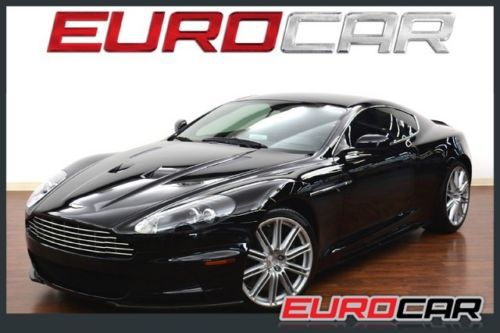

Aston Martin Dbs, Highly Optioned, Immaculate Condition, California Car on 2040-cars

Costa Mesa, California, United States

Aston Martin DBS for Sale

2009 aston martin(US $132,850.00)

2009 aston martin(US $132,850.00) Dbs coupe 6.0l nav cd locking/limited slip differential rear wheel drive a/c

Dbs coupe 6.0l nav cd locking/limited slip differential rear wheel drive a/c 2012 aston martin dbs ultimate edition(US $219,995.00)

2012 aston martin dbs ultimate edition(US $219,995.00) Alarm volumetric black calipers carbon fiber satellite logos sports 2+2 seating(US $194,900.00)

Alarm volumetric black calipers carbon fiber satellite logos sports 2+2 seating(US $194,900.00) 2010 aston martin dbs stratus white obsidian black 1 owner & perfect 7684 miles!

2010 aston martin dbs stratus white obsidian black 1 owner & perfect 7684 miles! 2009 aston martin(US $139,950.00)

2009 aston martin(US $139,950.00)

Auto Services in California

Zoll Inc ★★★★★

Zeller`s Auto Repair ★★★★★

Your Choice Car ★★★★★

Young`s Automotive ★★★★★

Xact Window Tinting ★★★★★

Whitaker Brake & Chassis Specialists ★★★★★

Auto blog

The Windsor Castle Concours d'Elegance in pictures, courtesy of Bentley

Sat, 15 Sep 2012Bentley went to the Windsor Castle Concours of Elegance as the main sponsor and showed off six of its best among the gathering of "60 of the finest motor cars in the world," including the 4¼-liter Bentley 'Embiricos' Special built for a Greek shipping magnate and gentleman racer in the 1930s.

Even better, for us at least, is that when Bentley decided to capture the moment it took pictures of most of the metal on the lawn, not just the Bentleys. Thanks to that, we have a high-res gallery that's home to rarities like the Vauxhall 30-98 Type OE Boattail Wensum Tourer, beauties like the Bugatti Type 57S Atalante, long-tail Ford GT40, Maserati Tipo 60 Birdcage, Aston Martin DB4GT Zagato, a sinister Ferrari 250 GTO and the even more sinister Rolls-Royce Phantom Aerodynamic Coupe, among others. All you need to do now is click and enjoy.

Aston Martin's Vanquish S Red Arrow aerobatics special edition is a stunning tribute

Tue, Apr 11 2017Aston Martin's in-house custom car division, Q, has just revealed its latest model, the Aston Martin Vanquish S Red Arrows Edition. The Vanquish is themed around the Red Arrows, a British aerobatics team like the American Blue Angels. The connection to the team starts from the outside, with a bright, gloss red paint job with white and blue accents on the carbon fiber trim to replicate the look of the Red Arrows' planes. The badges have red, white, and blue enamel to evoke the Union Jack flag, and a white stripe along the side is meant to look like the smoke trails left by the planes. Inside, the interior is finished in black leather with khaki green leather inserts and matching seatbelts. According to Aston Martin, this color scheme echoes the flight suits worn by the Red Arrows team. The flight team's logo, which shows their diamond-shaped flight formation, is embroidered into the seat backs. The door panels also receive custom embroidery, which shows the "Vixen Break" maneuver. This particular Vanquish S loses its rear seats to make space for a pair of racing helmets that come with the car. The helmets are painted in Red Arrows colors. In addition to the helmets, Aston Martin will include scale models of the car and a Red Arrows plane, a racing suit, embroidered bomber jacket, and a custom luggage set. In keeping with the Red Arrows theme, only nine of these cars will be sold, one for each member of the aerobatics team. Each car will also be signed by the corresponding Red Arrows pilot. Aston will build a tenth car that will be donated to the RAF Benevolent Fund, which helps support veterans and their families. Related Video:

Jay Leno, Ex-Stig test Aston Martin's latest cars

Fri, Jul 8 2016Aston Martin is on a roll right now. From unveiling its latest V12-powered hypercar codenamed the AM-RB 001 to building one-off convertibles of hardcore track toys, the automaker has really hit its stride. With cars like the DB11 and V12 Vantage S, Aston is also working on reinventing its road cars. Jay Leno, because he's Jay Leno, was lucky enough to test both cars at Willow Springs, and he invited former Stig Ben Collins to have some fun. In this clip from Jay Leno's Garage, the comedian gets a design overview of the DB 11 and then talks to Collins about his racing career, working on Top Gear, and doing Hollywood stunt driving. The pair plays a little James Bond chase on the track, with Collins in the V12 Vantage S and Leno in the DB11. Jay isn't exactly working all of the 600 hp from the twin-turbocharged, 5.2-liter V12, as it's a prototype. Meanwhile, Collins is hot-dogging the V12 Vantage S, with its anachronistic naturally aspirated 5.9-liter V12 and seven-speed manual transmission, behind him. Although the driving pace isn't quite matched, when two remarkable cars get together, everyone wins. Related Video: