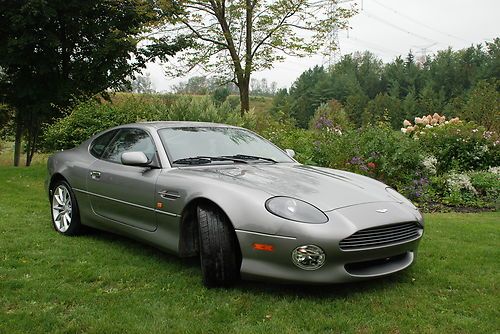

Aston Martin DB7 for Sale

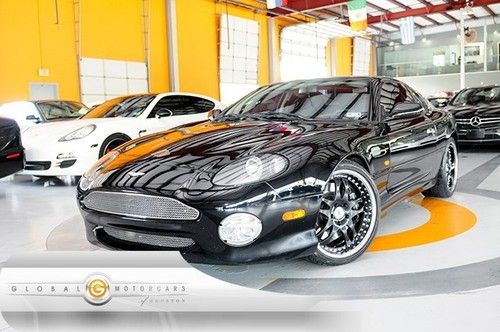

02 aston martin db7 vantage automatic asanti-wheels wood-trim custom-leather(US $34,995.00)

02 aston martin db7 vantage automatic asanti-wheels wood-trim custom-leather(US $34,995.00) No reserve always garaged mint owned by 72 yr old banker perfect carfax

No reserve always garaged mint owned by 72 yr old banker perfect carfax 2003 aston martin db7 vantage convertible 2-door; balintyre blue; 12,162 miles

2003 aston martin db7 vantage convertible 2-door; balintyre blue; 12,162 miles 20,165 miles db7 convertible sport seats carbon fiber trim automatic(US $42,900.00)

20,165 miles db7 convertible sport seats carbon fiber trim automatic(US $42,900.00) 2002 db7 v12 vantage convertible 18k miles,black/black,we finance(US $49,950.00)

2002 db7 v12 vantage convertible 18k miles,black/black,we finance(US $49,950.00) 2000 aston martin db7 v12 vantage silver blue

2000 aston martin db7 v12 vantage silver blue

Auto blog

Dany Bahar plans Aston Martin shooting brake at Modena-based tuner

Tue, Jul 8 2014You can't keep a good man down, or so the saying goes. The jury may still be out on whether Dany Bahar was a good thing for the automotive industry – with some portraying him as an overambitious opportunist and others pitting him as a genuine car guy against the bean-counters – but he's not about to stay down for long. Bahar, for those unfamiliar, was a top executive at Red Bull, serving as right-hand man to Dietrich Mateschitz right around the time that the energy drink company was getting into Formula One and NASCAR. He was then poached by Ferrari to serve as its commercial chief and brand director before taking up the reins as CEO of Lotus. Things didn't go quite so well for him there after new owners fired him, accused him of misappropriating company funds and canceling just about every one of his ambitious (or perhaps overambitious) projects to take Lotus into the modern age. But now he's back on his feet. According to Car and Driver, Bahar's new project is a tuning house and coachbuilder called Ares. Similar to an outfit like Mansory (with which Bahar, incidentally, fostered close ties while at Lotus), Ares is out to make high-end vehicles like the Range Rover Sport, Rolls-Royce Wraith and Lamborghini Huracan that much more unique. But the biggest project Ares is planning to undertake is to turn the Aston Martin Rapide S and Bentley Continental GT into shooting brakes for wealthy customers. Ares wouldn't be the first outfit to do so, Bertone having made a wagon version of the Rapide and Touring having offered an extended-roof Continental. But to show he's not messing around, Bahar has assembled a top team at Ares. Wolf Zimmermann, who worked for Mercedes-AMG before becoming Bahar's R&D chief at Lotus, is handling the technical aspects. 24-year-old Romanian designer Mihai Panaitescu, who is said to have worked on those aborted Lotus projects, is handling the style aspect. And the whole outfit is being based in Modena, Italy – the city that is home to outfits like Pagani, Maserati and nearby Ferrari. Predictably enough, Ares will launch initially in China, Russia and the Middle East, but reportedly plans to make it to the US sometime early next year. Featured Gallery 2014 Aston Martin Rapide S: First Drive View 32 Photos News Source: Car and DriverImage Credit: Copyright 2014 Drew Phillips / AOL Aftermarket Aston Martin dany bahar aston martin rapide s

Aston launches certification program for historic cars

Sun, Sep 13 2015After 102 years in business, Aston Martin has an in-house program to provide factory certification to the products it has made for more than a century. The Aston Martin Assured Provenance program is a way for owners to have their classic cars examined by the gents at Aston Martin Works at Newport Pagnell, and then - if successful - be assessed one of four levels of certification. Owners pay a fee to have their car looked over by in-house experts who perform a digital scan and then examine all of the car's visuals and mechanics. Those records are then given to the Sanctioning Committee, another group of experts that decides which level, from Platinum to Bronze, should be awarded to the vehicle. The owner pays another fee if the car get certified, after which said owner gets a photo book of the car, the certificate in a presentation case, two sets of plaques for the instrument panel and door sills, and a USB with the digital record of the car. The program is open to original vehicles and those reworked by Aston Martin. The press release below has more. Related Video: ASTON MARTIN LAUNCHES ASSURED PROVENANCE RATING FOR CLASSIC CARS 11 September 2015, Gaydon - Aston Martin is today unveiling an authoritative new Assured Provenance certification programme which, for the first time in the brand's 102-year history, comprehensively assesses the background of its heritage sports cars. Created to offer a true blue riband service to heritage car owners and collectors, and drawing on the unrivalled knowledge of a committee of authoritative Aston Martin experts, the pioneering Assured Provenance certification programme is administered and run by the brand's world-renowned in-house heritage car facility – Aston Martin Works. The first official authentication programme to be provided in-house by Aston Martin, the new scheme offers four levels of verification to take into account not simply all-original examples, but also sports cars that have been modified by Aston Martin itself over the years. As part of the painstaking procedure of examination and authentication, all cars submitted to the process will undergo a digital scan which will be verified and held in a secure archive for future reference. Every car will be assessed at Aston Martin's internationally renowned heritage restoration, service and repair facility – Aston Martin Works at Newport Pagnell, Buckinghamshire – where they will undergo a thorough visual and mechanical investigation.

Aston Martin investor says demand is 'phenomenal,' returned first in China

Sun, Dec 6 2020LONDON - Carmaker Aston Martin is seeing "phenomenal" demand, boosted by a rebound in China, the company's executive chairman and billionaire investor Lawrence Stroll said on Friday. "Demand right now is phenomenal," he told the Financial Times' "The Future of the Car" digital conference. "China really returned first and strongest, and is gangbusters." Stroll led a consortium which invested in Aston earlier this year as the carmaker struggled following its 2018 stock market flotation, after which its share price slumped. Since then a new chief executive has taken over and the 107-year company, famed for being fictional agent James Bond's car of choice, did a deal in October which sees German carmaker Daimler up its stake in the firm. Shareholders approved the latest capital injection plan on Friday. Stroll said Aston's current growth trajectory meant "the public markets are the right place" for the firm whilst eying an increase in the value of its shares, which stand at 79 pence ($1.06). "They'll be significantly worth more than they are today," he said. Reporting by Costas Pitas, editing by David Milliken and Louise Heavens