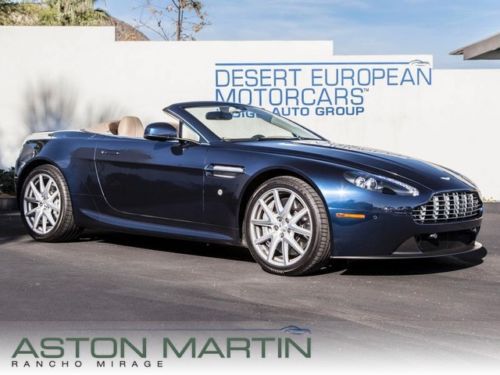

2013 Aston Martin V8 Vantage Roadster Midnight Blue Walnut Premium Audio on 2040-cars

Rancho Mirage, California, United States

Aston Martin Vantage for Sale

2007 aston martin vantage,meteorite/chocolate, serviced(US $66,888.00)

2007 aston martin vantage,meteorite/chocolate, serviced(US $66,888.00) 2009 vantage,blk/blk,sport pkg,srvcd,newtires,newbrakes(US $78,888.00)

2009 vantage,blk/blk,sport pkg,srvcd,newtires,newbrakes(US $78,888.00) 2012 aston martin vantage,toro red/blk,serviced,clean(US $106,999.00)

2012 aston martin vantage,toro red/blk,serviced,clean(US $106,999.00) Coupe navigation just 21k miles!!!(US $57,850.00)

Coupe navigation just 21k miles!!!(US $57,850.00) 2006 aston martin vantage coupe first year of production(US $65,000.00)

2006 aston martin vantage coupe first year of production(US $65,000.00) Msrp $150k convertible 6-speed manual red brake calipers only 600 miles(US $124,900.00)

Msrp $150k convertible 6-speed manual red brake calipers only 600 miles(US $124,900.00)

Auto Services in California

Z & H Autobody And Paint ★★★★★

Yanez RV ★★★★★

Yamaha Golf Cars Of Palm Spring ★★★★★

Wilma`s Collision Repair ★★★★★

Will`s Automotive ★★★★★

Will`s Auto Body Shop ★★★★★

Auto blog

Aston Martin hoons its DB10 for 007

Thu, Sep 24 2015It always goes back to Skyfall, doesn't it? On November 6, 2015, we will join James Bond again as he hunts for another piece of his past, one that has grown into a dark, evil creeper known as Spectre. Since Aston Martin is now nearly just as synonymous with Bond as the agent's nemesis Blofeld, it's certain that the carmaker will have just as much fun as we do during the buildup. Or more fun, perhaps, judging by this spot. The rather handsome DB10 is put to work sending the world a message for the spy we love the most, and blows a lot of smoke in the effort. You can watch that in the video above. Speaking of smoke, if you haven't got enough of the pre-release action yet there's another video below with director Sam Mendes and his special effects minions showing what went into creating the practical effects on three continents, like flying a helicopter down a Mexico street. Enjoy both.

Aston Martin Vantage GT8 spied looking all fast on the 'Ring

Wed, Apr 13 2016Aston Martin keeps rolling out new versions of its long-serving Vantage, and we keep not complaining. This latest piece, spotted on the Nurburgring, looks particularly mean in matte black with a nice big wing on the back. We believe it to be the anticipated Vantage GT8, which should be the ultimate version of the V8 Vantage. The GT8 will follow in the footsteps of the Vantage GT12; its smaller engine should pack less of a punch, but the car will be lighter in the nose a V12 Vantage, which should help handling balance. Expect the 4.7-liter V8 to be retuned to produce more power than it has in any other Vantage: currently, the top V8 Vantage tops out at 430 horsepower, and we wouldn't be surprised to see the GT8 boast more like 450. That would still leave plenty of breathing room to the V12 models that start at 565. The aero package looks similar to the GT12's aggressive setup but incorporates several changes, including fewer cooling ducts and a reshaped front splitter, rear wing, and diffuser. Expect the interior to come stripped out like the GT12's. This top V8 Vatage ought to make a fine swan song for the eleven-year-old model line before its AMG-powered, turbocharged successor arrives. But don't expect to see too many of them – sources anticipate just 150 examples to be built, which is more than the 100 units of the GT12, but will still make this a rare bird indeed. Related Video:

Bond, junk bond? Aston Martin financial ratings go south as it awaits DBX

Sat, Sep 28 2019Ratings agencies Standard & Poor's and Moody's have taken a dim view of Aston Martin Lagonda. S&P cut its credit rating on the storied carmaker deeper into junk territory this week, and Moody's revised its credit outlook to "negative" after the company raised $150 million in debt from a bond issue at 12% interest, with the option to raise another $100 million at 15%. The Standard & Poor's rating was trimmed by one notch to 'CCC+', which reflects substantial risks and takes it close to default territory after a faster-than-expected cash burn this year. The outlook is negative. The negative outlook reflects ongoing pressure on profits, a high cash burn, and very high leverage in the face of heightened risks linked to a potential no-deal Brexit and new tariffs on car imports threatened by the United States. The potential salvation for the company is its new DBX luxury SUV, the success of which is critical to its ambitious growth strategy and ongoing creditworthiness, S&P said. But Moody's noted that it's burning cash at a high rate as it nears the launch of the DBX. The British carmaker, known as James Bond's favorite marque, has been hit by falling demand in Europe, the Middle East and Africa. It slumped to a first-half loss in July. Chief Executive Andy Palmer said concerns around Brexit and U.S.-China trade relations were skewing the outlook to the downside, so it was prudent to address investor concerns about its balance sheet. "Taking this debt on — short-term debt — is we think the correct tool to completely remove that thesis that we don't have sufficient liquidity," he told Reuters. "In every substantial and material way, this ensures that we can get through to DBX in spite of what all of those global uncertainties might throw at us." The main tranche comprises notes with an interest rate of 12% due in 2022, while the additional notes could be issued under the same terms if permitted, or could be issued as unsecured notes with an interest rate of 15%, Aston Martin said. Shares of stock in the company, which have had a precipitous fall since they listed in London in October 2018 at 19 pounds, were trading down 5% at 545 pence in early deals. Broker AJ Bell said Aston Martin was known for its high end prices and that situation now also applied to its debt. "These rates are very high and are a major red flag that investors consider the car company to be a high risk entity," it said.