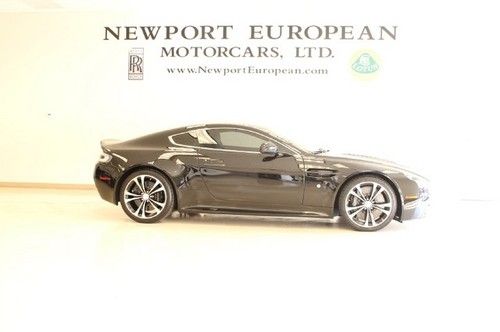

2007 Aston Martin V8 Vantage 20" Forgiato Wheels H&r Springs on 2040-cars

Calabasas, California, United States

Body Type:Convertible

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: ASTON MARTIN

Model: Vantage

Warranty: Unspecified

Mileage: 18,002

Exterior Color: Black

Interior Color: Black

Aston Martin Vantage for Sale

2008 aston martin v8 vantage base hatchback 2-door 4.3l(US $69,000.00)

2008 aston martin v8 vantage base hatchback 2-door 4.3l(US $69,000.00) 2007 aston martin v8 roadster~well optioned~20,075 mi~high grade yes!!(US $67,775.00)

2007 aston martin v8 roadster~well optioned~20,075 mi~high grade yes!!(US $67,775.00) Rare, 2011, carbon black aston martin v12 vantage!

Rare, 2011, carbon black aston martin v12 vantage! Certified roadster berwick bronze warranty navigation quicksilver exhaust radar(US $84,995.00)

Certified roadster berwick bronze warranty navigation quicksilver exhaust radar(US $84,995.00) Aston martin vantage green low miles convertible 2dr sportshift(US $84,500.00)

Aston martin vantage green low miles convertible 2dr sportshift(US $84,500.00) 2009 aston martin v8 vantage coupe black/black(US $76,950.00)

2009 aston martin v8 vantage coupe black/black(US $76,950.00)

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

Aston Martin tipped for F1 return with Red Bull, Mercedes

Mon, Jul 6 2015Aston Martin could be plotting a return to Formula One for the first time in over half a century. And not as a backmarker, either. That is, at least, if the latest rumors materialize. While most automakers that participate in F1 do so as either a team owner (like Ferrari and Mercedes) or as an engine supplier (think Renault or Honda), the rumored Aston Martin deal would take a different approach. According to Autosport, the proposal would have the Red Bull Racing team run Aston Martin branding – but not its engines. Those would be provided by Mercedes, just like the engines in the British marque's upcoming slate of road cars. In that regard, the deal would not be unlike the one which Red Bull currently has with the Renault-Nissan Alliance, which sees the team running Renault engines and Infiniti branding. Andy Palmer was a pivotal figure in brokering that unusual arrangement when he was working for Carlos Ghosn, and is now tipped to be brokering a similar deal in his new capacity as Aston Martin's CEO. Though Aston has found glory in sports car racing (including Le Mans and its various associated series), it was never much of a contender in grand prix racing. It competed in a handful of races in 1959 and 1960, but never achieved results worth bragging about. Aston was rumored to be plotting a return when David Richards sat as chairman of the company, having run Aston's racing program as well as Honda's F1 team previously. Those rumors, however, never materialized. Whether this time 'round gains any traction remains to be seen - Aston Martin declined to either confirm or deny the reports when reached for comment by Autoblog. Red Bull has been growing increasingly dissatisfied (and increasingly vocal about its dissatisfaction) with Renault engines over the past couple of seasons. Though the two parties won four back-to-back world titles together, things took a noticeable step backward after the new turbo engine regulations took hold for the 2014 season. Nissan/Infiniti and Red Bull are contracted to continue collaborating until the end of next season. After that is when the new Aston deal could take hold, and Mercedes is reportedly keen on the idea so that it could add another customer to its F1 engine supply business and offset the costs of development. That could effectively prove the end of Renault in F1 (at least for the time being). Aside from Red Bull, the French automaker currently supplies only that outfit's sister team Toro Rosso.

Aston Martin DB5 from ‘GoldenEye’ will be auctioned

Thu, Jun 14 2018Think of an Aston Martin DB5 in a Bond film, and you're likely to think of "Goldfinger" — the film and the car are forever linked in cinema history. But it's not the only Bond film with a DB5 chase, as the producers were eager to establish Pierce Brosnan as a credible Sean Connery equivalent, and put him in a DB5 on a mountain road in 1995's "GoldenEye." There was no white Mustang to chase in "GoldenEye," as Brosnan's Bond played with a red, reportedly rented Ferrari F355 driven by Famke Janssen. A few years after the film's premiere, in 2001, the DB5 was sold for $200,000. That doesn't sound fantastical for a Bond car, but at the time it was the most expensive piece of Bond memorabilia ever sold. At the end of the decade, the actual "Goldfinger" DB5 sold for roughly $4 million, which is unlikely to be topped by the "GoldenEye" car this summer. The car is not a barn-find or a lost cinema classic, either, as it has been on display in several museums such as the National Motor Museum in Britain. Bonhams will be auctioning this DB5 on July 13 at the Goodwood Festival of Speed. The car's estimated at $1.6 million to $2.14 million, which is still half or less than half of what the "Goldfinger" car brought in. Still, it's a silver Aston Martin with actual cinema history, and it's believably one of the reasons why restored classic Astons still get resprayed in Silver Birch. Related Video:

This Aston Martin Vanquish Zagato Shooting Brake is a masterpiece in pink

Wed, Dec 26 2018Customizing the exterior colors and styling of a car can be boiled down to a general choice: Go with a low-key classic look or take an outlandish approach that makes the car more exclusive. At least one Aston Martin Vanquish Zagato owner went down the latter route and chose a bright pink paint job for their shooting brake. Brought to our attention by Jalopnik, the car popped up on President and Group CEO Aston Martin Lagonda Ltd Andy Palmer's Instagram. " My Friday factory walk (Gemba) and I came across this beautiful Zagato Shooting Brake about to be shipped," he said on the post. "It's certainly going to stand out for a lucky customer." Stand out, it will. The pink paint, with black wheels and gold accents, adds a new element of uniqueness to the car. As an Aston Martin, it was already a premium sports car. The Zagato treatment makes it even more rare, as does the gorgeous shooting brake bodywork. For some people, that's enough. For others, that the car alone doesn't fully display their character and personality. This is the second time the Vanquish Zagatos have come up in the news in the past week. A different owner chose the classic Villa d'Este paint scheme, but went all out and bought one of each of the Zagato styles. Regardless of which style you prefer, this pink Aston proves one thing: this Zagato looks good in any color. View this post on Instagram A post shared by Andy Palmer (@andyataston) on Dec 8, 2018 at 3:50am PST Related Video: