2011 Buick Regal Cxl on 2040-cars

500 N Shadeland Ave., Indianapolis, Indiana, United States

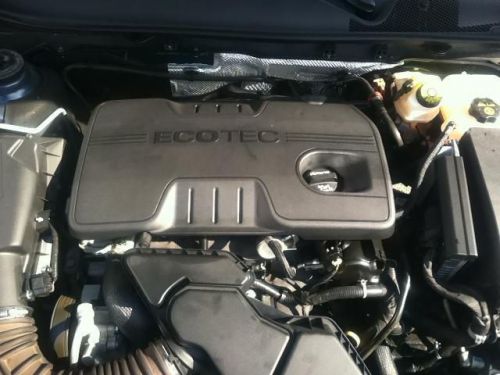

Engine:2.4L I4 16V GDI DOHC

Transmission:6-Speed Automatic

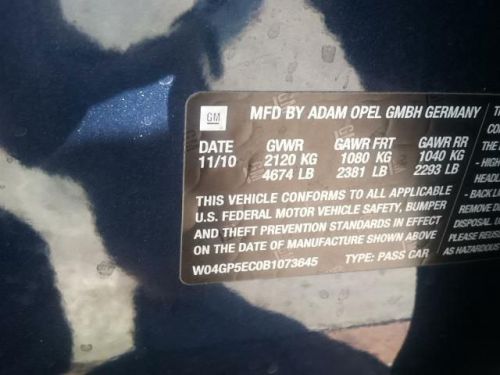

VIN (Vehicle Identification Number): W04GP5EC0B1073645

Stock Num: 1400293P

Make: Buick

Model: Regal CXL

Year: 2011

Exterior Color: Blue

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 39499

Drive this home today! Isn't it time for a Buick?! Tired of the same dull drive? Well change up things with this attractive-looking 2011 Buick Regal. Life is full of disappointments, but at least this great Buick Regal will always be there for you and never let you down. New Car Test Drive said, '...We found the Regal very quiet, with a very smooth ride, a welcome respite on miserable commutes and a good partner for cross-country drives. It may be the quietest car in its class. Mix in a solid thud to the doors, tactile clicks to the controls and a structure safe and secure, and the Regal is a well-rounded package...' Doing Business in the area for over 35 years. Call Greg Robertson for details on this vehicle. "Eastgate Chrysler Jeep Dodge Ram"

Buick Regal for Sale

2012 buick regal base(US $17,980.00)

2012 buick regal base(US $17,980.00) 2013 buick regal turbo - premium 1(US $21,980.00)

2013 buick regal turbo - premium 1(US $21,980.00) 2013 buick regal premium 2

2013 buick regal premium 2 2014 buick regal turbo/e-assist premium i(US $33,775.00)

2014 buick regal turbo/e-assist premium i(US $33,775.00) 2014 buick regal gs(US $41,020.00)

2014 buick regal gs(US $41,020.00) 2000 buick regal ls(US $5,990.00)

2000 buick regal ls(US $5,990.00)

Auto Services in Indiana

Zang`s Collision Consultants ★★★★★

Woody`s Hot Rodz ★★★★★

Wilson`s Auto Service ★★★★★

Vrabic Car Center ★★★★★

Vorderman Autobody ★★★★★

Voelz Body Shop Inc ★★★★★

Auto blog

Nissan Sentra, Buick LaCrosse to headline LA Auto Show

Wed, Oct 21 2015We're less than a month away from the start of the Los Angeles Auto Show, and automakers have been lining up their debuts for the upcoming left-coast expo. The latest announcement comes from the show's organizers who are eager to tout the global debuts slated for next month. Chief among them will be new versions of the Buick LaCrosse and Nissan Sentra. So far all we've seen of the 2017 LaCrosse is a glimpse at the front grille, but it's already promising to bring elements of the Avenir concept to the street. The original LaCrosse was launched in 2004 and was replaced in 2010 with the current model. The Sentra nameplate has been around much longer, but the current model was launched more recently in 2013. The new version spied recently while undergoing testing is promised to be a substantial update on that model, not a complete replacement, bringing it up to speed with the latest equipment and revised styling. This represents the first official confirmation we've received of when Nissan will be unveiling the new Sentra. Mitsubishi will also be on hand with its new Outlander Sport, as well as the redesigned Mirage. They'll be joined as well by new versions of a couple of high-end models that promise to resonate with the local crowds in tinseltown. Land Rover has chosen the LA show as a suitable venue to unveil the production Range Rover Evoque Convertible that will drop the top on one of the most stylish luxury crossovers on the market. And Porsche, as we know, is gearing up to hit the track with the new Cayman GT4 Clubsport - a customer racing version of the company's little two-seat, mid-engined sports car that's been lightly modified for motorsport competition. Of course these won't be the only new metal on display at the Californian auto expo. They'll be joined as well by the likes of the new Infiniti QX30, Hyundai Elantra, Kia Sportage, and Jaguar F-Pace - many of which we've already seen. Meanwhile companies like Fiat, Ford, Mazda, Mercedes, Subaru, Volvo, Volkswagen, and Elio Motors are keeping their plans under wraps for the time being. But with mere weeks to go, it won't be long before we see what they've got in store as well.

Buick luxury sedan design sketch would make a great flagship

Tue, Nov 29 2022Over the Thanksgiving holiday General Motors posted a sketch of a futuristic Buick sedan to social media. In fact, the sleek wedge is just the latest in a series of illustrations that seem to point the way to a luxury EV coming in 2024 (for model year 2025). That's when Buick has promised its first fully-electric vehicle, with the promise that the entire lineup will be gasoline free.      View this post on Instagram            A post shared by GM Design (@generalmotorsdesign) The sketch shows a low, long sedan that seems to be inspired (or perhaps served as the inspiration for) the Buick Wildcat concept revealed in June. However, there are significant differences as well. The sketch shows a profile that's more cab backward than the Wildcat's, with a gently sloping roofline that's more Audi A7 than the physical car's aggressive Nissan GT-R-like top. The front end is less busy than the Wildcat's as well, with the chrome better integrated into the fascia and headlights. Similar brightwork appears on the rocker panels and on the fenders behind the wheel arches, cues the Wildcat concept lacks. Buick's updated logo sits at the end of a sporty BMW-esque trough on the hood. Of course, the exaggerated wheels have such little clearance they wouldn't really be able move or turn, much less survive a pothole, but we can forgive that artistic liberty. Other recent sketches shown on the GM Design account on Instagram show a more refined version of the same sedan, but without the Wildcat's Honda CR-V-esque taillights. Another super-luxurious coupe with hints of Syd Mead looks just as beautiful but is unbranded and may work better as a Cadillac. The Buick brand feels a bit redundant these days, but stunning designs like these could help differentiate the brand. The General has plenty of trucks and SUVs already. If it's going to foist crossover after crossover at us, maybe the Buick division could stand out as the sedan-and-coupe-only brand. Related video:

Paul and Todd from Everyday Driver | Autoblog Podcast #477

Thu, May 26 2016Episode #477 of the Autoblog Podcast is here. This week, Dan Roth is joined by guests Paul Schmucker and Todd Deeken of Everyday Driver to talk cars, podcasting, and more. It's a freewheeling chat, and it all starts with the Autoblog Garage - check it out! Check out the rundown with times for topics, and thanks for listening! Autoblog Podcast #477 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics EveryDay Driver In The Autoblog Garage 2016 Buick Cascada Ford Mustang Boss 302 vs. Shelby GT350 Hosts: Dan Roth Guests: Paul Schmucker, Todd Deeken Total Duration: 01:08:20 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show in iTunes Podcasts Buick Ford buick cascada cascada