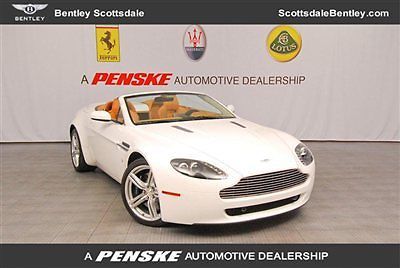

2008 Aston Martin 2dr Conv on 2040-cars

Beverly Hills, California, United States

Aston Martin Vantage for Sale

2007 aston martin vantage v8 engine 2 door (like new well taken care of)(US $76,200.00)

2007 aston martin vantage v8 engine 2 door (like new well taken care of)(US $76,200.00) 08 aston martin vantage 45k miles htd seats navigation premium sound(US $58,000.00)

08 aston martin vantage 45k miles htd seats navigation premium sound(US $58,000.00) 09 aston martin vantage conv only 7k miles sportshift rear camera navigation(US $87,000.00)

09 aston martin vantage conv only 7k miles sportshift rear camera navigation(US $87,000.00) 12 v12 vantage black black only 8k miles prem audio 144 month financing(US $159,995.00)

12 v12 vantage black black only 8k miles prem audio 144 month financing(US $159,995.00) 2008 aston martin 2dr conv(US $74,990.00)

2008 aston martin 2dr conv(US $74,990.00) 2010 aston martin vantage coupe, only 18k miles, well cared for, texas owned(US $83,950.00)

2010 aston martin vantage coupe, only 18k miles, well cared for, texas owned(US $83,950.00)

Auto Services in California

Z & H Autobody And Paint ★★★★★

Yanez RV ★★★★★

Yamaha Golf Cars Of Palm Spring ★★★★★

Wilma`s Collision Repair ★★★★★

Will`s Automotive ★★★★★

Will`s Auto Body Shop ★★★★★

Auto blog

Wingsuits are somehow involved in new season of 'Top Gear'

Mon, Jan 14 2019It's a shame that Matt LeBlanc is leaving "Top Gear," but there's a bit of solace in the situation: There's still one more season of him as frontman. BBC just released the new trailer for series 26, and it shows LeBlanc, Chris Harris and Rory Reid getting into all sorts of shenanigans around the globe. "Top Gear" announced LeBlanc's imminent departure back in May 2018, but he still had to finish one more season before leaving. Thus, the upcoming series will be his last, and it looks like he'll go out in a whirlwind of dust, bent metal, water spray and burnt rubber. The trailer shows everything expected from a season of the storied automotive show (well, everything except Hammond, May, and Clarkson, if you're one of those people). There will be precision driving, dubious stunts, name-calling and gobs of stunning videography. In the short one-minute clip, there are flashes of numerous attention-piquing vehicles. The new Bentley Continental GT, a Bentley Le Mans racer, Porsches, Ferraris, the Aston Martin Vantage, and the Mercedes-AMG GT all make appearances. And for some random fun, the boys are seen in wingsuits (doubtful it's actually them), and playing polo in some three-wheel rickshaws (before wrecking said rickshaws). We'll update with more information as soon as we know when the show will start. Related Video: News Source: BBC Celebrities TV/Movies Aston Martin Bentley Ferrari Mercedes-Benz Porsche Videos Top Gear chris harris matt leblanc rory reid

Aston Martin sold its old Vanquish tooling, but to whom?

Thu, Oct 25 2018Where do car models go when they become old? In some cases, they go to developing markets to be reborn again: Nissan built the Sentra in Mexico for ages, and old Peugeot saloons have been made in Iran for decades. Sometimes a separate company buys the tooling, which has been the case for Saab, for instance: the 9-3 and 9-5 sedans found a new life in China, albeit with new sheetmetal. These scenarios usually play out with passenger cars and trucks, and more rarely with sports cars. But for the Aston Martin Vanquish, there might be plans afoot. Aston Martin was revealed to have sold the second-generation Vanquish tooling and design drawings in June, for around $26 million. Aston didn't disclose the name of the buyer, so speculation quickly rose. Who wants to start building the V12 range-topper originally launched in 2012? Automotive News suggests the buyer could be a boutique European tuner such as Mansory, who would expand from converting cars into having bespoke products of its own. Jalopnik mentions Zagato, who has already partnered with Aston Martin and helped create the exclusive Zagato Vanquish. Whoever the buyer turns out to be, they will get 18 months of assistance from Aston Martin Consulting, as dictated in the deal. An interesting development would be if the Vanquish would be recreated as an electric supercar, if the anonymous buyer chooses not to fit their creations with Aston's V12 engines. Still, Aston won't be the first British sportscar maker to sell its tooling to another company: surely everybody remembers the time the front-wheel-drive Lotus Elan reappeared in Korea, as the Kia Elan/Vigato? Related Video:

Aston Martin DB5 'No Time to Die' Edition takes 007 to the tikes

Wed, Sep 22 2021Last August, The Little Car Company introduced the Aston Martin DB5 Junior. It was a two-thirds-scale replica of the life-sized item, with an electric powertrain in place of the inline-six, made for kids whose leases were up on their Little Tikes Cars and wanted to get into something more mature. A year later, with the new James Bond film No Time to Die finally reaching theaters at the end of this month, The Little Car Company (TLC) has rolled out a DB5 Junior No Time to Die Edition in its sales garage. Working with Aston Martin, Eon Productions, and Bond film special effects supervisor Chris Corbould, the newest little Aston gets more power and a host of gadgets. The original DB5 Junior contained a 1.8-kWh battery pack powering a 6.7-horsepower motor, and could be driven in Novice or Expert modes. The Bond-themed version has been uprated to a 7.2-kWh pack turning a 21.5-hp motor, and can be piloted in Novice, Expert, Competition and Escape modes. It's the most powerful vehicle the company currently offers, and can go up to 80 miles on a charge. Fidelity to the original includes Silver Birch paint and Smiths instruments, although a couple of gauges have been swapped out to serve an EV powertrain instead of internal combustion. The Bilstein dampers and Brembo brakes with brake regeneration are subtle improvements. And true, Daniel Craig's Bond doesn't drive the droptop DB5, but TLC made a Q Branch executive decision so that parents could fit in the car beside their kids. Gadgets are controlled by a hidden switch panel in the passenger's door, because agents-in-training should focus on driving. They goodies menu lists a digital license plate, fake Gatling guns behind the headlights, a real smokescreen generator emitted through exhaust tips, and a skid mode. Owners of the last year's DB5 Junior will get first right of refusal to purchase the No Time to Die Edition. Unlike the original, which TLC made 1,059 examples of, the DB5 Junior No Time to Die Edition will be limited to 125 units. The new version doubles the price of the original, costing GBP90,000 ($122,616 U.S.) plus tax to become a miniature agent in Her Majesty's Secret Service. Related Video: