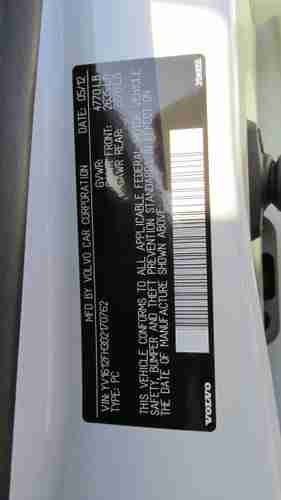

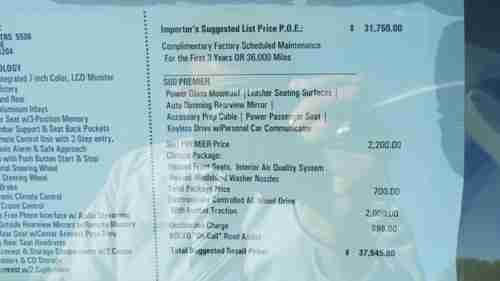

Brand New 2013 Volvo S60 T5 Awd Sedan 2.5l Free Maintenance Msrp: $37,545 on 2040-cars

Stockton, California, United States

For Sale By:Dealer

Transmission:Automatic

Body Type:Sedan

Vehicle Title:Clear

Engine:2.5L TURBO

Safety Features: CITY SAFE, WHIPS PROTECTION, SIDE IMPACT PROTECTION SYSTEM, Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Model: S60

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 50

Sub Model: T5 AWD

Exterior Color: ICE WHITE

Disability Equipped: No

Interior Color: SOFT BEIGE/BLACK LEATHER

Number of Doors: 4

Number of Cylinders: 5

Warranty: Vehicle has an existing warranty

Year: 2013

Trim: S60 T5 AWD

Options: SIRIUS RADIO 6MOS FREE, POWER DRIVER SEAT WITH MEMORY, IPOD INTEGRATION, BLUETOOTH, 6-SPEED AUTO TRANSMISSION, HD RADIO, DUAL CLIMATE ZONES, Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Drive Type: AWD

Volvo S60 for Sale

2012 volvo s60 fwd 4dr sdn t5 leather sunroof(US $24,993.00)

2012 volvo s60 fwd 4dr sdn t5 leather sunroof(US $24,993.00) 2002 volvo s60 great buy leather moonroof(US $2,999.00)

2002 volvo s60 great buy leather moonroof(US $2,999.00) 2002 volvo s60 2.4t(US $4,265.00)

2002 volvo s60 2.4t(US $4,265.00) 2005 volvo s60 r 2.5l i5 turbo awd 6-speed manual! cleanest s60r on ebay!

2005 volvo s60 r 2.5l i5 turbo awd 6-speed manual! cleanest s60r on ebay! 2002 volvo s60

2002 volvo s60 We finance! leather moonroof 1owner non smoker no accidents carfax certified!(US $16,900.00)

We finance! leather moonroof 1owner non smoker no accidents carfax certified!(US $16,900.00)

Auto Services in California

Yuki Import Service ★★★★★

Your Car Specialists ★★★★★

Xpress Auto Service ★★★★★

Xpress Auto Leasing & Sales ★★★★★

Wynns Motors ★★★★★

Wright & Knight Service Center ★★★★★

Auto blog

Volvo Cars sees flat or lower retail sales this year

Wed, Jul 20 2022STOCKHOLM — Volvo Cars flagged a potential dip in retail sales this year after posting higher second-quarter profits. Supply problems, above all a global shortage of semiconductors, have squeezed output and retail sales in recent quarters, but Volvo said it was seeing a "marked improvement" in the stabilization of its supply chain. The Sweden-based carmaker said on Wednesday it expected full year retail deliveries to be lower or on par with 2021, while wholesale volumes will increase. "However, due to the time lag between production and retail deliveries, those improvements are not expected to result in an increase in retail sales during the calendar year," the company said. Volvo Chief Executive Jim Rowan said the company would "keep an eye on" consumer sentiment, not least due to higher inflation. "But right now demand is very strong," he said. Volvo's quarterly operating profit rose to 10.8 billion Swedish crowns ($1.06 billion) from 4.8 billion a year ago as accounting effects from the listing of high-performance automaker Polestar gave a boost. Operating earnings for the core business at Volvo Cars, majority owned by China's Geely Holding, reached 4.6 billion in the quarter. "Volvo reported a solid set of Q2 results in the light of multiple hurdles including semiconductor constraints and impact of Chinese lockdowns on demand," investment bank JPMorgan said in a note. Volvo has been a strong performer in recent years and recorded 2021 earnings that surpassed pre-pandemic levels.Â

Child cobalt miners: Automakers pledge ethical minerals sourcing for EVs

Wed, Nov 29 2017BERLIN - Leading carmakers including Volkswagen and Toyota pledged on Wednesday to uphold ethical and socially responsible standards in their purchases of minerals for an expected boom in electric vehicle production. Demand for minerals such as cobalt, graphite and lithium is forecast to soar in the coming years as governments crack down on vehicle pollution and carmakers step up their investments in electric models. To cover its plans for more than 80 new models by 2025, Volkswagen alone is looking for partners in China, Europe and North America to provide battery cells and related technology worth more than 50 billion euros ($59 billion). Talks with major cobalt producers, including Glencore, at VW's Wolfsburg headquarters last week ended without a deal. More than half of the world's cobalt comes from the Democratic Republic of Congo, a country racked by political instability and legal opacity, and where child labor is used in mines. On Wednesday, a group of 10 leading passenger-car and truck manufacturers announced an initiative to jointly identify and address ethical, environmental, human and labor rights issues in raw materials sourcing. The partnership dubbed "Drive Sustainability" consists of VW, Toyota Motor Europe, Ford, Daimler, BMW, Honda, Jaguar Land Rover, Volvo Cars and truckmakers Scania and Volvo. The alliance "will assess the risks posed by the top raw materials (such as mica, cobalt, rubber and leather) in the automotive sector," said Stefan Crets of the CSR Europe business network. "This will allow Drive Sustainability to identify the most impactful activities to pursue" to address issues within the supply chain.Reporting by Andreas Cremer.Related Video: Image Credit: Michael Robinson Chavez/The Washington Post via Getty Images Green BMW Ford Honda Jaguar Land Rover Mercedes-Benz Automakers Toyota Volkswagen Volvo Green Automakers Green Culture Electric Scania ethics mining

Daimler rebuffs Geely offer to buy stake

Wed, Nov 29 2017HONG KONG/BEIJING - Daimler AG has turned down an offer from China's Geely to take a stake of up to 5 percent via a discounted share placement, as the German automaker has long been reluctant to see existing shareholdings diluted, sources with knowledge of the talks said. A stake of that size would be worth $4.5 billion at current market prices. Although Daimler declined the offer, it told Geely it was welcome to buy shares in the open market, the sources added. Carmakers in China have embarked on a flurry of dealmaking, as they scramble to boost production of electric and plug-in hybrid vehicles ahead of tough new quotas to be imposed by Beijing, which wants to reduce urban smog and lower the country's reliance on oil. People with knowledge of Geely's thinking said the company was keen to access Daimler's electric car battery technology and wanted to establish an electric car joint venture in Wuhan, the capital of Hubei province. Geely, which also owns Swedish car maker Volvo, is still hopeful it can secure a deal in some form over the coming weeks, they added. The two automakers met in Beijing in recent weeks at Geely's behest. There, the Chinese firm, formally known as Zhejiang Geely Holding Group, offered to take a stake of between 3 percent and 5 percent if Daimler would issue new shares at a discount, the sources said. It was not immediately clear what kind of discount for the shares Geely had in mind or whether Geely was interested in buying the shares on the open market. A spokesman for Geely declined to comment. A spokesman for Daimler said the company was "very happy with our shareholder structure at present", but added that it would welcome new investors with a long-term interest in the company. Shares in Daimler were up 1 percent in early Wednesday trade, in line with the broader market.DAIMLER ALREADY TIED TO BAIC, BYD Geely, which has a market value of some $32 billion, is the leading domestic brand in China with a 5 percent market share, according to an analysis by Nomura Securities. A stake of 5 percent would establish it as Daimler's third-largest shareholder behind the Kuwait Investment Authority and BlackRock, who hold 6.8 percent and 6 percent respectively, according to Reuters data.