Simply Amazing Just 35,025 Miles 1977 Buick Electra 225 Landau Loaded Original. on 2040-cars

Lakeland, Florida, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:403 V-8

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Make: Buick

Model: Electra

Trim: Coupe

Drive Type: Rear Wheel Drive

Mileage: 35,052

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: Red

Stock #: 19308

Interior Color: White

Sub Model: NO RESERVE

Buick Electra for Sale

Auto Services in Florida

Wildwood Tire Co. ★★★★★

Wholesale Performance Transmission Inc ★★★★★

Wally`s Garage ★★★★★

Universal Body Co ★★★★★

Tony On Wheels Inc ★★★★★

Tom`s Upholstery ★★★★★

Auto blog

Third 1987 Buick Regal GNX will be auctioned in January

Mon, Nov 13 2017A member of the 1987 Buick press fleet is hitting the auction block next year and it's a rarified gem: a low-mileage Regal Grand National GNX, serial No. 003 and one of just 547 models built for that year, and the last of the traditional body-on-frame, rear-wheel-drive Grand Nationals. It'll be auctioned at the Barrett-Jackson Scottsdale Auction in January. The GNX No. 003 was loaned out to publications including Autoweek, Motor Trend and Road & Track, where it racked up around 8,200 miles. "Through it all, a constant sad undertone was the understanding that 1987 was to be the final appearance of the traditional body-on-frame, rear-wheel-drive G-body (which also underpinned the best-selling Chevy Monte Carlo, Pontiac Grand Prix and Olds Cutlass)," reads a the description published on Barrett-Jackson's website. "A totally redesigned W-body Somerset Regal, with front-wheel drive and unitized body construction, was slated to replace the popular midsize Buick in 1988." So Buick opted to make "a Grand National to end all Grand Nationals" with the '87 GNX, partnering with ASC/McLaren to equip them with wheel lip flares, fender vents, 16-by-8-inch BBS rims and more aggressive tires. It left untouched the Grand National's standard Sequential Electronic Fuel Injection 3.8-liter V6 but added a larger Garrett T-3 turbocharger with a ceramic impeller, a larger intercooler, more aggressive fuel, spark and waste gate tables, and a dual exhaust system that boosted output from 235 horsepower and 330 foot-pounds of torque to 276 hp and 360 lb-ft. That was enough, Barrett-Jackson reports, to make the performance coupe quicker and faster in quarter-mile tests than the Ferrari F40 and Porsche 930 Turbo. After making the test-drive rounds in the automotive media, the car sold in 1988 as a brass hat/company official car to Fischer Buick in Troy, Mich. with approximately 8,200 miles on it. From there, it quickly sold to a local resident who drove it very little, and sold it in the spring of 1989. Since 1992, it has reportedly been kept in climate-controlled storage, totally original, unmodified and undamaged, with just 10,790 miles on the odometer today. It recently underwent a complete mechanical service and cosmetic reconditioning. You can check out the listing on Barrett-Jackson here. The first '87 GNX ever produced resides in the General Motors Heritage Collection and No. 002 is at the Sloan Museum in Flint, Mich. Interestingly, another '87 GNX, No.

Opel did a great job on the 2018 Buick Regal

Wed, Dec 7 2016Ladies and gentlemen, the 2018 Buick Regal. The car you see is actually the Opel Insignia Grand Sport, but General Motors will bring it to the United States as the next-generation Regal virtually unchanged. The Insignia, revealed Wednesday by Opel, gets a sleek new design punched up with LED lights and sweeping proportions meant to conjure a fastback silhouette. It will debut in March at the Geneva Motor Show and launch next year in Europe. Expect the Regal to go on sale in the middle of 2017 in the US. The Opel-Buick relationship has been tight in the last decade, with the outgoing Regal earning strong praise for its German-tuned chassis and premium appearance. While Buick has been the recipient of much of Opel's work, the Insignia is now borrowing one of Buick's great names: Grand Sport. View 12 Photos Opel points to the Monza concept as the source of inspiration for the Insignia, though Buick will undoubtedly say the Avenir concept was the Regal's creative stimulus. Some think it looks like a Mazda. Mark Adams, vice president of GM Design Europe also oversees the automaker's global styling operations. "Its design combines flowing lines and subtle surfaces with crisp, precise lines to even exaggerate its dramatic proportions: it looks longer, lower, and wider than it actually is, and it definitely looks upscale," he said in statement. Expect similar thoughts for the Regal. Opel is also working on an Insignia wagon, which we've captured in spy photos before. We've also heard whispers that it will come to the US market with a Regal badge. Opel's announcement previews many of the details we'll see in the new Regal. Based on a new chassis, the Insignia is 386 pounds lighter than the previous car. The wheelbase is 3.62 inches longer and the track is .43 inches wider. Opel tapered the front and rear overhangs, so there's only a slight gain in overall length. The interior has more room, Opel says, and features a touchscreen with GM's IntelliLink system. The car will also have several drive modes, which tailor the chassis, throttle response, and shifting dynamics. Other technologies includes a head-up display, 360-degree camera, lane-keeping assist, adaptive cruise control, and cross-traffic alert. The Insignia will offer an eight-speed automatic transmission and all-wheel drive with torque-vectoring. We expect both to come to the US market. Meanwhile, another GM brand, Vauxhall, unveiled the Vauxhall Insignia for the British market.

GM reportedly developing 2.5-liter turbo four-cylinder

Mon, May 15 2023General Motors is allocating a massive amount of resources to developing electric technology, but it's not forgetting about the gasoline-powered cars that make up the bulk of its sales. It's reportedly designing a new 2.5-liter turbocharged four-cylinder engine based on its 2.7. Citing "sources familiar with the matter," enthusiast website GM Authority wrote that the 2.5-liter four is "in [the] final stages of development," meaning it should be announced sooner rather than later (assuming the report is accurate). Technical details are few and far between as of writing. The publication learned that the 2.5 will be part of the Cylinder Set Strategy (CSS) family of engines and that it will be mechanically related to the 2.7-liter currently found in the Chevrolet Silverado 1500, among several other models. It will feature dual overhead camshafts. It's too early to tell which models the 2.5-liter four-cylinder will end up in, or how much power it will generate. The output will likely depend on the application. For context, the 2.7 delivers 310 horsepower at 5,600 rpm and 348 pound-feet of torque between 1,500 and 4,000 rpm in the Silverado. In the smaller Colorado, it provides anywhere between 237 and 310 horsepower depending on the trim level selected. While this is pure speculation, our crystal ball tells us the engine will end up powering crossovers. It's an easy deduction to make. We can't imagine it will be offered in the Silverado, and seeing it in the Colorado is unlikely because its entry-level engine develops 237 horsepower; there's likely not much of a market for a midsize truck with 200 or so horsepower. Putting it in the Corvette wouldn't make sense and the Camaro has nearly reached the end of its life cycle without a successor planned. This leaves us with Chevrolet's range of crossovers, like the Equinox, as well as their GMC-, Buick-, and Cadillac-branded counterparts. We're not discounting the possibility that the cars set to receive the 2.5 haven't been unveiled, but those are likely crossovers, too; the odds of seeing another big Chevy sedan are very, very low. General Motors hasn't commented on the report, and it hasn't publicly announced plans to expand its CSS family of engines. If the report is accurate, we should learn more about the new turbocharged, 2.5-liter four-cylinder engine in the not-too-distant future. Featured Gallery 2022 Chevrolet Equinox RS View 56 Photos Buick Chevrolet GM GMC

1970 buick electra 225 custom-formerly owned by broadway star carol channing!!!!

1970 buick electra 225 custom-formerly owned by broadway star carol channing!!!! 1966 buick electra convertible

1966 buick electra convertible 1985 buick electra estate wagon wagon 4-door 5.0l

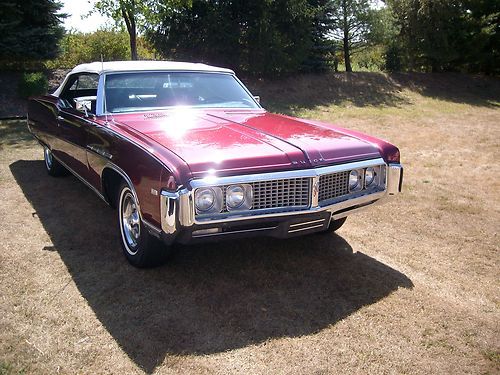

1985 buick electra estate wagon wagon 4-door 5.0l 1969 buick electra 225 convertible

1969 buick electra 225 convertible 1970 buick electra.

1970 buick electra. 1984 buick electra limited arizona original only 40375 miles

1984 buick electra limited arizona original only 40375 miles