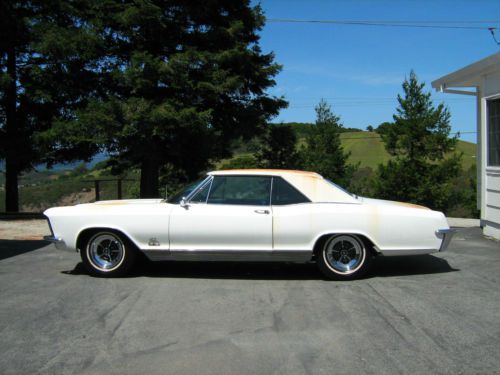

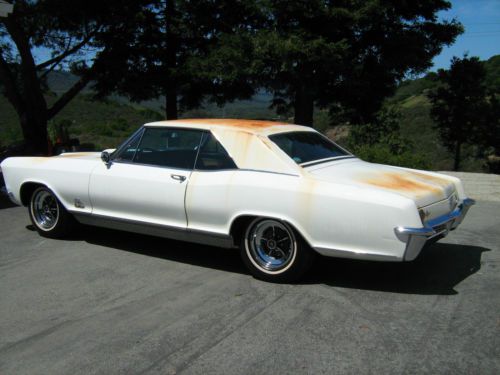

1965 Buick Riviera Gs - 425 Dual-quad - 13,009 Original Miles! on 2040-cars

Redwood City, California, United States

|

1965 Buick Riviera Gran Sport - Dual-Quad 425 Super Wildcat V8 - 13,009 original miles! A TRUE TIME CAPSULE! Numbers matching! Only 3,400 GS's were built in '65 I bought this from my next-door neighbor, she was the original owner. The car was bought right off the lot from the Buick dealership in Redwood City, CA in 1965, and has spent its entire life here in Redwood City, California. Almost all of that time the car was just sitting in a garage. The engine was started frequently and still runs beautifully. The car is still sitting on the original Winston Poly P225/75R15 tires from the factory. Original chrome rims. Has the original "protect-o-plate documentation, original owners manuals, original black & gold California license plates, along with the original dealer cardboard plates. Dual-Quad 425 Super Wildcat V8 Dual-exhaust (newly replaced all 3 mufflers with NOS) Posi-Traction, PS, PB, Wonderbar radio, tinted glass; remote control mirrors; four-way power seats; power windows, power wing windows; deluxe tilt steering wheel; factory air conditioning; Unique clam shell headlights (missing motors); all gauges and lights work perfectly. All original interior is absolutely CHERRY! The car was professionally appraised in 2007 by Bud Millard of Automobile Appraisal Association. The condition was assessed as "very good" and the car appraised at $35,000. Body condition is great except for 3 or 4 small dings and a small dent at the tip of the hood. The front grill has minor damage, but a new NOS grill comes with the car. The original paint is faded and has visible surface rust due to the California sun. Car sold as-is! Any questions, Call Ronnie at 650-366-6644 |

Buick Riviera for Sale

1965 buick riviera(US $21,000.00)

1965 buick riviera(US $21,000.00) 1985 buick riviera t-type coupe 2-door 3.8l

1985 buick riviera t-type coupe 2-door 3.8l 1982 buick riviera convertible only 33,230 miles. garage kept all original

1982 buick riviera convertible only 33,230 miles. garage kept all original 1963 buick riviera base hardtop 2-door 7.0l(US $25,000.00)

1963 buick riviera base hardtop 2-door 7.0l(US $25,000.00) 1964 buick riviera hardtop 2-door 6.6l

1964 buick riviera hardtop 2-door 6.6l 48k original miles, all original complete survivor, original piant, nice riviera(US $18,995.00)

48k original miles, all original complete survivor, original piant, nice riviera(US $18,995.00)

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

2019 Buick Envision starts just under $33,000

Mon, Feb 26 2018Buick has announced that prices for its new 2019 Envision will start at $33,985 (including destination), positioning the refreshed compact SUV right between its best-selling Encore entry-level crossover and more upmarket Enclave and taking aim at competitors including the Lincoln MKC and Acura RDX. The Envision will be offered in five trim levels — Envision, Preferred, Essence, Premium and Premium II, which starts at $45,590 — when the crossover goes on sale this spring. Prices exclude tax, title, license, dealer fees and optional equipment. We told you recently about the optional new nine-speed Hydra-Matic 9T50 automatic transmission and 2.0-liter turbocharged four-cylinder on the top two trim levels. The upgraded engine offers 252 horsepower and 295 pound-feet of torque. The standard setup remains the 197-hp 2.5-liter inline four-cylinder engine making 147 lb-ft of torque and mated to a six-speed automatic, offered in front- or all-wheel drive. The crossover gets a new winged Buick emblem on the grille, new headlamps and newly sculpted front and rear facias, plus optional 19-inch wheels. It also gets a Buick-first tire-fill alert that signals when a tire has reached the recommended pressure level. Standard technology features include an in-vehicle air ionizer to eliminate odors, a switch to turn off its fuel-saving engine stop feature, rear-park assist, an 8-inch diagonal infotainment system and 4G LTE WiFi hotspot. By dropping the starting MSRP by nearly $1,000, GM says the Envision is now better positioned against its top-selling Encore (starting MSRP $22,990), for which nearly 60 percent of buyers come from outside the automaker's stable of brands. Related Video:

GM announces six new recalls, covering 3.5 million vehicles

Mon, 16 Jun 2014General Motors has just initiated another crushingly large recall, this time affecting some 3.36 million vehicles built between 2000 and 2014 and sold in the US, Canada and Mexico. Once again, the issue surrounds the cars' ignition switches, which can be kicked out of the run position if they're carrying extra weight or if they experience a "jarring" event. In this particular case, though, GM will modify the keys, rather than the ignition itself.

A four-by-six-millimeter hole will be drilled into the key, which will more safely accommodate the weight of the key ring. As is usually the case, the work will be done free of charge. The recalled vehicles include the 2000 to 2005 Cadillac Deville, 2004 to 2005 Buick Regal LS and GS, 2004 to 2011 Cadillac DTS, 2005 to 2009 Buick Lacrosse, 2006 to 2008 Chevrolet Monte Carlo, 2006 to 2011 Buick Lucerne and 2006 to 2014 Chevrolet Impala. Only the Impala is still in production, and even then, it's only sold to fleet companies.

According to an official statement from GM, there have been eight crashes and six injuries due to this latest issue. As if this isn't a dire enough blow for GM, the company has announced five smaller recalls, covering 165,000 vehicles.

This 1988 Buick LeSabre Estate Wagon looks like a boxy, wood-sided bargain

Fri, May 8 2020The growing interest in 1980s cars has meant that General Motors' full-size B-body station wagons of the era are now attracting the interest of collectors as well as iconoclasts seeking an SUV alternative. This 1988 Buick LeSabre Estate Wagon for sale right now on eBay Motors, looks to be a tempting example of the genre. It has covered just 72,000 miles and is described as a "rust-free southern car." The A/C is said to be cold, and it's equipped with power windows, a split-bench front seat and a rear-facing third seat. Whereas the Electra was the wagon for the finest estates, the LeSabre presumably was for those that were one rung down, so it has a slightly more downmarket maroon cloth interior where the Electra would have velour. Yet this LeSabre Estate Wagon is still slathered in a full complement of woodgrain siding, and this car sports a factory set of wire wheel covers. We're told the 5.0-liter V8 sound great, while the paint is said to be "a little tired" and one headlight looks like it needs to be replaced. The "Buy It Now" price is $8,500, and the seller is also inviting offers. Plus, 1% of the sales price benefits St. Jude's Children's Research Hospital, so there's a feel-good factor. For comparison, this wagon's Oldsmobile twin currently being auctioned on Bring a Trailer already has been bid past $8,900 for four days still to go in the auction. This '83 Custom Cruiser has 74,000 miles and looks maybe a little spiffier, but not a lot more so. The seller of this Oldsmobile includes a video in his listing, and in it he appears to be not wearing pants. Sometimes it's all about presentation. Related Video: