2014 Buick Lacrosse Leather Group on 2040-cars

6000 S 36th St, Fort Smith, Arkansas, United States

Engine:2.4L I4 16V GDI DOHC Hybrid

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1G4GB5GR9EF269205

Stock Num: 14503

Make: Buick

Model: LaCrosse Leather Group

Year: 2014

Exterior Color: White Diamond Tri-Coat

Interior Color: Light Neutral

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 12

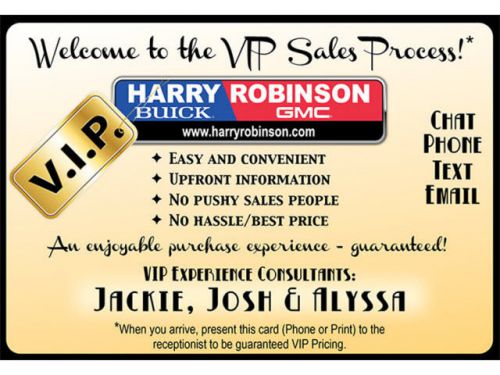

Shopping with the VIP department gives you VIP Pricing! Haggle-free pricing means a pleasant experience for all of us. Call/text 888-231-6584 to speak with Jackie, Alyssa, James or Jon. We price low and fair, allowing us to focus on your needs. Shopping with the VIP department gives you VIP Pricing! Haggle-free pricing means a pleasant experience for all of us. Call/text 888-231-6584 to speak with Jackie, Alyssa, James or Jon. We price low and fair, allowing us to focus on your needs. June Rebates: $1500 off Acadia and Enclave, $1000 off 14 Lacrosse and 14 Regal. Huge discounts on all trucks! 2015 Yukons and 2500's in stock.

Buick Lacrosse for Sale

2014 buick lacrosse leather group(US $39,295.00)

2014 buick lacrosse leather group(US $39,295.00) 2014 buick lacrosse premium i group(US $44,745.00)

2014 buick lacrosse premium i group(US $44,745.00) 2014 buick lacrosse premium i group(US $41,950.00)

2014 buick lacrosse premium i group(US $41,950.00) 2014 buick lacrosse leather group(US $43,615.00)

2014 buick lacrosse leather group(US $43,615.00) 2010 buick lacrosse cxs(US $22,875.00)

2010 buick lacrosse cxs(US $22,875.00) 2010 buick lacrosse cxs(US $22,250.00)

2010 buick lacrosse cxs(US $22,250.00)

Auto Services in Arkansas

Roberts Brothers Tire Service ★★★★★

Precision Automotive ★★★★★

Money Tree ★★★★★

Meineke Car Care Center ★★★★★

Marks Auto Repair ★★★★★

Hodges Wrecker Service ★★★★★

Auto blog

Is this GM's next electric crossover?

Thu, Nov 16 2017GM made headlines this week when CEO Mary Barra presented the company's electrification and automation plans at the Barclays Global Automotive Conference in New York. "We are committed to a future electric vehicle portfolio that will be profitable," Barra said, which could be taken as a jab at Tesla. In the presentation ( PDF here), though, we see a new vehicle in a slide titled "Leveraging existing BEV platform to expand in near term." The vehicle, seen above, accompanied the captions "New CUV entries" and "two entries by 2020." Is this a sneak preview of an upcoming electric crossover from GM? The image seems too realistic and intentional to be a random placeholder. If this is, indeed, an upcoming battery-electric CUV based on the Bolt, the question remains: Will it be a Chevy or a Buick? It has no visible badging, but it shares DNA from both brands. As Inside EVs points out, though, it does bear a resemblance to the Chevrolet FNR-X concept unveiled in Shanghai earlier this year. With two CUVs on the way, it's not unthinkable that there could be a version for each brand. In addition to this slide, the presentation includes plans for an "All new multi-brand, multi-segment platform" launching in 2021. The all-new modular battery system will cost less than $100 per kWh, providing higher energy density and faster charging. The platform will host at least nine different vehicles, including a compact crossover, seven-seat luxury SUV and a large commercial van. GM has said it will launch 20 new EVs by 2023, and that it targets 1 million EV sales per year by 2026. Many of those sales will be in China. Related Video:

2013 Buick Encore

Wed, 14 Aug 2013Ignored On Arrival, But Coming On Strong

An image exists out there that perfectly conveys the fate we thought would befall the Buick Encore after its world debut at the 2012 Detroit Auto Show. The shot shows the just-unveiled Encore on stage, basking in the glow of spotlights but surrounded by a large display area that's bereft of both cars and people. Two journalists are sitting on a couch over to the side, both facing the Encore but ignoring it as they inspect their swag, and a solitary custodial engineer pushes a vacuum back and forth across a sea of gray carpet.

Like a kid with his birthday cake at a party no one came to, this little crossover's debut was largely, almost cruelly, ignored. Who can blame us, though? Two shows ago, the Motor City's main stage welcomed the redesigned Aston Martin-esque Ford Fusion, the 3 Series-assassin ATS from Cadillac and the return of Dodge to the small car game with the Dart. A fourth model for the wayward Buick brand, especially one so arguably un-Buick in form and function, did not seem to deserve the attention paid to its peers that year.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.