1967 Buick Electra 225 Convertible Excellent Parts Car on 2040-cars

Sanford, Maine, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:V-8

Fuel Type:Gasoline

For Sale By:Dealer

Year: 1967

Make: Buick

Model: Electra

Trim: CONVERTIBLE

Options: Convertible

Power Options: Power Windows, Power Seats

Drive Type: RWD

Mileage: 93,607

Exterior Color: Black

Disability Equipped: No

Interior Color: Burgundy

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 8

|

THIS IS A NO RESERVE AUCTION |

Buick Electra for Sale

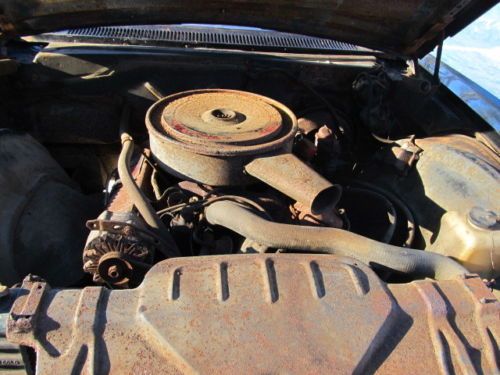

1967 buick electra 225 convertible project car, rusty but very restorable

1967 buick electra 225 convertible project car, rusty but very restorable 1962 buick electra convertible 225 401 cu. in. nailhead w 445 ft lbs of torque

1962 buick electra convertible 225 401 cu. in. nailhead w 445 ft lbs of torque 1976 buick electra limited coupe 2-door 7.5l

1976 buick electra limited coupe 2-door 7.5l 1960 buick electra base sedan 4-door 6.6l

1960 buick electra base sedan 4-door 6.6l 1973 buick electra like brand new!!!!!

1973 buick electra like brand new!!!!! Nice low mileage buick electra 225 convertible with 47300 miles 455 motor

Nice low mileage buick electra 225 convertible with 47300 miles 455 motor

Auto Services in Maine

Weller Truck Parts Inc ★★★★★

Victory Lane Quick Oil Change ★★★★★

Romulus Auto Supply II ★★★★★

Portland Glass Co ★★★★★

Jack Ray`s Auto Mart ★★★★★

Henson`s Auto Repair ★★★★★

Auto blog

We really want to use an eCrate to restomod an old GM car. Here's what we'd build

Fri, Oct 30 2020You hopefully saw the news today of GM's introduction of its Connect and Cruise eCrate motor and battery package, which effectively makes the Bolt's electric motor, battery pack and myriad other elements available to, ah, bolt into a different vehicle. It's the same concept as installing a gasoline-powered crate motor into a classic car, but with electricity and stuff. This, of course, got us thinking about what we'd stuff the eCrate into. Before we got too ahead of ourselves, however, we discovered that the eCrate battery pack is literally the Bolt EV pack in not only capacity but size and shape. In other words, you need to have enough space in the vehicle to place and/or stuff roughly 60% of a Chevy Bolt's length. It's not a big car, but that's still an awful lot of real estate. There's a reason GM chose to simply plop the pack into the bed and cargo area of old full-size SUVs. Well that, and having a rear suspension beefy enough to handle about 1,000 pounds of batteries. So after that buzz kill, we still wanted to peruse the GM back catalog for classics we'd love to see transformed into an electric restomod that might be able to swallow all that battery ... maybe ... possibly ... whatever, saws and blow torches exist for a reason. 1971 Buick Riviera Consumer Editor Jeremy Korzeniewski: If you’re going to build an electric conversion, why not do it with style? ThatÂ’s why IÂ’m choosing a 1971-1973 Buick Riviera. You know, the one with the big glass boat-tail rear end that ends in a pointy V. Being a rather large vehicle with a big sloping fastback shape, IÂ’m hoping thereÂ’s enough room in the trunk and back seat to pack in the requisite battery pack. That would likely require cutting away some of the metal bulkhead that supports the rear seatback, but not so much that a wee bit of structural bracing couldnÂ’t shore things up. The big 455-cubic-inch Buick V8 up front will obviously have to go. Remember, this was the 1970s, so despite all that displacement, the Riviera only had around 250 horsepower (depending on the year and the trim level). So the electric motorÂ’s 200 horsepower and 266 pound-feet of torque ought to work as an acceptable replacement.  1982 Chevrolet S10 Associate Editor Byron Hurd: OK, so the name "E-10" is already taken by a completely different truck, but let's not let labels get in the way of a fun idea.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

GM program sees dealers taking on way more loaner cars

Wed, Dec 17 2014Given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. Bring your car into the dealership for service, and you may need a loaner car in exchange. And with so many recalls being carried out, that means a lot of loaners – especially at General Motors dealerships. That could be one of the reasons why GM is massively expanding its loaner fleet program. While many Chevrolet and Buick-GMC dealerships have an on-site rental car location operated by a third party like Enterprise (which may or may not provide a GM vehicle), others manage their own loaner fleets. But while the range of dealerships operating such fleets was once small, reports Automotive News, the number has been growing rapidly: from the locations responsible for only 20 percent of those brands' sales two years ago to about 90 percent today. The impetus for that growth comes down to a massive expansion of GM's Courtesy Transportation Program. The initiative encourages dealers to ramp up their loaner fleet to a maximum size determined by GM, with a mix determined by the dealer itself, so that a showroom in Texas can be bolstered with a fleet of pickup trucks and a dealer in California can employ more Volt and Camaro Convertible loaners. The dealership gets a $500 credit for each vehicle its puts in its fleet, and can use those vehicles as loaners for service customers, as multi-day test drivers or to rent out separately. The vehicles remain in the dealer's fleet for 90 days or 7,500 miles, then they can be sold as used, but with new-car incentives. The dealer gets a fleet of loaners, customers get to use the loaners, try out a new car overnight or buy a barely used car with attractive incentives, and GM gets to clock more sales. But therein lies the kicker: the automaker counts the dispatch of the loaner new vehicle to the dealership as a new-car sale, which could end up distorting its sales figures. Counting loaner vehicles as sold vehicles is something of an industry-standard practice, but given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. One dealership - Paddock Chevrolet in Kenmore, NY, for example - had no loaner fleet two years ago, but now runs a fleet of 50 vehicles. Multiply that by the 4,000 or so dealers GM has across America and you're talking about the potential for hundreds of thousands of these sorts of sales.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.035 s, 7949 u