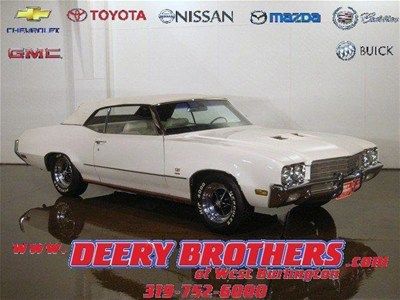

1969 Buick Skylark Custom 2-door Hardtop 39,000 Original Documented Miles L@@k ! on 2040-cars

Plainfield, Illinois, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Model: Skylark

Warranty: Unspecified

Mileage: 39,770

Sub Model: Custom 2-Door Hardtop

Exterior Color: Truphet Gold

Interior Color: Gold

Doors: 2

Number of Cylinders: 8

Engine Description: 350 C.I. V8

Buick Skylark for Sale

1967 buick skylark convertible 2-door 340 cu. in. 5.6l v8(US $10,000.00)

1967 buick skylark convertible 2-door 340 cu. in. 5.6l v8(US $10,000.00) 1965 buick skylark 310 wildcat real survivor

1965 buick skylark 310 wildcat real survivor 1970 buick gs gran sport stage 1 convertible all numbers matching real deal car

1970 buick gs gran sport stage 1 convertible all numbers matching real deal car 1969 buick skylark custom 2 door hardtop

1969 buick skylark custom 2 door hardtop 1971 buick skylark custom convertible 2-door

1971 buick skylark custom convertible 2-door 1971 auto white(US $27,777.00)

1971 auto white(US $27,777.00)

Auto Services in Illinois

Yukikaze Auto Inc ★★★★★

Woodworth Automotive ★★★★★

Vogler Ford Collision Center ★★★★★

Ultimate Exhaust ★★★★★

Twin Automotive & Transmission ★★★★★

Trac Automotive ★★★★★

Auto blog

2013 Buick Encore nets strong IIHS, NHTSA safety scores

Wed, 05 Jun 2013After being crushed from every which way and rolled over like a labrador, the 2013 Buick Encore has been named a Top Safety Pick by the Insurance Institute for Highway Safety. To earn the accolade, a vehicle must achieve the highest rating of "Good" in each of the institute's four main crash tests: Front Moderate Overlap, Side, Rollover and Rear. The Encore aced those four tests with "Good" ratings, but missed out on the coveted Top Safety Pick+ designation by receiving a Poor rating in the institute's new Front Small Overlap test. To be named a Top Safety Pick+, the Encore would need to score at least an "Acceptable" rating in the new test, as well as "Good" in all four original crash tests.

Despite the miss, the Encore joins the Enclave, LaCrosse, Verano and Regal as Top Safety Picks all. If you count only the Encore with all-wheel drive, then all five Buicks have also earned five-star overall ratings from the National Highway Traffic Safety Adminstration, making Buick one of the few manufacturers to offer a full lineup with high scores from both safety rating organizations.

The front-wheel-drive Encore, despite performing equally as well as the all-wheel-drive version in NHTSA's crash tests, only earned four stars overall. As far as we can tell, the discrepancy between the two is because some safety equipment, like Forward Collision Warning and Lane Departure Assist, are optional features on the FWD Encore and standard on the AWD model.

2014 Buick Regal GS AWD

Thu, 27 Feb 2014"This is just silly," I said as I laughed my way sideways around the icy track at Circuit ICAR, a racecourse, drag strip and kart track at the Montreal-Mirabel International Airport in Quebec. It wasn't the activity that had me cracking up, though. After all, winter driving experiences aren't uncommon in this business.

No, in this particular case, it was the car that had me chuckling. I wasn't in a mad hot hatch or a rally-derived rocket - I was in a Buick. The 2014 Regal GS, to be more precise. Somehow, despite its recent product renaissance (not to mention its distant - yet storied - history of performance models), I was having a hard time believing that this attractive, turbocharged, all-wheel-drive sedan sliding around the Great White North could possibly be wearing a Tri-Shield badge on its nose.

But it was, and slide about it did. While having access to a vehicle in this setting is fairly rare, what's rarer is the fact that I've had so much exposure to it. In Mr. Ewing's recent Volkswagen Golf R drive story, for instance, his ice capades were his first experience with the new model. In my case, though, I was lucky enough to first test the refreshed Regal GS for a week back in December before flying to Quebec to drive it on the snowy, icy, winding roads of Canada's most fiercely independent province and on the track at Mirabel.

Updated Buick LaCrosse, Regal to debut at New York Auto Show

Tue, 26 Feb 2013Judging by the spy shots we saw last week for the 2014 Buick LaCrosse and 2014 Buick Regal, we knew it wouldn't be much longer until we saw both sedans receive a grand debut. Today, Buick confirmed to Autoblog both cars will be introduced at the New York Auto Show next month, but no further information has yet been released about either model.

Having been on the market for an extra couple years, the changes to the LaCrosse appear to be more significant than those coming for the Regal, but both will be getting refreshed exterior designs as well as updated interiors. The Regal's new face brings it more in line with the all-new Encore and the restyled Enclave, while the LaCrosse should get a more distinctive, upscale appearance.

Both cars will be introduced exactly a month from today, and we'll be there to bring you all the coverage.