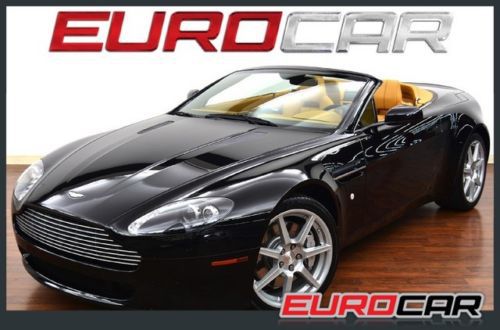

Aston Martin Vantage, Sport Shift, Highly Optioned, Immaculate Condition on 2040-cars

Costa Mesa, California, United States

Aston Martin Vantage for Sale

Msrp $197k v12 vantage cabon black edition nav only 6k miles(US $148,900.00)

Msrp $197k v12 vantage cabon black edition nav only 6k miles(US $148,900.00) 2014 aston martin vantage coupe' rare color combination(US $144,300.00)

2014 aston martin vantage coupe' rare color combination(US $144,300.00) 2007 aston martin vantage convertible. f1. loaded. $142k msrp.gorgeous color.(US $72,898.00)

2007 aston martin vantage convertible. f1. loaded. $142k msrp.gorgeous color.(US $72,898.00) 2007 aston martin v8 vantage

2007 aston martin v8 vantage 12 morning frost pearl white 4.7l v8 convertible *power heated seats *navigation

12 morning frost pearl white 4.7l v8 convertible *power heated seats *navigation Leather nav vantage coupe 2d automatic rwd abs (4-wheel) air conditioning(US $70,995.00)

Leather nav vantage coupe 2d automatic rwd abs (4-wheel) air conditioning(US $70,995.00)

Auto Services in California

Yuba City Toyota Lincoln-Mercury ★★★★★

World Auto Body Inc ★★★★★

Wilson Way Glass ★★★★★

Willie`s Tires & Alignment ★★★★★

Wholesale Import Parts ★★★★★

Wheel Works ★★★★★

Auto blog

British carmakers facing hard choices as the clock ticks toward Brexit

Thu, Feb 21 2019ST ATHAN, Wales/GAYDON, England - In three cavernous former Royal Air Force hangars at an old airbase in Wales, luxury carmaker Aston Martin is forging ahead with construction of a new vehicle assembly plant. The paint shop is in, robots are being unpacked, and production of the company's critical new sport utility vehicle is on track to start this year – Brexit deal or no deal. "I still have to believe that we'll get to a proper and right decision because a no-deal Brexit is frankly madness," Aston Martin CEO Andy Palmer told Reuters at the company's Gaydon headquarters in England, where designers are working on a diverse lineup of vehicles for the 2020s and beyond. Headlines have focused on plant closures and job losses ahead of Britain's divorce from the EU. Nissan has scrapped plans to build its new X-Trail SUV in the country, while Honda will close its only UK car plant in 2021 with the loss of up to 3,500 jobs - though it has been said the decision was not related to Britain's exit from the EU. However, many auto companies - from luxury marques like Aston Martin to mass-market brands such as Vauxhall - are working on ways to survive after March 29. On the outskirts of London, workers at Vauxhall's operation in Luton are preparing to produce a new line of commercial vans following fresh investment from the brand's French owner PSA, which they are counting on to sustain more than 1,000 jobs. While post-Brexit market conditions remain a big unknown, Vauxhall boss Stephen Norman told Reuters Britain's exit from the European Union could present an opportunity to increase the brand's market share. He is pursuing a marketing campaign to boost demand for the company's modestly priced cars and SUVs. The continued investment by some carmakers and the potential sales upside seen by Vauxhall reflect the conflicting decisions and opportunities that brands face depending on their size, their customers and where they are in the production cycle. All automakers in Britain will have to find ways to make Brexit work, even if only in the short term. Nissan builds nearly 450,000 cars and multiple models, making it hard to pull out of the country any time soon. Toyota builds just one model in Britain, the Corolla, but has only just started making it. The typical life cycle of a car is six years. RACKS OF DASHBOARDS Aston Martin and Vauxhall are as different as two auto companies can be.

Aston Martin owners rev up for possible sale or stock IPO

Sat, Dec 16 2017LONDON — Aston Martin's owners have hired financial advisory firm Lazard to prepare for a stock market listing or sale of the British sports car maker made famous by fictional spy James Bond, sources familiar with the matter told Reuters. Italian private equity fund Investindustrial and a group of Kuwaiti investors, who together own more than 90 percent of the marque, are hoping to cash in on a recovery in sales and are in the initial stages of a strategic review. They have hired investment bank Lazard to work on a preliminary plan and could either opt for an initial public offering (IPO) in the third or fourth quarter of 2018 or a trade sale, two of the sources said on Friday. A deal could value the maker of the sports car driven by Britain's Prince William on his wedding day at between 2 billion and 3 billion pounds ($4 billion), one of the sources said, adding a listing was the most likely option. However, no final decision had been taken and the investors could decide to retain control, the sources added. Investindustrial declined to comment while Aston Martin and Lazard did not return requests for comment. Adeem Investment, one of the Kuwaiti investors, was not immediately available. If successful, a float of Aston Martin would be a milestone deal for the 104-year-old car manufacturer and would follow the IPO of Italian sportscar maker Ferrari which made its Wall Street debut in 2015 amid strong investor demand. Investindustrial, led by founder Andrea Bonomi, bought 37.5 percent of Aston Martin in 2012 in what was the fund's best-known investment in Britain. The fund, which has clinched a number of Southern European investments since its launch in 1990, is Aston Martin's single biggest investor and is driving the plans, the sources said. Beside Lazard, other investment banks have approached the private equity fund in recent weeks offering advice ahead of a possible IPO, another source said. Yet no other mandates will be awarded this year for the Gaydon-based firm, which is in the midst of a turnaround plan that aims to restore the business to profitability following six years of losses. Aston Martin, which recently unveiled its new Vantage model, is on course to post its first annual pre-tax profit since 2010 as strong demand for the luxury automaker's DB11 sports car boosts its performance.

Aston Martin makes RapidE electric car a limited edition after LeEco pulls out

Mon, Jun 26 2017Aston Martin was forced to scale back production plans for its first electric model after cash-strapped investment partner LeEco pulled out of the project, Chief Executive Andy Palmer told Reuters on Monday. The result, though, may be an even more exclusive car, aimed at customers who consider Tesla's top of the range $130,000 Model S to be a little too run of the mill. Aston Martin will build only 155 of its RapidE, about a third of the initial plan, and lean more heavily on Formula One engineering specialist Williams after the withdrawal of Chinese TV and smartphone vendor LeEco, Palmer said. The setback and Aston's response underscore the challenges and risks niche carmakers face as they scramble to address future demand for electrification from consumers and regulators. While the privately held Aston Martin brand benefits from the endorsement of fictitious spy James Bond, it lacks the backing of a large automotive parent that many rivals enjoy. "We've decided to make this car rare, which will obviously tend to push the price higher," Palmer said. "Aston Martin now plans to proceed independently, funding further development of RapidE by ourselves." Palmer agreed to be interviewed after sources told Reuters Aston Martin's partnership with LeEco had unraveled. Unveiling the alliance in February last year, LeEco and Aston pledged to launch an all-electric version of the Rapide S sedan in 2018. But the Chinese conglomerate has since slashed its electric car investments, including its U.S. startup Faraday Future's planned $1.3 billion factory in Nevada. Some Faraday suppliers, including seat maker Futuris and media provider Mill Group, have sued the company for non-payment, according to court records. Spokesmen for LeEco and Faraday did not respond to requests for comment on the end of the Aston partnership. Aston Martin declined to discuss its partner's business. $250,000 PRICE TAG Aston returned to profit in the first quarter, a decade after it was sold by Ford. Now owned by private equity groups Investindustrial and Kuwait's Investment Dar, the company is rolling out a new model each year under a taut recovery plan drawn up by Palmer, who joined from Nissan in 2014. Without LeEco's backing, the sports carmaker, based in Gaydon, Warwickshire, is pushing ahead as sole investor in the electric car, after paring down production and pushing back the launch date to 2019. The plan won board approval on June 21.