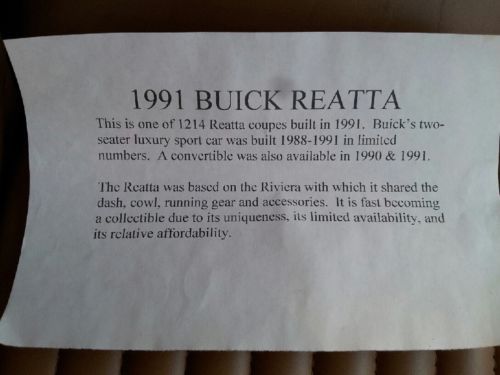

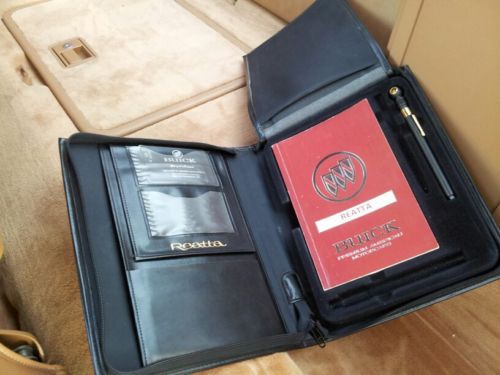

Sport Luxury Coupe Excellent Clean Clear Title Sun Roof Stereo Books Collectors on 2040-cars

San Antonio, Texas, United States

Buick Reatta for Sale

Buick reatta 1989-extraordinary condition-all records-drives beautifully(US $6,900.00)

Buick reatta 1989-extraordinary condition-all records-drives beautifully(US $6,900.00) (US $3,500.00)

(US $3,500.00) 1989 buick reatta base(US $991.00)

1989 buick reatta base(US $991.00) 1989 buick reatta base coupe 2-door 3.8l low miles(US $3,700.00)

1989 buick reatta base coupe 2-door 3.8l low miles(US $3,700.00) 1988 buick reatta coupe

1988 buick reatta coupe 1990 buick reatta base convertible 2-door 3.8l(US $8,000.00)

1990 buick reatta base convertible 2-door 3.8l(US $8,000.00)

Auto Services in Texas

Wynn`s Automotive Service ★★★★★

Westside Trim & Glass ★★★★★

Wash Me Car Salon ★★★★★

Vernon & Fletcher Automotive ★★★★★

Vehicle Inspections By Mogo ★★★★★

Two Brothers Auto Body ★★★★★

Auto blog

Buick Encore takes a hit of Mokka to tackle Dakar

Wed, 03 Sep 2014There are many vehicles we'd consider taking racing. Even on a cross-country rally as punishing as the Dakar. But a Buick Encore? That's not one that would enter our motorsports-based consciousness. Yet it's basically what General Motors is entering in the South American rally raid this year, and you're looking at it.

Unveiled at the Moscow Motor Show, this rally machine is based on (or at least billed as) an Opel Mokka - the name that GM's European brand applies to the vehicle Americans know as the Encore, Buick's subcompact crossover. Only it's obviously been extensively modified. It's got a ten-inch raised suspension, a 137-gallon fuel tank, carbon-fiber bodywork and... hold on, we're sure we're missing something here. Oh, right: a 6.2-liter V8 kicking out 340 horsepower and 487 pound-feet of torque to all four wheels through a six-speed sequential gearbox.

In other words, this is not the same Encore (or Mokka) you can pick up at your local Buick, Opel or Vauxhall dealership. It's not even close. It's not even recognizable as such, really. It was unveiled alongside a more sedate Opel Mokka Moscow Edition and a slew of other local debuts for the Opel brand that you can read more about in the (translated and original) Russian press release below.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM recalls over 230,000 more Trailblazer-family SUVs over door electronics

Sun, 16 Jun 2013Back in August, the National Highway Traffic Safety Administration announced a recall on the General Motors GMT360 SUVs (Buick Rainier, Chevrolet Trailblazer, GMC Envoy, Isuzu Ascender and Saab 9-7X) ranging from the 2005 to 2007 model years and the 2006 GMT370 SUVs (Chevrolet Trailblazer EXT and GMC Envoy XL) due to potential fires associated with the driver's door module. Initially limited to 250,000 units sold or registered in 20 Snow Belt states (and the District of Columbia), the recall has now been expanded to include an additional 193,000 of these SUVs in the US and, according to The Detroit News, 40,000 more sold outside the US, including Canada and Mexico.

Like the original recall, the issue is still a faulty driver's door module that can short out, which could lead to a fire. The Detroit News is reporting that, out of the 443,000 units being recalled, GM says that there were 58 fires that caused 11 minor injuries, and the expanded recall accounted for six fires and one injury. Despite the lower number of fires, the recall notice recommends that owners park their vehicles until the recall repairs has been performed.

On recalled units with functional modules, the repair consists of a protective coating being applied to the module, while vehicles with modules that are not working properly will have the driver's door module replaced. The official recall notice is posted below, and it includes contact information for customers of all five brands.