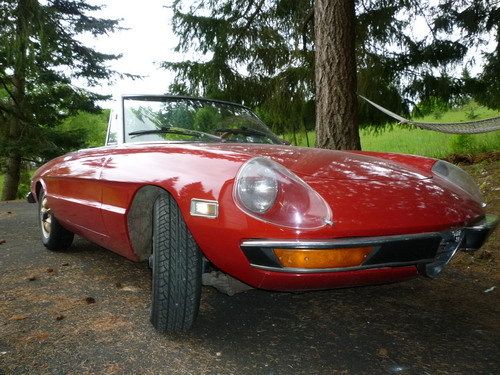

1974 Alfa Romeo Spider on 2040-cars

Tustin, California, United States

Body Type:Convertible

Engine:2.0 L 4 Cylinder

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Black

Make: Alfa Romeo

Number of Cylinders: 4

Model: Spider

Trim: Convertible

Drive Type: 2 WD

Options: Cassette Player

Mileage: 111,000

Exterior Color: Red

Alfa Romeo Spider for Sale

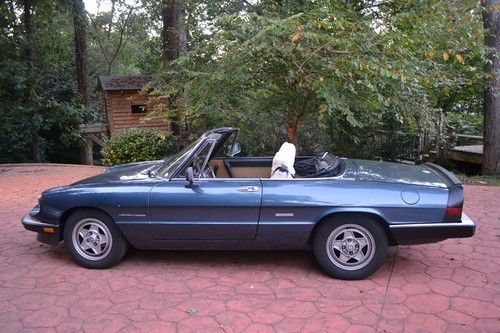

1986 alfa romeo spider veloce convertible 2-door 2.0l

1986 alfa romeo spider veloce convertible 2-door 2.0l 1988 alfa romeo spider series 3 quadrifoglio(US $14,950.00)

1988 alfa romeo spider series 3 quadrifoglio(US $14,950.00) A spider veloce 5 spd, she starts and runs, original leather and wheels.ciao!!

A spider veloce 5 spd, she starts and runs, original leather and wheels.ciao!! 1987 alfa romeo spider veloce - no reserve

1987 alfa romeo spider veloce - no reserve 1983 alfa romeo spider veloce convertible 2-door 2.0l(US $2,000.00)

1983 alfa romeo spider veloce convertible 2-door 2.0l(US $2,000.00) 1972 alfa romeo spider veloce 2.0l alpha

1972 alfa romeo spider veloce 2.0l alpha

Auto Services in California

Woody`s Auto Body and Paint ★★★★★

Westside Auto Repair ★★★★★

West Coast Auto Body ★★★★★

Webb`s Auto & Truck ★★★★★

VRC Auto Repair ★★★★★

Visions Automotive Glass ★★★★★

Auto blog

Stellantis invests more than $100 million in California lithium project

Thu, Aug 17 2023Stellantis said it would invest more than $100 million in California's Controlled Thermal Resources, its latest bet on the direct lithium extraction (DLE) sector amid the global hunt for new sources of the electric vehicle battery metal. The investment by the Chrysler and Jeep parent announced on Thursday comes as the green energy transition and U.S. Inflation Reduction Act have fueled concerns that supplies of lithium and other materials may fall short of strong demand forecasts. DLE technologies vary, but each aims to mechanically filter lithium from salty brine deposits and thus avoid the need for open pit mines or large evaporation ponds, the two most common but environmentally challenging ways to extract the battery metal. Stellantis, which has said half of its fleet will be electric by 2030, also agreed to nearly triple the amount of lithium it will buy from Controlled Thermal, boosting a previous order to 65,000 metric tons annually for at least 10 years, starting in 2027. "This is a significant investment and goes a long way toward developing this key project," Controlled Thermal CEO Rod Colwell said in an interview. The company plans to spend more than $1 billion to separate lithium from superhot geothermal brines extracted from beneath California's Salton Sea after flashing steam off those brines to spin turbines that will produce electricity starting next year. That renewable power is expected to cut the amount of carbon emitted during lithium production. Rival Berkshire Hathaway has struggled to produce lithium from the same area given large concentrations of silica in the brine that can form glass when cooled, clogging pipes. Colwell said a $65 million facility recently installed by Controlled Thermal can remove that silica and other unwanted metals. DLE equipment licensed from Koch Industries would then remove the lithium. "We're very happy with the equipment," he said. "We're going to deliver. There's just no doubt about it." Stellantis CEO Carlos Tavares called the Controlled Thermal partnership "an important step in our care for our customers and our planet as we work to provide clean, safe and affordable mobility." Both companies declined to provide the specific investment amount. Controlled Thermal aims to obtain final permits by October and start construction of a commercial lithium plant soon thereafter, Colwell said. Goldman Sachs is leading the search for additional debt and equity financing, he added.

Stellantis ready to kill brands and fix U.S. problems, CEO Tavares says

Thu, Jul 25 2024¬† MILAN ó Stellantis is taking steps to fix weak margins and high inventory at its U.S. operations and will not hesitate to axe underperforming brands in its sprawling portfolio, its chief executive Carlos Tavares said on Thursday. The warning for lossmaking brands is a turnaround for Tavares, who has maintained since Stellantis was created in 2021 from the merger of Italian-American automaker Fiat Chrysler and France's PSA that all of its 14 brands including Maserati, Fiat, Peugeot and Jeep have a future. "If they don't make money, we'll shut them down," Carlos Tavares told reporters after the world's No. 4 automaker delivered worse-than-expected first-half results, sending its shares down as much as 10%. "We cannot afford to have brands that do not make money." The automaker now also considers China's Leapmotor as its 15th brand, after it agreed to a broad cooperation with the group. Stellantis does not release figures for individual brands, except for Maserati which reported an 82 million euro adjusted operating loss in the first half. Some analysts say Maserati could possibly be a target for a sale by Stellantis, while other brands such as Lancia or DS might be at risk of being scrapped given their marginal contribution to the group's overall sales. Stellantis' Milan-listed shares were down as much as 12.5% on Thursday, hitting their lowest since August 2023. That brings the loss for the year so far to 22%, making them the worst performer among the major European automakers. Few automotive brands have been killed off since General Motors ditched the unprofitable Saturn and Pontiac during a U.S. government-led bankruptcy in the global financial crisis in 2008. Tavares is under pressure to revive flagging margins and sales and cut inventory in the United States as Stellantis bets on the launch of 20 new models this year which it hopes will boost profitability. Recent poor results from global carmakers have heightened worries about a weakening outlook for sales across major markets such as the U.S., whilst they also juggle an expensive transition to electric vehicles and growing competition from cheaper Chinese rivals. Japan's Nissan Motor saw first-quarter profit almost completely wiped out on Thursday and slashed its annual outlook, as deep discounting in the United States shredded its margins. Tavares said he would be working through the summer with his U.S. team on how to improve performance and cut inventory.

7 major automakers to build open EV charging network

Wed, Jul 26 2023A new joint venture established by BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz and Stellantis will build a new North American electric vehicle charging network on a scale designed to compete with Tesla's industry-benchmark Supercharger network. The 30,000-plus planned new chargers will accommodate both Tesla's almost-standard North American Charging System (NACS) and existing automakers' Combined Charging System (CCS) options, effectively guaranteeing compatibility with the vast majority of current and upcoming electric models ó whether they're from one of the involved automakers or not.¬† "With the generational investments in public charging being implemented on the Federal and State level, the joint venture will leverage public and private funds to accelerate the installation of high-powered charging for customers. The new charging stations will be accessible to all battery-powered electric vehicles from any automaker using Combined Charging System (CCS) or North American Charging Standard (NACS) and are expected to meet or exceed the spirit and requirements of the U.S. National Electric Vehicle Infrastructure (NEVI) program." Critically, the automakers involved will have a say in how the charging tech is implemented, guaranteeing that the hardware will play nicely with each automaker's in-house charging systems. Hyundai and Kia, for example, were hesitant to jump on board the Tesla NACS bandwagon earlier this year over concerns that the Supercharger network is insufficient for powering the two automakers' 800-volt charging systems; similar tech is used by Volkswagen and Porsche.¬† In addition to providing much-needed capacity and high-output charging for America's growing fleet of electric cars and trucks, the new network will integrate seamlessly with each automaker's in-app and in-vehicle features, rather than forcing customers to use third-party tools and payment systems, as is the case with some existing public charging infrastructure.¬† "The functions and services of the network will allow for seamless integration with participating automakers¬í in-vehicle and in-app experiences, including reservations, intelligent route planning and navigation, payment applications, transparent energy management and more. In addition, the network will leverage Plug & Charge technology to further enhance the customer experience," the announcement said.