1940 Buick Other Special Convertible Sedan 41c on 2040-cars

Detroit, Michigan, United States

For more pictures email at: karrenwhatcott@coolsite.net .

Will Sell immediately, Beautiful classic needs new home.

All original manuals and literature included.

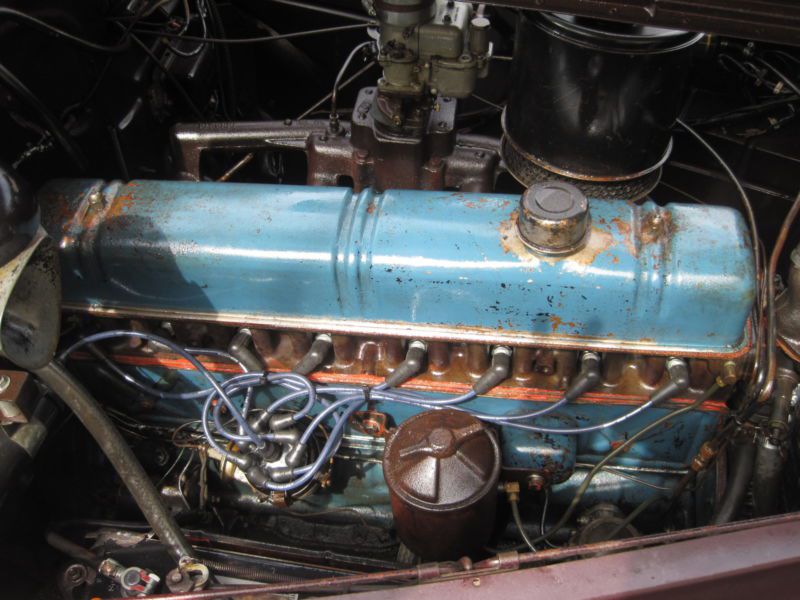

1940 Buick Model 41C, Special, Convertible Sedan, 8 Cylinder, 121 Wheelbase side mounts with covers, buick emblems

are inside car, runs and drives well, many new upgrades including brakes, see receipts.

Dynaflash straight eight engine, 3 speed manual column shift transmission, leather upholstery, dual side mounts,

rear seat.

Need a new home and some TLC, Some paint imperfections, cracks and surface rust in places, All the chrome is

presentable, some with pits but we shined the bumper up with steel wool. These cars are very valuable

This is a very rare car with a very low production. All glass glass is there, No cracks and windows roll up nice.

Only 552 of the 1940 convertibles were produced.

Buick Century for Sale

Buick: century riviera(US $7,000.00)

Buick: century riviera(US $7,000.00) Willys: coupe 2 door coupe(US $26,000.00)

Willys: coupe 2 door coupe(US $26,000.00) 1973 buick gran sport(US $24,500.00)

1973 buick gran sport(US $24,500.00) Buick: electra limited(US $6,900.00)

Buick: electra limited(US $6,900.00) Other makes: kr 200(US $12,999.00)

Other makes: kr 200(US $12,999.00) Other makes: kr 200(US $12,999.00)

Other makes: kr 200(US $12,999.00)

Auto Services in Michigan

Wilson`s Davison Tire & Auto ★★★★★

Wade`s Automotive ★★★★★

Village Ford Inc ★★★★★

Village Ford ★★★★★

U P Tire & Auto Service ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Junkyard Gem: 1985 Buick Skyhawk Custom Coupe

Sat, Jan 7 2023General Motors began building cars on the compact J Platform in 1981, and J-based machinery stayed in production all the way through the 2005 Chevrolet Cavalier and Pontiac Sunfire. The best-known of the J-cars in North America was always the Cavalier, but The General's Pontiac, Oldsmobile, Buick and even Cadillac divisions each sold their own Js here. The Buick version was the Skyhawk, built for the 1982 through 1989 model years. Here's a sporty '85 Skyhawk coupe, found in a Northern California boneyard recently. The Custom trim level was the cheapest version of the Skyhawk in 1985, and the two door was the most affordable configuration (midgrade Skyhawks were Limiteds and the T-Type was at the top of the Skyhawk pyramid that year). The MSRP on this car started at $7,512 (about $21,220 in inflation-adjusted 2022 dollars), making it the least expensive new Buick offered for sale in the United States in 1985. The Skyhawk name had been used on the Buick version of the Chevrolet Monza during the 1970s. The Chevrolet-badged sibling of this car was much cheaper, with the list price of the base '85 Cavalier coupe set at $6,872 (around $19,410 today). There were cheaper new Chevrolets that year, of course; a new Chevette cost just $5,470, while the Isuzu-built Spectrum was $6,295 and the Suzuki-built Sprint a skinflinty $5,151. The base engine in the Custom and Limited was this 2.0-liter SOHC straight-four rated at 86 horsepower. A turbocharged 1.8-liter version with 150 horses was available for an extra 800 bucks ($2,260 now). A four-on-the-floor manual transmission was standard equipment in the 1985 Skyhawk, but the buyers of most of these cars insisted on automatics. The price for this one was $425 ($1,200 today). A five-speed manual cost just $75 ($210). Velour-ish upholstery in Bordello Red (Buick didn't use that name) was all the rage during the 1980s and well into the 1990s. This car's interior looks pretty nice, considering where it's parked. Community Buick GMC in Iowa is still in business today. The five-digit odometer means we can't know how many miles were on this car at the end. I brought a Chicago-made 1950s Pho-Tak Foldex 30 film camera with me to the junkyard that day, as one does, and I photographed the Skyhawk on Kodak Portra 160 film. The irritatingly perky Skyhawk owners in this TV commercial appear to be about one-third the age of typical mid-1980s Buick shoppers.

Buick has best sales year ever, delivers over 1M cars globally

Wed, 08 Jan 2014If there are any lingering doubts why General Motors held onto Buick while killing Pontiac, Hummer and Saturn, one only has to look at the sales numbers from 2013 for the real answer. Thanks largely to strong sales in China, Buick set a global sales record last year by selling more than one million vehicles.

The lion's share of Buick sales came from China, which sold more than 809,000 units - about four times more Buicks than were sold in North America as a whole. In the US, the Buick Encore accounted for almost half of all US sales with 97,311 units as Buick spent the summer trying to keep up with demand of the subcompact crossover. Likewise, China-only models like the GL8 minivan and Excelle sedan (same as the US-spec Verano) were strong sellers in that market.

For good measure, Buick more than doubled its sales in Mexico with 2,319 units. Scroll down for the full press release.

China-market Buick Envista rumored possible replacement for the Encore

Tue, Nov 15 2022Buick currently sells four crossovers, the Encore, Encore GX, Envision, and Enclave. That number will soon be whittled to three, the Encore expected to end production after this model year. If speculation provided by GM Authority is correct, there could be changes afoot in the middle of the line in time for the 2024 model year. Buick has said it will maintain four ICE-powered crossovers, so the brand will need something to fill the coming gap. GMA sources suggest the China-market Buick Envista could get the nod. Buick launched the coupe-esque model across the Pacific in August, a relation to the Chevrolet Seeker that appeared on the Chinese market in April. The Envista debuted the brand's latest design language inspired by pure-electric concepts like the Electra-X and WIldcat. Thin, angled headlights frame a wide, low grille, leading back to a roof that slopes into a high back and double spoilers. GM applied to trademark the Envista name in the U.S. in early 2019, then maintained it with extension requests until earlier this year. Then, in September 2022, the automaker abandoned the application, which could bode ill for whatever chance there was, if any. Another snag could be that the Envista is 182.5 inches long, 71.5 inches wide, and 61.6 inches high on a 106.3-inch wheelbase. Various reports have pitched the Envista to fill the (small) space between the Encore GX and the Envision; however, the Envista falls just 0.10 short of the Envision's length, and it's three inches smaller in every other dimension. On the other hand, the Envista is 11.1 inches longer and 0.1 inch wider than the Encore GX, with a wheelbase 4.1 inches longer. That makes a lot of overlap in the dimensional Venn diagram. Were the Envista to come as-is, it wouldn't so much be a replacement for the Encore as be a different kind of compact SUV from the Envision on a more modern platform. Further speculation from "sources familiar with the matter" says a U.S.-market Envista could get the Avenir treatment. Avenir marks the ultimate in Buick luxury, an appellation currently restricted to the Envision and Enclave. According to a separate report, the Encore GX is also headed into the Avenir club with the compact crossover gets refreshed for the 2024 model year. An Encore GX Avenir would adopt some exterior tweaks like 18-inch alloys, and turn a load of optional equipment available for the Encore GX Essence trim into standard equipment. Related video: