1991 Buick Rivera, No Reserve on 2040-cars

Palmdale, California, United States

Body Type:Coupe

Engine:6

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Buick

Model: Riviera

Trim: COUPE

Warranty: Vehicle does NOT have an existing warranty

Drive Type: UNKNOWN

Options: Leather Seats

Mileage: 76,594

Power Options: Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: White

Interior Color: Tan

NO RESERVE THIS CLASSIC 1991 BUICK RIVIERA LOW MILEAGES ONLY 76,000 RUNS GREAT TRASMISSION SHIFT OK GOOD TIRES 70% LIFE LEATHER SEAT IN GOOD CONDITION ONLY NEED TO FIX THE CEILING AUTOCHECK VEHICLE HISTORY REPORT SHOW 28% NO ACCIDENTS NO TITLE PROBLEM IF YOU NEED THE REPORT IS AVAILABLE AT YOUR REQUEST

Buick Enclave for Sale

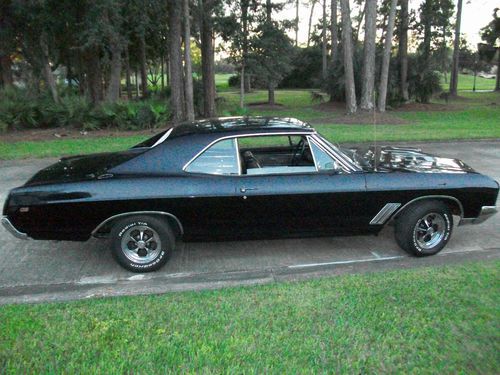

No reserve real 1966 buick skylark gs

No reserve real 1966 buick skylark gs ~~no reserve 1995 buick regal gran sport coupe~~

~~no reserve 1995 buick regal gran sport coupe~~ We finance!!! cxl suv 3.6l leather heated seats alloy wheels clean carfax

We finance!!! cxl suv 3.6l leather heated seats alloy wheels clean carfax 1968 buick skylark sedan

1968 buick skylark sedan 1996 buick roadmaster wagon lt1 1 owner 16 years, cheap delivery, low miles

1996 buick roadmaster wagon lt1 1 owner 16 years, cheap delivery, low miles 96 factory wood delete station 5.7l v8 tow pack posi 79k mi az car no reserve

96 factory wood delete station 5.7l v8 tow pack posi 79k mi az car no reserve

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

2016 Buick Cascada First Drive

Wed, Jan 27 2016Florida became a state in 1845. It is the third most populous state in the United States, home to the most-visited theme park in the world. It is where you'll find every convertible ever sold in the United States, be it a pasty white Infiniti M30 or a Lamborghini. And soon, many examples of the 2016 Buick Cascada will call it home. Florida is full of Buicks. Wonder if anyone bought a Rendezvous Ultra? It's in Florida. The Buick Reatta, the company's last convertible before this? Also there. Buick, however, is eager to get those who better remember Bush vs. Gore than Nixon vs. Kennedy to ask, "That's a Buick?" Which is how we arrive at the Cascada. The Cascada isn't so much a new Buick as a car that's new to Buick. It's been on sale for about three years as the Opel Cascada in Europe, along with badge-engineered siblings sold by Vauxhall and Holden in other parts of the world. Buick took that time to make several hundred changes to the Cascada for US consumption and then found it without many rivals. The Chrysler 200 convertible, Volkswagen Eos, and Volvo C70 would all be prime targets for the Cascada here, were they not all dead now. Buick's gamble is that these Chrysler, VW, and Volvo (also Saab, for that matter) customers are looking for somewhere to go next. The Cascada isn't so much a new Buick as a car that's new to Buick. One thing is certain: the Cascada is eye-catching to Floridians. I had no fewer than six people in Miami and Key West walk up to me and ask what kind of car it was, or even say, "That's that new Buick convertible, right?" Despite being three years old, the Cascada's looks have aged pretty well. And it's been spared many of the tacked-on details, like fake portholes and chrome wheels, that were adhered to the Regal when it made its trip over from Opel-land. Top up or down, the Cascada is attractive. Unlike the Audi A3 or BMW 2 Series convertibles (the former being the Buick's prime target), there's no abruptness to the design, no sharply ending lines. The Buick looks relaxed in a Palm Beach or Palm Springs way, even on the inside with the convincingly stitched dash top and standard heated leather seats (one of the pieces redesigned for the Buick). That being said, the pattern on the seat material is a misstep, looking like it was inspired by Aunt Flora's 1972 patio furniture. Then it's surprising that you don't exactly sink into the Cascada. While the seats are mounted low, they're not pillow soft.

2020 Buick Encore GX First Drive | Bringing serenity to the subcompact market

Mon, Aug 24 2020With Buick seeing sales success in our crossover-crazed world, itís no wonder the company is adding to its crossover lineup with the 2020 Buick Encore GX. It sits just above the existing Encore, and it offers more space and new turbocharged engines for just a bit more money. In fact, as it starts at just $900 more than the existing Encore and offers more power, space and fuel economy, it¬ís unquestionably the Encore version to get when heading to your Buick dealer. But compared with other crossovers, the Buick¬ís only real advantage is in its quietness, refined powertrain and upmarket badge. Otherwise it's a fine but unexceptional crossover. Powering the Encore GX is your choice of small turbocharged three-cylinder engines. The standard engine, available with every trim, is a 1.2-liter unit making 137 horsepower and 162 pound-feet of torque. It¬ís only able to be paired with a CVT and front-wheel drive. It¬ís also not the most efficient powertrain offering, returning 28 mpg in town, 31 on the highway, and 29 combined. The optional engine, available only on the upper two trims Select and Essence, is a 1.3-liter example making 155 horsepower and 174 pound-feet of torque. This engine can be paired with a CVT and front-wheel drive, or a nine-speed automatic transmission with all-wheel-drive. Also, because of efficiency boosters such as an offset crankshaft, electric oil pump, electric brake booster and electric turbo wastegate, it¬ís the most efficient choice. With the CVT and front-wheel drive, the Encore GX manages 30 mpg in the city, 32 on the highway, and 31 combined. The all-wheel-drive version only gets 26 mpg in town, 29 on the highway and 28 combined. Our test car was an Encore GX with the 1.3-liter engine and the CVT, and on paper, it¬ís the engine to go with. It¬ís more power with less fuel use. And while it¬ís not the most powerful car in its segment, its torque is accessible throughout the rev band, so it never feels slow. Buick has done an excellent job keeping the engine quiet, either through powertrain refinement or through extensive sound deadening. You¬íll never hear more than a faint growl from under the hood. The CVT is absolutely the transmission to choose, too. It¬ís amazingly smooth and unobtrusive. The revs are always kept low and there¬ís just enough variance in them that it doesn¬ít feel like a rubber band. It responds fast to your right foot, too, so you aren¬ít waiting for more rpm when needing to accelerate faster.

The last Buick Cascada unceremoniously rolls off the assembly line

Mon, Oct 7 2019Motorists in the market for a new Buick Cascada need to act fast. Peugeot-owned Opel has built the last example of the drop-top model in its Gliwice, Poland, factory, and there's no replacement in sight. Buick announced the Cascada's demise in early 2019, and GM Authority learned the model went out unceremoniously. There's no indication that the final example received a commemorative plaque on its dashboard, or is headed to a private collection; photos of it aren't even available. The dealership who ordered it might not know it's about to receive the last specimen of the breed. As a non-luxury, front-wheel-drive convertible, the Cascada was marooned on an island that Buick's rivals abandoned halfway through the 2010s. The Chrysler 200 Convertible and the Volkswagen Eos were discontinued after the 2014 and 2015 model years, respectively. Landing in a class of one likely raised more than a few eyebrows in Buick's product planning division, but it was a semi-enviable position that helped the firm sell about 17,000 units of the Cascada between the 2016 and 2019 model years. It proudly pointed out about 60 percent of buyers were new to General Motors. Left-hand-drive examples of the Cascada were sold under the Buick and Opel banners. Right-hand-drive models joined the Vauxhall range in the United Kingdom, and they wore a Holden emblem in Australia. The four flavors were identical with the exception of some brand-specific trim pieces and powertrains. None will get a successor; the aforementioned carmakers are no longer operating under the same roof, and the global convertible segment is steadily shrinking.  The Cascada's multinational provenance made more sense before General Motors sold its Opel and Vauxhall divisions to PSA Groupe, the Paris-based carmaker that owns Peugeot, Citroen and DS. The French firm pledged to keep producing cars for Buick for as long as necessary, but the former sister companies tacitly agreed to stop co-developing vehicles. The sedan and station wagon variants of the Regal are now the only Opel-designed, PSA-built model left in the the Buick portfolio.