2003 Buick Lesabre Limited Sedan 3.8l Luxury Family Comfort Nice No Reserve on 2040-cars

Frankford, Delaware, United States

Buick LeSabre for Sale

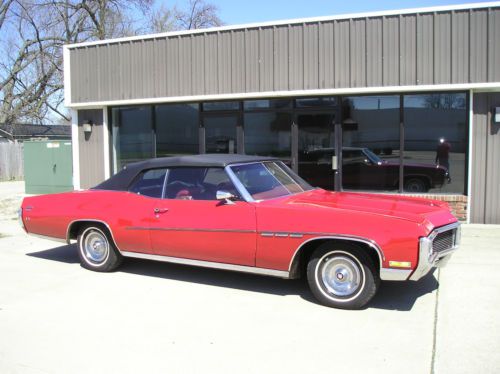

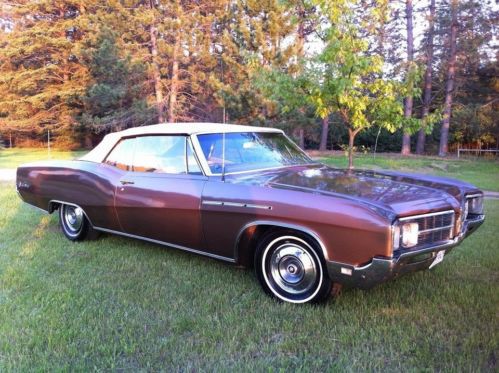

1970 buick lesabre custom convertible 2-door 5.7l(US $11,500.00)

1970 buick lesabre custom convertible 2-door 5.7l(US $11,500.00) 34,000 original miles like new inside take a look

34,000 original miles like new inside take a look 2001 biuck lesabre limited - only 19,000 actual miles!!(US $13,500.00)

2001 biuck lesabre limited - only 19,000 actual miles!!(US $13,500.00) 1985 buick lesabre collector's edition coupe 2-door 5.0l

1985 buick lesabre collector's edition coupe 2-door 5.0l 1975 blue runsdrivesgreatbodyinteriorvgoodseasonready!

1975 blue runsdrivesgreatbodyinteriorvgoodseasonready! 1968 buick lesabre custom convertible 2-door 5.7l(US $11,000.00)

1968 buick lesabre custom convertible 2-door 5.7l(US $11,000.00)

Auto Services in Delaware

Taylor & Signore Auto Repair Inc ★★★★★

Quality Automotive ★★★★★

Diamond State Tire Inc ★★★★★

Corvette Upgrade ★★★★★

Clarksville Auto Service ★★★★★

Car Effex ★★★★★

Auto blog

Buick Adam a reality after all... but only in China

Mon, 03 Mar 2014General Motors may have parred down its brand portfolio, but it still has more under its umbrella than most. That's why, while a company like Ford might market the same vehicle under its own name in markets around the world, GM uses different brands in different markets. But no two are aligned quite as closely as Opel in Europe and Buick in the United States and China.

What we know here as the Buick Regal is sold overseas as the Opel Insignia. Our Encore is their Mokka. Verano? Astra sedan. But one thing we don't get here is the Opel Adam. The diminutive city car is GM's take on the Mini Cooper, Fiat 500, Citroën DS3 et al. Launched at the 2012 Paris Motor Show, the Opel Adam is named after the company's founder (like an ironic thumbing of the nose to the Ferrari Enzo). But while it's sold, like most Opels, in the UK as a Vauxhall, the prospect of it porting over to Buick seems slim to none. Right?

Sorta. While the Adam isn't likely to come Stateside, the latest reports (as yet unconfirmed by GM) suggest that The General is planning to sell the Adam in China where the Buick brand is also a strong seller. Local production could ensue, with prices targeting the Fiat 500 and engines - according to CarNewsChina.com - to include inline-fours displacing 1.2 and 1.4 liters with 69 and 100 horsepower, respectively.

Wagons make a bit of a comeback, with new models, sales on the rise

Thu, Jan 10 2019Consider this an official invitation to hop on the wagon bandwagon. There's still tons of room because, well, it's a wagon (and market share is still extremely small). But according to new data, the segment is growing. According to a report from Bloomberg, using data from Edmunds.com, roughly 211,600 Americans purchased wagons in 2018. That is technically down from the 237,600 sold in 2017, but wagon sales in the U.S. are up 29 percent from where they were five years ago. It's also the third year in a row that wagon sales broke the 200,000 mark. The sales trends have been somewhat representative of the availability of wagons. New models have debuted during the past 5 years and therefore offer more opportunity at more brands to buy wagons. In addition to more modest cars such as the Volkswagen Golf Sportwagen, several luxury and performance brands are offering wagons today, such as Mercedes-Benz, Audi, Porsche, Jaguar, Volvo and Buick. (Bloomberg's headlines make the point that "crossovers are for the Kardashians," and wagons are just, well, classier.) This uptick in brand-name availability, as well as extremely well-executed design on most of the wagons currently available, has helped increase the segment's desirability. That, and its ability to better accomplish the same tasks at hand while standing out from the crossover and SUV crowd. Still, the posted numbers represent a small fraction of the total vehicles sold. According to the data, wagons only held a 1.4 percent market share in 2017, the segment's best recent year. Wagons hold a steadfast place in America's past, and they're writing an interesting new story. With the downturn in traditional cars, they may continue to create an unexpected narrative. Related Video: News Source: Bloomberg, Edmunds Audi BMW Buick Volkswagen Volvo Wagon station wagon

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.