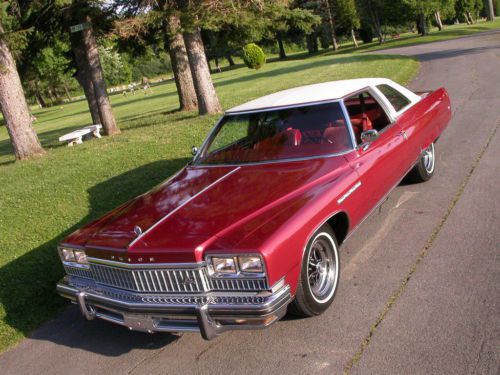

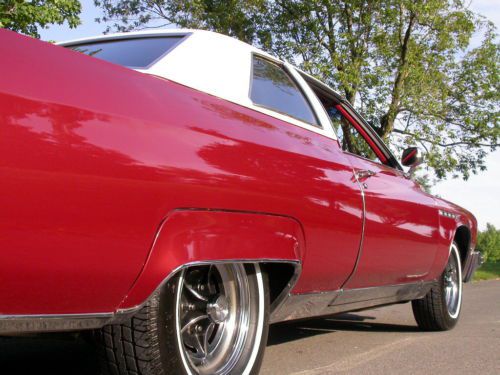

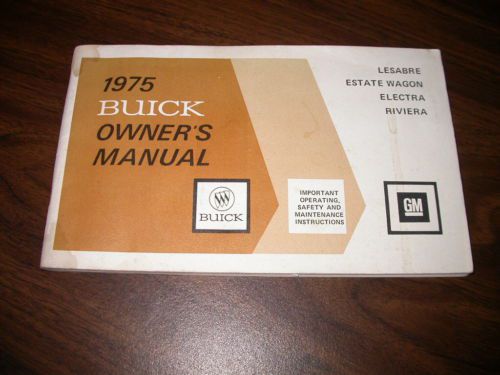

1975 Buick Electra Limited ,, 49,555 Original Miles !!!!! on 2040-cars

Clinton, New York, United States

Buick Electra for Sale

1970 buick electra 225 custom convertible 2-door 7.5l - very good condition(US $22,500.00)

1970 buick electra 225 custom convertible 2-door 7.5l - very good condition(US $22,500.00) 1970 buick electra 225 custom convertible 2-door 7.5l

1970 buick electra 225 custom convertible 2-door 7.5l Electra wagon rear seat woody awesome condition 74k miles!(US $7,000.00)

Electra wagon rear seat woody awesome condition 74k miles!(US $7,000.00) 1968 buick electra limited 225 hardtop 2 door

1968 buick electra limited 225 hardtop 2 door 1968 buick electra 225 custom convertible 2-door

1968 buick electra 225 custom convertible 2-door The best 1975 buick electra 225 limited all original condition just 61,628 miles

The best 1975 buick electra 225 limited all original condition just 61,628 miles

Auto Services in New York

Witchcraft Body & Paint ★★★★★

Will`s Wheels ★★★★★

West Herr Chevrolet Of Williamsville ★★★★★

Wayne`s Radiator ★★★★★

Valley Cadillac Corp ★★★★★

Tydings Automotive Svc Station ★★★★★

Auto blog

2024 Buick Encore GX spy photos reveal Wildcat-based design

Thu, Dec 8 2022After the reveal of the Buick Wildcat concept car, the company made it clear the styling would appear on many upcoming cars. We've seen it on the recently revealed Envista for China and the U.S., and it will appear on the first Electra electric SUV. But apparently the design language will be adapted to current Buick models, too, as evidenced by the spy photos of the new Encore GX shown above. This is clearly a refreshed Encore GX, as it's mostly the same from the A-pillars back. But the whole front end has been given a radical makeover with the Wildcat's basic looks. There's one large grille placed low in the fascia with horizontal slats. It has a pointy nose and angry headlights. It's a much more aggressive design compared to the borderline cute look of the current Encore GX. The only other significant change to the Encore GX, at least from the outside, is the use of the new Buick badge. It has the three new shields placed at the same height and without the circle. At the back, the word "BUICK" is spelled out in chrome lettering below the new badge. Since this car is completely uncovered and in production-ready guise, we're betting the refreshed Encore GX will launch sometime next year as a 2024 model. Being a refresh, it will likely have the same turbo 1.2- and 1.3-liter three-cylinder engines with front- or all-wheel drive and either a CVT or nine-speed automatic transmissions. Related video: Buick Wildcat EV Concept Walkaround

Buick prepares Super Bowl ad blitz to introduce Cascada

Wed, Jan 27 2016Super Bowl 50 will kick off on February 7, and Buick will use the big game's massive audience to get the word out about the new Cascada convertible. The the broadcast spot will be paired with a humorous digital campaign to advertise the convertible online. Buick hasn't released the 30-second Super Bowl commercial yet, but a teaser image shows that it stars New York Giants wide receiver Odell Beckham, Jr. and actress Emily Ratajkowski, known for roles in the films Gone Girl and Entourage. The ad is part of the "Experience the New Buick" campaign, which aims to position the brand to appeal to a younger demographic. The brand also has Ellie Kemper, the star of Netflix's hilarious Unbreakable Kimmy Schmidt and Erin on The Office, to sell the Cascada, Regal, Encore, and Enclave in a new online campaign. She plays an exaggerated version of herself and flirts with a guy who thinks Kemper owns Buick's new convertible. The spot tries to capitalize on the quirky charm of the actor's Kimmy Schmidt character. Buick will cut the longer clip (below) into vignettes for ads on sites like YouTube. Buick spokesperson Crystal Wilson told Autoblog that viewers' reactions to Kemper's commercial have been "totally positive" so far. First-Ever Buick Super Bowl Ad Features Odell Beckham Jr. and Emily Ratajkowski Latest "Experience the New Buick" ad spotlights new Cascada convertible 2016-01-26 DETROIT – Buick's first-ever Super Bowl ad will bring the brand's award-winning "Experience the New Buick" campaign to the biggest night in TV advertising. The campaign launched in 2014 and challenges consumers' false perceptions of the brand. The 30-second spot, scheduled to air during Super Bowl 50, features Buick's all-new Cascada luxury convertible and stars New York Giants wide receiver Odell Beckham Jr. and actress/model Emily Ratajkowski. The spot will be the first new Buick commercial to air in 2016, a year where the brand will launch three new products. The Cascada, Buick's first convertible in 25 years, arrives in dealerships in the coming weeks. It features an athletic and sculptural beauty that delivers a distinctive profile, whether the top is up or down. Along with the perception-shifting Cascada, Buick showrooms will soon feature a redesigned LaCrosse sedan and the new Envision, a compact crossover. Both go on sale this summer.

GM SUV window switch recall urges owners to park vehicles outside

Thu, 07 Aug 2014It's not unusual for there to be a lag between an automaker announcing a recall and the official documentation showing up on the National Highway Traffic Safety Administration website. So it's no surprise that a recent GM campaign took about a month to appear in its official capacity. However, there appears to be some big differences between the two reports with potential safety implications.

In late June, GM announced that it needed to recall 181,984 examples of the Chevrolet Trailblazer, Buick Rainier, GMC Envoy, Isuzu Ascender and Saab 9-7x from the 2005-2007 model years, plus the 2006 Chevy Trailblazer EXT and 2006 GMC Envoy XL. The new documents paint a slightly different picture with 184,611 needing repaired and different model years listed.

The reason for the fix is still the same, though. It's possible for fluid to contact the master power window switch module in the driver's door, which can corrode the part. Eventually this could cause a short circuit, leaving the buttons inoperable and potentially leading to a fire. But the new NHTSA documents add an important note: "A fire could occur even while the vehicle is not in use. As a precaution, owners are advised to park outside until the remedy has been made."