Navigation Push Button Start Bluetooth Cd Player Leather Off Lease Only on 2040-cars

Lake Worth, Florida, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:4.3L 4282CC 261Cu. In. V8 GAS DOHC Naturally Aspirated

Body Type:Hatchback

Fuel Type:GAS

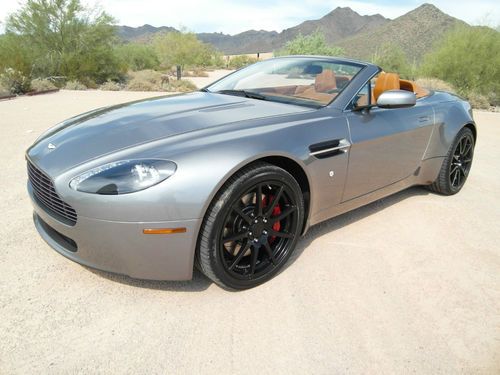

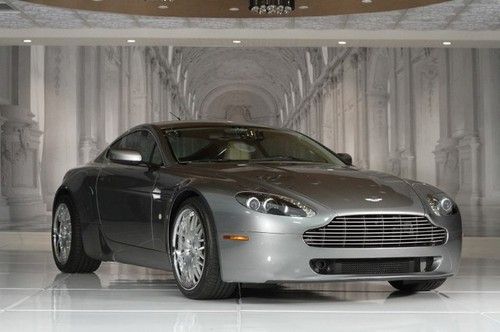

Make: Aston Martin

Model: V8 Vantage

Trim: Base Hatchback 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 41,349

Number of Doors: 2

Sub Model: Stk# 54313

Exterior Color: Gray

Number of Cylinders: 8

Interior Color: Black

Aston Martin Vantage for Sale

2010 aston martin vantage 14k miles*navigation*park assist*1owner clean carfax(US $83,973.00)

2010 aston martin vantage 14k miles*navigation*park assist*1owner clean carfax(US $83,973.00) 2009 aston martin v8 vantage coupe(US $65,500.00)

2009 aston martin v8 vantage coupe(US $65,500.00) 2008 aston martin vantage convertible only 15k miles, perfect condition!

2008 aston martin vantage convertible only 15k miles, perfect condition! 2007 aston martin vantage 6spd cpe, am green/tan, clean(US $72,999.00)

2007 aston martin vantage 6spd cpe, am green/tan, clean(US $72,999.00) 2008 aston martin(US $77,988.00)

2008 aston martin(US $77,988.00) 2007 aston martin(US $58,999.00)

2007 aston martin(US $58,999.00)

Auto Services in Florida

Zip Automotive ★★★★★

X-Lent Auto Body, Inc. ★★★★★

Wilde Jaguar of Sarasota ★★★★★

Wheeler Power Products ★★★★★

Westland Motors R C P Inc ★★★★★

West Coast Collision Center ★★★★★

Auto blog

Weekly Recap: Marchionne's Manifesto again calls for industry consolidation

Sat, May 2 2015Sergio Marchionne isn't taking no for an answer. Despite public rebuffs from General Motors and Ford, the leader of Fiat Chrysler Automobiles continues to push for consolidation within the auto industry. His latest assertion came Wednesday when he said a combination of FCA with another automaker could net savings of $5 billion or more annually. No, this isn't about selling his company, he claimed, it's about cutting costs. Put simply, the auto industry wastes money, Marchionne said during FCA's earnings conference call. Companies invest billions to develop basic components that all cars use, but many consumers don't care how they work or recognize the differences. "About half of this is really relevant in terms of positioning the car in the marketplace," he said. "The other half, in our view, is stuff which is neither visible to the consumer nor is it relevant to the consumer." In 2014, top automakers spent more than $100 million on product development, FCA estimated. Marchionne said consolidation could save up to $1 billion on powertrains alone, noting that almost every automaker offers four- and six-cylinder engines. Not everyone has to make their own, he contended. "The consumer could not give a flying leap whose engines we are using because they are irrelevant to the buying decision." That's pretty provocative for enthusiasts, but less so for average consumers. Still, there are major differences in power and efficiency ratings, even among similar engines. Skeptics could argue consolidation would also weaken competition and reduce choices for car buyers. Marchionne stressed his presentation, curiously entitled Confessions of a Capital Junkie, wouldn't require closing factories or dealerships. It's not his final "big deal" as CEO, intent to sell FCA, or a way to elevate his company up the automotive food chain. He claims he wants to fundamentally change the industry and its habit for burning cash. "The horrible part about this, and the thing that I find most offensive, is that the capital consumption rate is duplicative," he said. "It doesn't deliver real value to the consumer and it is in its purest form, economic waste." Other News & Notes Ford Profits dip in first quarter Ford profits fell $65 million to $924 million in the first quarter, hampered by slight dips in revenue and sales.

Fisker sues Aston Martin for $100M over The Force 1

Wed, Jan 6 2016We were expecting Henrik Fisker to bring The Force 1, his next vehicle design, to next week's Detroit Auto Show, but that might not happen. In December an attorney for Aston Martin sent Fisker a letter asking the Danish designer to either not show his car in Detroit or to change the design. Fisker responded to that letter by filing $100-million civil extortion lawsuit against Aston Martin in a California Federal court, naming company CEO Andy Palmer, chief spokesman Simon Sproule, and chief creative officer Marek Reichman as defendants. Based on the overhead-view sketch, the English carmaker believes that The Force 1 is "strikingly similar to several of Aston Martin's cars, including the DB10" from the movie Spectre. At the same time the carmaker's letter to Fisker admitted that it doesn't know what the final design will look like, but it appears that the carmaker's intent to "protect its valuable rights if necessary" could not make way for patience. Or perhaps Aston Martin is trying to prevent another Thunderbolt episode before it starts. That incident last year involved the carmaker suing Fisker over his reimagined Vanquish, with the two settling the matter out of court. Fisker says The Force 1 has isn't based on an Aston Martin, and as part of the lawsuit submitted a design breakdown of both the DB10 and The Force 1. Fisker's latest is apparently in partnership with VL Automotive, the company that's been threatening to release a V8-powered Karma sedan for years now, and the Detroit show organizers say they've been working with VL, not Fisker. The lawsuit seeks the $100 million for punitive and compensatory damages and court costs, alleging that Aston Martin's actions "would subject [Fisker] to public humiliation, embarrassment in the industry, and significant financial losses." The public allegations go even further, Fisker's lawyer Jonathan Michaels saying that the English brand, "In an effort to protect itself from further market erosion... conspired and devised a scheme to stomp out Henrik Fisker's competitive presence in the luxury sports car industry." News Source: Wall Street Journal Design/Style Government/Legal Detroit Auto Show Aston Martin Fisker Coupe Luxury Performance lawsuit Henrik Fisker spectre aston martin db10

Bond, junk bond? Aston Martin financial ratings go south as it awaits DBX

Sat, Sep 28 2019Ratings agencies Standard & Poor's and Moody's have taken a dim view of Aston Martin Lagonda. S&P cut its credit rating on the storied carmaker deeper into junk territory this week, and Moody's revised its credit outlook to "negative" after the company raised $150 million in debt from a bond issue at 12% interest, with the option to raise another $100 million at 15%. The Standard & Poor's rating was trimmed by one notch to 'CCC+', which reflects substantial risks and takes it close to default territory after a faster-than-expected cash burn this year. The outlook is negative. The negative outlook reflects ongoing pressure on profits, a high cash burn, and very high leverage in the face of heightened risks linked to a potential no-deal Brexit and new tariffs on car imports threatened by the United States. The potential salvation for the company is its new DBX luxury SUV, the success of which is critical to its ambitious growth strategy and ongoing creditworthiness, S&P said. But Moody's noted that it's burning cash at a high rate as it nears the launch of the DBX. The British carmaker, known as James Bond's favorite marque, has been hit by falling demand in Europe, the Middle East and Africa. It slumped to a first-half loss in July. Chief Executive Andy Palmer said concerns around Brexit and U.S.-China trade relations were skewing the outlook to the downside, so it was prudent to address investor concerns about its balance sheet. "Taking this debt on — short-term debt — is we think the correct tool to completely remove that thesis that we don't have sufficient liquidity," he told Reuters. "In every substantial and material way, this ensures that we can get through to DBX in spite of what all of those global uncertainties might throw at us." The main tranche comprises notes with an interest rate of 12% due in 2022, while the additional notes could be issued under the same terms if permitted, or could be issued as unsecured notes with an interest rate of 15%, Aston Martin said. Shares of stock in the company, which have had a precipitous fall since they listed in London in October 2018 at 19 pounds, were trading down 5% at 545 pence in early deals. Broker AJ Bell said Aston Martin was known for its high end prices and that situation now also applied to its debt. "These rates are very high and are a major red flag that investors consider the car company to be a high risk entity," it said.