 32 percent from the same period in 2016, according to suppliers familiar with GM's U.S. production schedule. The typical GM assembly plant builds 200,000-300,000 vehicles a year.COMING ATTRACTIONS: TRUCKS AND SUVS GM must "create some innovative new products" to replace slow-selling sedans "or start closing plants," said Sam Fiorani, vice president of AutoForecast Solutions. The auto maker already has begun to shift future production plans from cars to trucks, according to Morgan Stanley auto analyst John Murphy. He estimates that fewer than 10 percent of the new vehicle models that GM will introduce over the next four years will be passenger cars, with the rest divided among trucks, SUVs and crossovers. GM plans to add production of the new Cadillac XT4 crossover next year to its Malibu sedan plant in Fairfax, Kansas.

GM applies to trademark Buick Envision GX

Mon, Apr 18 2022GM Authority found a GM application with the U.S. Patent and Trademark Office to reserve the name Buick Envision GX. We can't be certain, but it seems this all but confirms that the three-row Buick Envision, which debuted a year ago in China as the Envision Plus (pictured), will sell here as the Envision GX. Doing so would reinforce the naming convention established in the U.S. with the Encore and slightly larger Encore GX. Adding a third row to the compact two-row Envision extends three of of four dimensions. According to specs the Chinese transport ministry put online last year, the three-row Envision will be 190.7 inches long on a 111.5-inch wheelbase, increases of 8.2 and 2.1 inches, respectively. Height grows by 2.7 inches as well, only the 74.1-inch width holding steady. That length has been utilized to make life easier for second- and third-row passengers. The Envision Plus in China comes with 2+3+2 seating, the second-row bench able to slide 9.8 inches. Behind that, cargo volume with the second and third rows stowed climbs from 52.7 cubic feet to 58 cubic feet. The sole engine will be the current Envision's 2.0-liter four-cylinder, making 228 horsepower and 258 pound-feet of torque, sent to the wheels through a nine-speed automatic. Power gets sent to the front wheels as standard, and all-wheel drive will be an option. On top of the extended rear overhang on the seven-seater, GM designers slipped in a few cosmetic changes to set it apart from the five-seater. A new horizontal trim piece connects the headlights, the lower bumper getting a pair of larger, reshaped intakes. A complementary horizontal slash connects slimmer taillights, the license plate surround squared off instead of trapezoid-shaped. Related video:

Nissan Sentra, Buick LaCrosse to headline LA Auto Show

Wed, Oct 21 2015We're less than a month away from the start of the Los Angeles Auto Show, and automakers have been lining up their debuts for the upcoming left-coast expo. The latest announcement comes from the show's organizers who are eager to tout the global debuts slated for next month. Chief among them will be new versions of the Buick LaCrosse and Nissan Sentra. So far all we've seen of the 2017 LaCrosse is a glimpse at the front grille, but it's already promising to bring elements of the Avenir concept to the street. The original LaCrosse was launched in 2004 and was replaced in 2010 with the current model. The Sentra nameplate has been around much longer, but the current model was launched more recently in 2013. The new version spied recently while undergoing testing is promised to be a substantial update on that model, not a complete replacement, bringing it up to speed with the latest equipment and revised styling. This represents the first official confirmation we've received of when Nissan will be unveiling the new Sentra. Mitsubishi will also be on hand with its new Outlander Sport, as well as the redesigned Mirage. They'll be joined as well by new versions of a couple of high-end models that promise to resonate with the local crowds in tinseltown. Land Rover has chosen the LA show as a suitable venue to unveil the production Range Rover Evoque Convertible that will drop the top on one of the most stylish luxury crossovers on the market. And Porsche, as we know, is gearing up to hit the track with the new Cayman GT4 Clubsport - a customer racing version of the company's little two-seat, mid-engined sports car that's been lightly modified for motorsport competition. Of course these won't be the only new metal on display at the Californian auto expo. They'll be joined as well by the likes of the new Infiniti QX30, Hyundai Elantra, Kia Sportage, and Jaguar F-Pace - many of which we've already seen. Meanwhile companies like Fiat, Ford, Mazda, Mercedes, Subaru, Volvo, Volkswagen, and Elio Motors are keeping their plans under wraps for the time being. But with mere weeks to go, it won't be long before we see what they've got in store as well.