2008 Buick Lucerne Cxl on 2040-cars

Salt Lake City, Utah, United States

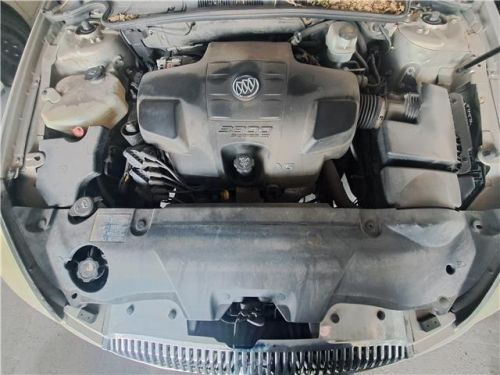

Engine:V6 Cylinder Engine

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1G4HD572X8U129925

Mileage: 0

Make: Buick

Trim: CXL

Drive Type: FWD

Horsepower Value: 197

Horsepower RPM: 5200

Net Torque Value: 227

Net Torque RPM: 3800

Style ID: 289149

Features: ENGINE, 3.8L V6 SFI

Power Options: Steering, power, rack-and-pinion

Exterior Color: Gold

Interior Color: --

Warranty: Unspecified

Model: Lucerne

Buick Lucerne for Sale

2010 buick lucerne(US $8,500.00)

2010 buick lucerne(US $8,500.00) 2008 buick lucerne cxl(US $1,025.00)

2008 buick lucerne cxl(US $1,025.00) 2008 buick lucerne(US $79.50)

2008 buick lucerne(US $79.50) 2007 buick lucerne cxl showroom clean affordable rare low mile family sedan(US $4,595.00)

2007 buick lucerne cxl showroom clean affordable rare low mile family sedan(US $4,595.00) 2008 buick lucerne(US $4,100.00)

2008 buick lucerne(US $4,100.00) 2008 buick lucerne no reserve v8 low miles leather look!!(US $1,666.00)

2008 buick lucerne no reserve v8 low miles leather look!!(US $1,666.00)

Auto Services in Utah

The Inspection Station ★★★★★

Stevens Electric Motor Shop ★★★★★

S & H Glass ★★★★★

Natural Solutions ★★★★★

Midas Auto Service Experts ★★★★★

Lone Peak Collision Repair ★★★★★

Auto blog

GM program sees dealers taking on way more loaner cars

Wed, Dec 17 2014Given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. Bring your car into the dealership for service, and you may need a loaner car in exchange. And with so many recalls being carried out, that means a lot of loaners – especially at General Motors dealerships. That could be one of the reasons why GM is massively expanding its loaner fleet program. While many Chevrolet and Buick-GMC dealerships have an on-site rental car location operated by a third party like Enterprise (which may or may not provide a GM vehicle), others manage their own loaner fleets. But while the range of dealerships operating such fleets was once small, reports Automotive News, the number has been growing rapidly: from the locations responsible for only 20 percent of those brands' sales two years ago to about 90 percent today. The impetus for that growth comes down to a massive expansion of GM's Courtesy Transportation Program. The initiative encourages dealers to ramp up their loaner fleet to a maximum size determined by GM, with a mix determined by the dealer itself, so that a showroom in Texas can be bolstered with a fleet of pickup trucks and a dealer in California can employ more Volt and Camaro Convertible loaners. The dealership gets a $500 credit for each vehicle its puts in its fleet, and can use those vehicles as loaners for service customers, as multi-day test drivers or to rent out separately. The vehicles remain in the dealer's fleet for 90 days or 7,500 miles, then they can be sold as used, but with new-car incentives. The dealer gets a fleet of loaners, customers get to use the loaners, try out a new car overnight or buy a barely used car with attractive incentives, and GM gets to clock more sales. But therein lies the kicker: the automaker counts the dispatch of the loaner new vehicle to the dealership as a new-car sale, which could end up distorting its sales figures. Counting loaner vehicles as sold vehicles is something of an industry-standard practice, but given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. One dealership - Paddock Chevrolet in Kenmore, NY, for example - had no loaner fleet two years ago, but now runs a fleet of 50 vehicles. Multiply that by the 4,000 or so dealers GM has across America and you're talking about the potential for hundreds of thousands of these sorts of sales.

Next Buick Regal to inherit styling cues from Opel Monza concept

Mon, 06 Oct 2014Ever look at a concept car from a foreign auto marque like Opel and wonder what relevance it will have to you as an American consumer? Well, we'll tell you: at least as far as the Opel Monza concept goes, it could mean a lot.

Speaking with Automotive News at the Paris Motor Show, Opel chief Karl-Thomas Neumann said, "You will see the Monza when you see the next Insignia." And the Insignia, we needn't point out, is essentially ported over to American showrooms as the Buick Regal.

The relationship between the Regal and Insignia only stands to grow closer as Opel design chief Mark Adams has also been charged with tightening the bonds between the two automakers positioned on opposite shores of the Atlantic. Adams also intends to imbue the next Insignia with more "premium brand values" in order to "add polish to the brand." Which in turn means that the Regal will be designed to look more upscale, too.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.